There's a battle raging in the City over whether Britain is headed for a post-Brexit recession

Wikimedia Commons

When Britain voted to leave the European Union on June 23, economists almost universally predicted one thing — a technical recession would happen within a couple of years, as the UK adjusts to realities of leaving the EU.

Now people are not so sure.

There is a growing divide among forecasters about whether or not Britain is going to slide into recession towards the end of this year and into the beginning of next, or if it will just keep its head above water, continuing to grow, albeit at a much slower pace than if we'd voted to stay in the EU.

In recent weeks, the tide of forecasting has broadly swung towards the suggestion that Britain will escape recession, with numerous forecasts revised upwards following a slew of better than expected economic data coming out of the country.

Earlier in September, both Credit Suisse and Morgan Stanley revised their initial post-Brexit expectations and argued that Britain will skirt around a so-called 'Brecession.' That revision came after stronger data released in August. Morgan Stanley economists Melanie Baker and Jacob Nell, and strategist Anton Hesse said at the time (emphasis ours):

"After the vote to Leave, we, and consensus, forecast a mild 2H recession and cut our 2017 forecast by almost 2pp. But, 2Q data has come in stronger than expected,and we see elements of strength in 3Q data, including July retail sales (1.5%M) and August composite PMI (53.6). In response, we've 'marked-to-market' our growth forecast from a sharp slowdown and Brecessionto a lesser slowdown, which narrowly avoids a technical recession."

The Bank of England — which had been hugely pessimistic on the immediate impact of a Brexit vote, and whose governor Mark Carney warned of a technical recession in the run-up to the vote — also u-turned.

Many though — chief among them Barclays — are still convinced that there will be a recession in the UK, even if that recession might not be as bad as initially expected. A recent report from the National Institute of Economic and Social Research noted that "the probability of a technical recession before the end of 2017 remains significantly elevated."

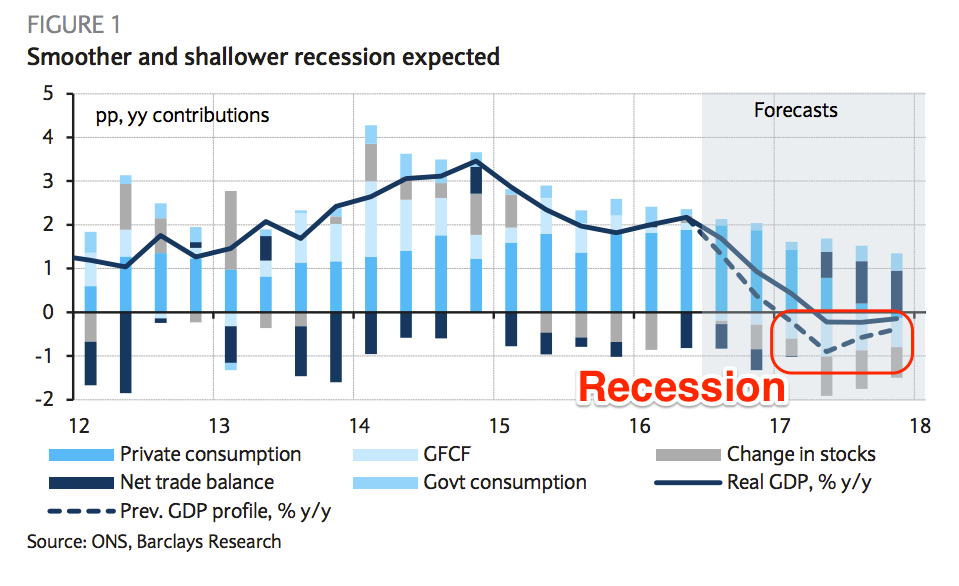

In a note to clients circulated last week, Barclays — which in the immediate aftermath of the referendum was the most bearish of all major banks on the UK economy — revised up its forecasts for Britain, but insisted that a "slow fuse" recession remains on the cards.

Here's what analysts Fabrice Montagne and Andrzej Szczepaniak had to say in a research note circulated to clients late last week (emphasis ours):

"Nevertheless, the changes to our forecast today do not alter our view that the UK is heading into a recession and we continue to expect negative quarterly growth in four out of the next six quarters. We continue to believe in a shallow but prolonged recession ahead, driven by investment contraction in the short term and a slowdown in domestic consumption in the course of next year."

And here's Barclays' chart:

Wikimedia Commons

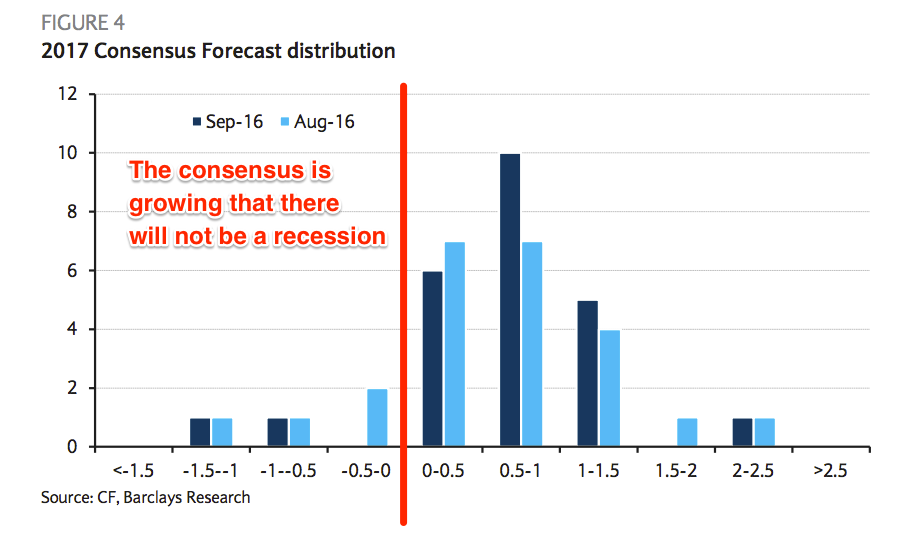

Barclays acknowledges that it now holds a contrarian view, with its forecast falling substantially below consensus. However, it notes that the huge range of forecasts — reflecting the uncertainty around what will actually happen to Britain as it begins Brexit negotiations — means that it is still well within forecast uncertainty.

"We acknowledge that even after our revisions, our forecast may still appear to be significantly below consensus for next year (currently slightly below 0.7% y/y) but given the dispersion of forecasts (standard deviation of 0.8pp) we believe we remain well within forecast uncertainty," Montagne and Szczepaniak say.

Take a look a Barclays' chart containing the forecasts of numerous market participants below:

Wikimedia Commons

One thing that is interesting to note, via Sky News' Economics Editor Ed Conway, who in a blog post earlier on Wednesday quite rightly pointed out that the definition of a recession is pretty arbitrary. To fall into a technical recession, the economy needs to contract in two consecutive quarters. So if growth drops 0.1% in Q4 2016 and Q1 2017, Britain will have experienced a recession.

By contrast, if growth falls 1% in Q4, grows 0.1% in Q1, and then falls another 1% in Q2, technically speaking we won't have experienced a recession. Now clearly, that's a pretty extreme example that isn't going to happen, but it is an example of how flawed the system for deciding what is and what isn't a recession is.

Wikimedia CommonsWhile opinion is divided on whether Britain will technically see a recession, what is clear from almost all forecasters — other than the most optimistic Brexit backers — is that Britain is going to undergo a painful correction even before the UK has formally exited the EU.

Earlier on Wednesday, the Organisation for Economic Co-operation and Development, forecast that Brexit will cut UK GDP growth from 2% to 1% next year.

UK GDP is about £1.8 trillion per year. So that one percentage point cut will wipe about £18 billion of economic activity off the chart. £18 billion in damage is not a trivial amount. It is twice the value of all the activity generated by banks that hold EU passporting rights for financial services, for instance.

Regardless of their predictions, it seems fairly obvious that no one is 100% certain of what will happen to the British economy over the coming years. Just look at the way banks have revised their forecasts on GDP growth in recent weeks and months. Morgan Stanley even acknowledged that it cannot say with any certainty what is going to happen to the British economy going forward.

NOW WATCH: The extraordinary life of former fugitive and eccentric cybersecurity legend John McAfee

See Also:

BREXIT FALLOUT: 76% of UK CEOs said they would consider moving operations abroad

The British economy has cleared its first post-Brexit hurdle

SEE ALSO: The British economy has cleared its first post-Brexit hurdle

DON'T MISS: BREXIT: 'No sign of a major collapse' — that's exactly what the Leave crowd want to hear

Yahoo Finance

Yahoo Finance