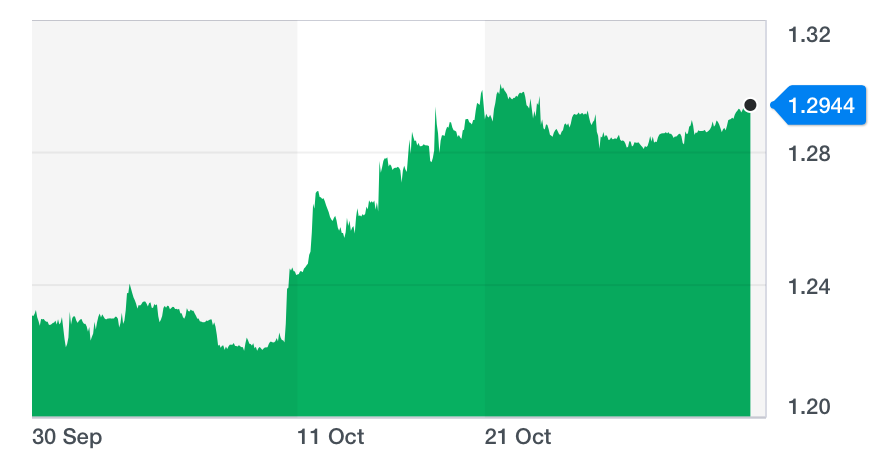

Pound set for its best month in a decade

The pound has borne the brunt of market anxiety about Brexit — but is now on track for its best month in over a decade.

Largely because the prospect of a no-deal Brexit has been taken off the table, the currency has climbed by more than 5.3% against the dollar (GBPUSD=X) since the beginning of October, its biggest rally since May 2009.

The pound is extraordinarily sensitive to Brexit developments, and is still down by more than 12% since the June 2016 referendum.

But for the first time since May, it broached the $1.30 mark earlier this month after prime minister Boris Johnson struck a Brexit deal with the European Union. The pound is currently hovering just below that recent high-water mark.

“Sterling has enjoyed its best month in a decade as the ghosts of a no-deal Brexit have finally been laid to rest,” Neil Wilson, chief market analyst at Markets.com, told Yahoo Finance UK.

A series of developments in the past few weeks have boosted the currency, such as the passing of a law that required Johnson to seek a Brexit extension by 19 October if a Brexit deal had not been ratified by that date.

Though he had said he would “rather be dead in a ditch” than agree to extend Brexit, Johnson requested the extension and it was granted by EU leaders this week. That means that the UK is now set to leave the EU on 31 January, unless parliament approves a deal in the interim.

The pound has also gained against the euro (GBPEUR=X), making October its best month against the eurozone’s common currency since January 2019.

And though the December general election throws an element of uncertainty in the mix, traders are confident that the UK will not be crashing out of the bloc any time soon.

“Whilst no deal remains technically on the table until the future relationship between the UK and EU is formally agreed — which could be years away – there is a sense that Britain now won’t crash out without a transition deal in place,” Wilson said.

He noted that while the UK had seen a run of “pretty mixed” economic data, it was holding up well in comparison to Germany, which is soon expected to fall into recession.

Though sterling has made steady gains, a further sustained rally is unlikely, Wilson said.

“A test of the $1.30 is likely but a sustained rally through that towards $1.35 looks unlikely in the near term as traders await the uncertain result of the election.”

The pound would likely remain within the $1.28–$1.30 range, Wilson predicted.

Yahoo Finance

Yahoo Finance