Texas Instruments (TXN) Boosts Clientele With GaN Selection

Texas Instruments TXN announced partnership with Chicony Power, wherein the latter uses TXN’s gallium nitride (GaN) technology and expertise in high-voltage design.

Chicony Power has incorporated TXN’s GaN technology with integrated gate driver, LMG2610, to power the new 65-W laptop power adapter, Le Petit. In addition to GaN technology, Chicony Power leveraged TXN’s UCC28780 and UCC28782 flyback controllers for its adapter.

Combining GaN technology with the flyback controllers, Chicony Power’s adapter has the ability to maintain temperature under control without compromising on performance.

On the back of TXN’s GaN technology, Chicony Power lowered the size of the power adapter by 50% while achieved high power density and increased efficiency by 94%, highlighting the robustness of GaN technology.

The recent partnership with Chicony Power adds strength to Texas Instruments’ growing customer base.

Moreover, TXN’s strength in the GaN technology will continue to help it gaining momentum among the customers further. This in turn will aid in expanding its presence in the booming GaN market which per a Straits Research report, is likely to reach $2.4 billion by 2030 by witnessing a CAGR of 24.95% during the 2022-2030 period.

Strengthening position in the aforesaid market is expected to help Texas Instruments win the confidence of the investors in the days ahead.

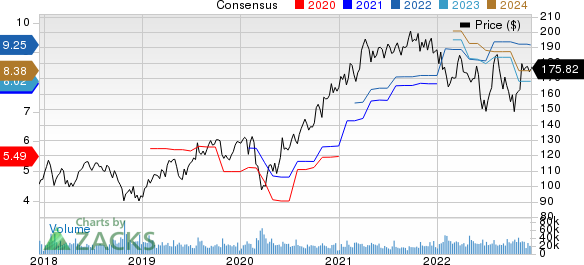

Shares of TXN have been down 6.7% in the year-to-date period against the Zacks Computer and Technology sector’s decline of 31.1%.

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Portfolio Strength – Key Catalyst

Apart from TXN’s strength in the GaN technology, the company keeps introducing new solutions or upgrading existing ones to provide advanced offerings to customers.

TXN recently unveiled the latest portfolio of isolated solid-state relays to help engineers reduce the cost and size of high-voltage power supplies while maintaining safe electric vehicles.

It introduced a radar sensor called AWR2944 to strengthen its presence in the booming ADAS market. AWR2944 is a 77-GHz sensor integrating a fourth transmitter to provide 33% higher resolution than the existing radar sensors.

It also introduced the 3D Hall-effect position sensor named TMAG5170. With the help of this sensor, engineers are able to get uncalibrated ultra-high precision at high speed for quick and accurate real-time control in factory automation and motor-drive applications.

We believe that the growing portfolio solutions will continue to help Texas Instruments sustain momentum in various end markets it serves.

Zacks Rank & Stocks to Consider

Currently, Texas Instruments carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Zacks Computer & Technology sector are Arista Networks ANET, Airbnb ABNB and Asure Software ASUR. While Arista Networks and Asure Software sport a Zacks Rank #1 (Strong Buy), Airbnb carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks has lost 8.9% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 17.5%.

Airbnb has lost 43.6% in the year-to-date period. ABNB’s long-term earnings growth rate is currently projected at 20.7%.

Asure Software has gained 7.4% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance