The Fed needs to cut rates this summer, says 'Oracle of Tampa' Jay Bowen

Traders are increasingly betting that the Federal Reserve will reduce rates before the end of the year. Interest-rate futures show an 84% probability that the Fed will cut rates at least once by the conclusion of its December meeting.

That’s not soon enough for Jay Bowen. “I think it needs to happen this summer and it needs to be 50 basis points,” said Bowen, president, chief executive officer and chief investment officer at Bowen, Hanes & Co., in an interview with Yahoo Finance’s On the Move. Once dubbed the “Oracle of Tampa,” by The Wall Street Journal, Bowen manages the Tampa Firefighters and Police Officers Pension Fund.

Rate futures are pricing in a 13% chance of a cut at the Fed’s June 19 meeting, rising to a 28% likelihood at the July 31 meeting, according to CME data as of Wednesday afternoon.

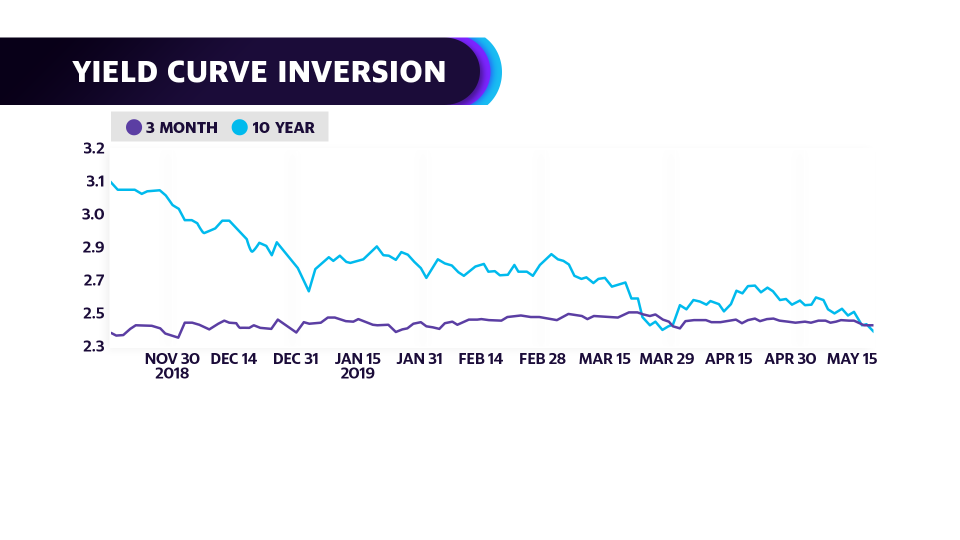

“The market is screaming that we need a rate cut right now,” said Bowen, pointing to the inversion of the yield curve. He predicts easing will happen before the Fed’s annual Economic Symposium in Jackson Hole, Wyo., in August.

He said investors should watch for upcoming comments from voting Fed members including New York Fed President John Williams, Vice Chairman Richard Clarida, and Governor Lael Brainard for signals a cut could be coming, including any indication they would change the way they target inflation.

Concerns over global growth, exacerbated by the U.S.-China trade war, have sent investors flooding into Treasuries, particularly the longer end of the curve. The yield on the 10-year note is at its lowest since September 2017.

Bowen is monitoring what he characterizes as deterioration in a number of indicators, including economic conditions, inflationary expectations, durable goods orders, and industrial production.

But the “Oracle of Tampa” thinks the Fed will indeed cut — and a trade deal will be struck, “so I would view the current situation as more of an opportunity.”

Julie Hyman is the co-anchor of Yahoo Finance’s On the Move.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance