The age of people leaving London has fallen to a record low

Affordability barriers in the capital mean that people are leaving London at a younger age than ever before.

Data from real estate agent Hamptoms Internation shows the average age of a Londoner purchasing a home outside the capital fell to a record low of 39 in 2019 – eight years younger than in 2009, and four years younger than in 2015.

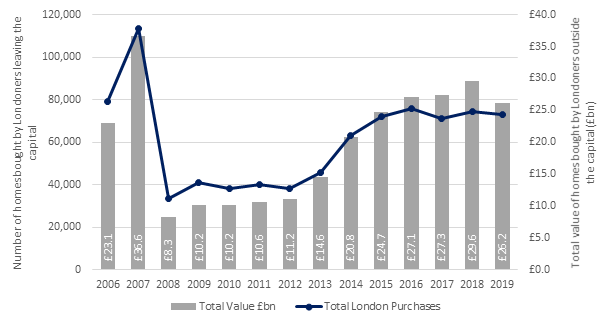

Londoners bought 73,000 homes outside the capital in 2019. This marks a 4% fall compared to the most recent peak in 2016, when 75,690 Londoners left the capital.

READ MORE: Housing affordability gap between most and least expensive areas at 20-year high

While many take advantage of being able to buy larger homes for their money, for others, leaving London is the only way of getting onto the housing ladder.

Nearly one in four (24%) Londoners who purchased a home outside the capital in 2019 were first-time buyers. This is an increase from 22% in 2016 and is considerably higher than the 14% recorded in 2013.

The research found most London leavers stay in the South of England. Almost seven in 10 (69%) of Londoners purchasing homes outside the capital in 2019 bought in the south-east, south-west or east of England.

READ MORE: The huge problem for expats in London and Dublin

The south-east was the most popular destination for London buyers, with nearly one in three (32%) London leavers moving to the region last year.

The average London leaver spent £358,650 on their home outside the capital, which equates to a collective total of £26.2bn over the year.

However, affordability barriers in the South have resulted in more London leavers moving to the midlands and north of England. In 2019, a record 13% of London leavers bought homes in the north of England.

READ MORE: Zoopla says lower house price growth is 'the new normal'

This is despite research showing that parts of London became more affordable in 2019. In Westminster, properties still cost nearly 20-and-a-half times the average London wage.

The proportion of Londoners heading to the north-east, north-west or Yorkshire and Humber has been rising at a significant rate over the last decade. In 2009, just 1% of London leavers bought homes in the North.

The Midlands has seen a similar increase in London buyers. Last year, 15% of London leavers bought a home in the Midlands, up from 12% in 2016 and 5% in 2009.

READ MORE: London property prices are being cut as Brexit uncertainty looms

“The number of Londoners purchasing a home outside the capital has fallen by 4% since the most recent peak of 2016. This was the prime time for Londoners to cash in on their property and move to the country,” explained Aneisha Beveridge, head of research at Hamptons International.

“This was when the price gap between a home in London and one elsewhere in Great Britain was at its widest. However since then, house prices outside of London have risen faster than those in the capital and this has resulted in more London homeowners staying put.

She added: “Historically most homeowners leaving London did so for life-stage reasons and to take advantage of being able to buy a larger home, but for others, leaving London is the only way of getting onto the housing ladder.

READ MORE: Just 8% of towns across Britain affordable for key workers to own home – study

“For many first-time buyers it also means moving further afield to areas such as the Midlands and North where they can get more for their money.”

Yahoo Finance

Yahoo Finance