Textron (TXT) to Enlarge Its Interior Manufacturing Facility

Textron Inc. TXT recently revealed its plans to add 16,000 square feet to its Interior Manufacturing Facility. The move comes to effectively meet the accelerating demand for unique and custom Cessna and Beechcraft aircraft interiors. The expansion is slated for completion by the middle of 2024.

Benefits of the Expansion

TXT’s Textron Aviation unit manufactures, sells and services Beechcraft and Cessna aircraft. The latest expansion will allow Textron Aviation to enhance production efficiency across its entire range of Cessna Citation jets, as well as Beechcraft King Air and Cessna SkyCourier turboprop aircraft by centralizing the machinery within the facility.

The move will facilitate and ease the manufacturing process of new models like the Cessna Citation M2 Gen2, CJ4 Gen2, Cessna SkyCourier, Beechcraft King Air 360 and King Air 260, thus allowing the company to promptly address the increasing jet demand.

Growth Prospects

Due to improving air traffic trends over the past few months, the commercial aerospace industry is once again booming significantly. As the impacts of the pandemic subsided, the outlook for air travel has improved in recent times, particularly buoyed by aging fleets and the rising growth pace in the aviation markets of emerging nations.

Per the report from Mordor Intelligence, the commercial aircraft market is likely to witness a CAGR of more than 4.4% during the 2023-2028 period. This entails the strong demand for jets in the days ahead as traveling demand continues to gain traction.

In light of such probable demand, a large manufacturing facility can position Textron as a more competitive player in the commercial aviation industry. Textron’s commitment to cutting-edge solutions, dependability and innovative advancements further adds to its competitive advantage.

Other jet manufacturers that are likely to benefit from the growing demand in commercial aerospace are as follows:

Embraer ERJ continues to witness the strong market demand for its E-jets worldwide. For 2023, it expects to deliver commercial jets in the band of 65-70, while Executive Aviation deliveries are expected in the band of 120-130 aircraft.

Embraer boasts a long-term earnings growth rate of 17%. The Zacks Consensus Estimate for ERJ’s 2023 sales suggests a growth rate of 22.1% from the prior-year reported figure.

Boeing BA remains the largest aircraft manufacturer in the United States in terms of revenues, orders and deliveries. Its commercial backlog at the end of the second quarter remained healthy, with more than 4,800 airplanes valued at $363 billion.

Boeing boasts a long-term earnings growth rate of 4%. The Zacks Consensus Estimate for BA’s 2023 sales suggests a growth rate of 18.5% from the prior-year reported figure.

Airbus SE EADSY boasts an order backlog of 7,967 commercial aircraft as of Jun 30, 2023. The company expects to deliver 720 commercial aircraft in 2023.

The long-term earnings growth rate of Airbus is 12.4%. The Zacks Consensus Estimate for EADSY’s 2023 sales implies a growth rate of 17.8% from the prior-year reported figure.

Price Movement

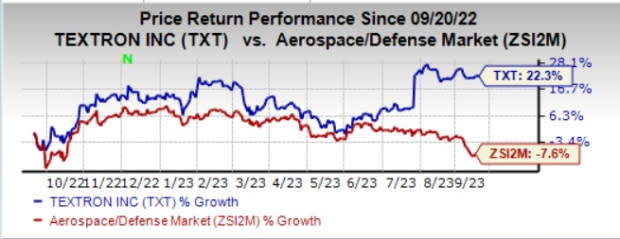

In the past year, shares of Textron have risen 22.3% against the industry’s decline of 7.6%.

Image Source: Zacks Investment Research

Zacks Rank

Textron currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance