Thailand Fertilizer Industry Research Report 2024-2033: Development Environment, Supply and Demand, Import and Export, Competition, Major Brands, Outlook

Thai Fertilizer Industry

Dublin, April 17, 2024 (GLOBE NEWSWIRE) -- The "Thailand Fertilizer Industry Research Report 2024-2033" report has been added to ResearchAndMarkets.com's offering.

Agriculture and plantation play a very important role in Thailand's economic development. In the past 20 years, the proportion of Thailand's agricultural economy in GDP has been roughly around 8%-10%, and the total annual output value has exceeded 1.5 trillion baht (US$ 40 billion). Thailand's fertilizer industry has limited production capacity and requires a large amount of imported fertilizers every year. According to the publisher analysis, Thailand is a country with an obvious fertilizer trade deficit. Thailand's annual fertilizer import volume exceeds 4 million tons, but its export volume is only about 500,000 tons. Saudi Arabia, China, Russia, Canada and Malaysia are the top five import sources of fertilizers in Thailand in 2022.

Although the size of Thailand's agricultural land has not changed significantly in recent years, Thailand's agricultural productivity is growing rapidly, and this demand has led to an increase in the adoption of various agricultural products and technologies, promoting the development of Thailand's fertilizer industry.

According to World Bank data, Thailand's cultivated land area in 2021 was approximately 17.15 million hectares, accounting for 32.9% of the total land area. Among them, most of the farms are concentrated in the northeastern region of Thailand. The region suffers from poor soil quality, seasonality, variable rainfall, and scarcity of surface water. According to the publisher analysis, fertilization is crucial to improving agricultural productivity in Thailand.

At the policy level, the Thai government supports farmers by providing agricultural input subsidies. In 2019, the government announced new incentives for Thai farmers in the form of cheap fertilizers. This will promote the application of chemical fertilizers in Thailand. In addition, as the price of fertilizers in Thailand has continued to rise since the beginning of 2022, the Thai government has introduced policies to limit fertilizer prices to maintain the stability of the domestic agricultural economy.

Rice crops dominate Thailand's crops, accounting for 41%, followed by rubber 28%; palm 12%; sugar cane 7%; feed corn 7% and pineapple 5%. These major crops in Thailand are generally fertilized with nitrogen fertilizers., and most soil in Thailand is deficient in nitrogen. Therefore, nitrogen fertilizer is the most commonly used chemical fertilizer in Thailand, especially urea. In 2021, Thailand's urea imports accounted for 73.6% of Thailand's fertilizer imports.

In 2020-2022, COVID -19 had a direct negative impact on the value chain of Thailand Fertilizer market . The main raw materials for the production of fertilizers include ammonium, sulfuric acid, phosphorus and potassium. Logistics obstruction has limited the supply of raw materials, and fertilizer prices have also affected the domestic fertilizer industry during the epidemic. The rise in fertilizer prices has a huge impact on a high-deficit country like Thailand, which basically relies on imports. According to the publisher analysis, Thailand's fertilizer industry has gradually recovered since 2023.

The concentration of chemical fertilizers in Thailand is moderate, and the participants mainly include companies such as Yara (Thailand) Company Limited, Haifa, Chai Thai Co. Ltd, Thai Central Chemical Public Company Limited and Saksiam Group .

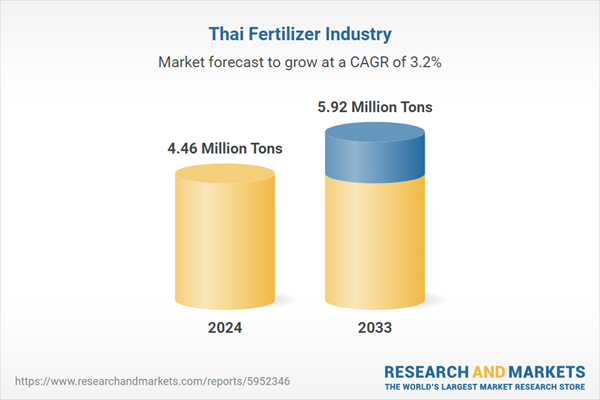

The publisher predicts that with the development of Thailand's agriculture and planting industry, Thailand's fertilizer imports will gradually increase in the next few years. The publisher estimates that Thailand's fertilizer imports will be approximately 5.92 million tons in 2033, with a compound annual growth rate of approximately 3.2% from 2024 to 2033.

Topics covered:

Overview of Thailand's Fertilizer Industry

Economic environment and policy environment for fertilizers in Thailand

Thailand's fertilizer market size from 2019 to 2023

Analysis of major Thai fertilizer manufacturers

Main driving forces and market opportunities of Thailand's fertilizer industry

What are the key drivers, challenges and opportunities for Thailand's fertilizer industry during the forecast period 2024-2033?

What is the expected revenue of the Thailand Fertilizer market during the forecast period 2024-2033?

What strategies are adopted by the key players in the market to increase their market share in the industry?

Which segment of the Thailand fertilizer market is expected to dominate the market in 2033?

Thailand Fertilizer Market Forecast from 2024 to 2033

What are the main headwinds facing Thailand's fertilizer industry?

Key Attributes:

Report Attribute | Details |

No. of Pages | 60 |

Forecast Period | 2024 - 2033 |

Estimated Market Value in 2024 | 4.46 Million Tons |

Forecasted Market Value by 2033 | 5.92 Million Tons |

Compound Annual Growth Rate | 3.2% |

Regions Covered | Thailand |

Key Topics Covered:

1 Thailand Overview

1.1 Geographical conditions

1.2 Thailand's demographic structure

1.3 Thailand's economy

1.4 Thailand's minimum wage standard in 2014-2024

1.5 Impact of COVID-19 on Thailand's Fertilizer Industry

2 Development environment of Thailand's fertilizer industry

2.1 Economic environment

2.1.1 Development status of Thailand's agriculture and planting industry

2.1.2 Analysis of chemical fertilizer usage in Thailand market

2.2 Technical environment

2.2.1 Main types of chemical fertilizers used in Thailand

2.2.2 Technical level of Thailand's fertilizer manufacturing industry

2.3 Policy environment for Thailand's fertilizer industry

2.3.1 Main government policies for Thailand's fertilizer industry

2.3.2 Foreign investment policies in Thailand's fertilizer industry

2.4 Analysis of operating costs of Thailand's fertilizer industry

2.4.1 Human resource costs

2.4.2 Electricity price

2.4.3 Factory rent

2.4.4 Other costs

3 Supply and demand status of Thailand's fertilizer industry

3.1 Supply status of Thailand's fertilizer industry

3.1.1 Thailand's total fertilizer production

3.1.2 Production of different types of fertilizers

3.2 Demand status of Thailand's fertilizer industry

3.2.1 Analysis of fertilizer consumption in Thailand

3.2.2 Analysis of demand for different types of fertilizers in the Thai market

3.2.3 Comprehensive forecast of Thailand's fertilizer market

3.3 Analysis of Thailand Fertilizer Market Price

4 Import and export status of Thailand's fertilizer industry from 2019 to 2023

4.1 Import status of Thailand's fertilizer industry

4.1.1 Thailand's chemical fertilizer import volume and import value

4.1.2 Thailand's main import sources of chemical fertilizers

4.2 Export status of Thailand's fertilizer industry

4.2.1 Thailand's fertilizer export volume and export value

4.2.2 Main export destinations of fertilizers in Thailand

5 Analysis of market competition in Thailand's fertilizer industry

5.1 Barriers to entry in Thailand's fertilizer industry

5.1.1 Brand barriers

5.1.2 Quality barriers

5.1.3 Capital barriers

5.2 Competition structure of Thailand's fertilizer industry

5.2.1 Bargaining power of fertilizer suppliers

5.2.2 Consumer bargaining power

5.2.3 Competition in Thailand's Fertilizer Industry

5.2.4 Potential Entrants to the Fertilizer Industry

5.2.5 Alternatives to chemical fertilizers

6 Analysis of major fertilizer brands in Thailand

6.1 Yara (Thailand) Company Limited

6.2 NFC Public Company Limited

6.3 Chai Thai Co. Ltd

6.4 Thai Central Chemical Public Company Limited

6.5 Haifa Group

6.6 SAKSIAM GROUP

6.6.1 Development History of SAKSIAM GROUP

6.6.2 Main products of SAKSIAM GROUP

6.6.3 SAKSIAM GROUP's operating model

6.7 ICL Fertilizers ( Ranthai Agro Co. Ltd)

6.8 Rayong Fertilizer Trading Company Limited (UBE Group)

6.9 COMPO Expert

6.10 ICP FERTILIZER COMPANY

7 Outlook of Thailand's Fertilizer Industry from 2024 to 2033

7.1 Analysis of development factors of Thailand's fertilizer industry

7.1.1 Driving forces and development opportunities of Thailand's fertilizer industry

7.1.2 Threats and challenges faced by Thailand's fertilizer industry

7.2 Supply Forecast of Thailand's Fertilizer Industry

7.3 Thailand Fertilizer Market Demand Forecast

7.4 Thailand's Fertilizer Import and Export Forecast

For more information about this report visit https://www.researchandmarkets.com/r/l81tvm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance