There's a realistic way to save for a London property deposit

If you’re looking at getting on the UK housing ladder, especially in London, it looks like 2020 is the time to buy.

According to a Reuters poll of analysts and experts, house prices in Britain’s capital are set to fall by 1.6% this year and 0.1% in 2019, with property prices in the capital having a one in three chance of crashing. While this is worrying for people looking to move or cash out on their property, it is a good sign for those looking to get on the housing ladder as analysts think London is currently overvalued.

“The weight of evidence suggests that housing is overvalued once more,” said Hansen Lu at Capital Economics to Reuters. Tony Williams at property consultancy Building Value says that a “disorderly Brexit,” which also means a no-deal Brexit, “will exacerbate” the trend of traditional international buyers are staying away from the London housing market.

Currently property prices in the UK’s capital hover around £500,000 ($644,663) and are consistently above anywhere else in England.

How to save for a deposit

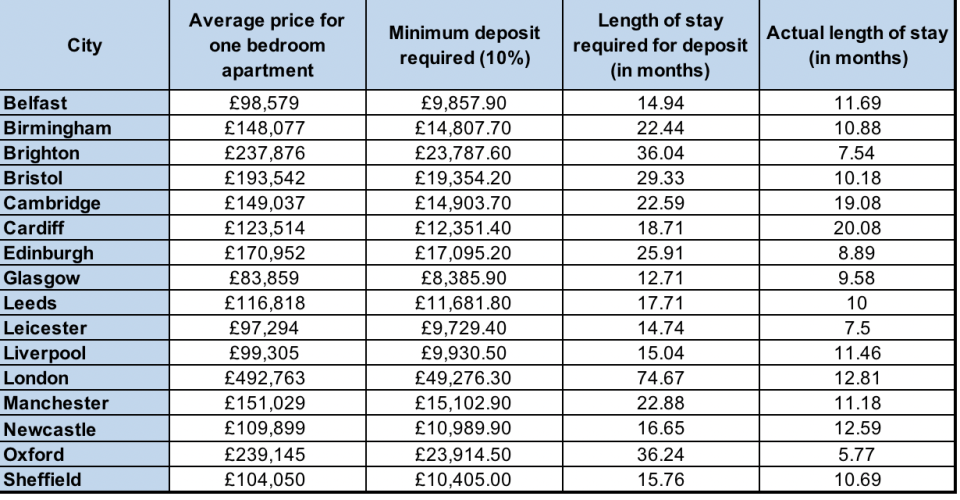

That may seem daunting for someone who isn’t even on the property ladder yet. After all, the average amount for a deposit is 10% of the value of the property.

Yahoo Finance UK spoke to price comparison website MoneySuperMarket (MONY.L) about how it’s possible to save for a deposit when the bar of entry is so high in places like London, where the cost of living is high and wage growth is stagnating.

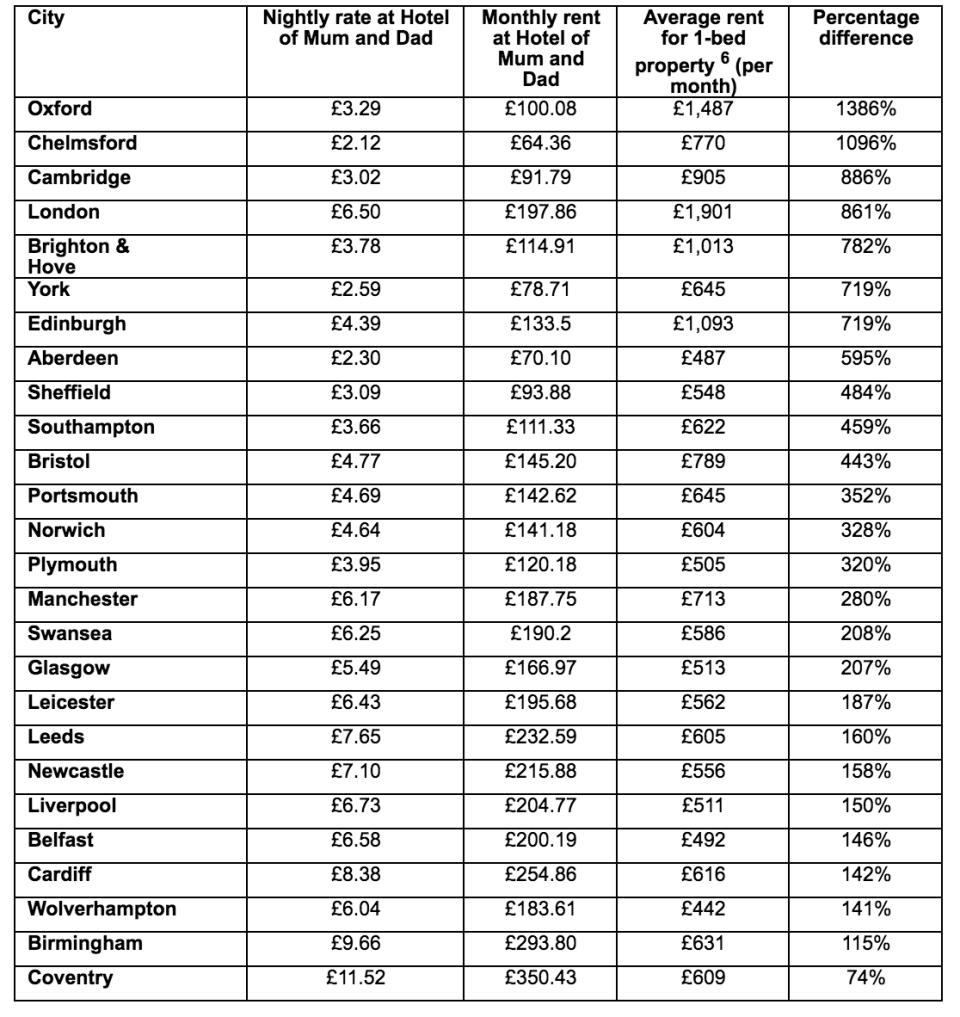

According to MoneySuperMarket’s report “Hotel of Mum and Dad,” it found that the number of adult children who have moved back in with their parents has grown 8%, more than the population of London within the last 20 years.

“Despite the housing market in London levelling out slightly in recent months, it’s still incredibly hard for first-time buyers to get on the property ladder,” MoneySuperMarket’s Caoimhe Keogan told Yahoo Finance UK.

“With the average London house price coming in at over £480,0001, it’s understandable that many prospective homeowners living in the capital can’t afford both to rent and save for a deposit at the same time. Luckily, as our research shows, parents are willing to welcome their children back home in order to support their financial wellbeing. And with the average London rent for a one bed property standing at £1,901, there are huge savings to be made by staying at home.”

The group looked at various average costs that can be saved while staying at home. For example, laundry, food shopping, toiletries, as well as gas, electricity and water bills. While not everyone will have parents that can supplement when they are at home, the research shows that, on average, Londoners are paying their parents just £6.50 a night, or £198 a month, for staying with them.

Couple that with the amount saved on rent and how if parents supplement a variety of other living costs, like evening meals and laundry, as well as staying frugal, staying at home would allow you to save a sizeable amount for a deposit.

“It used to be that a school qualification was enough to make a good living. Then it took a university degree or a short apprenticeship,” said Dr Michael Muthukrishna, assistant professor of Economic Psychology at LSE. “Now it requires post-graduate degrees, internships and volunteer work—which can be unpaid—as well as on-the-job training. This has meant that the age of people having their first child, owning a home and becoming financially independent has been steadily rising.”

Of course though, this is weighted differently depending where you are in the UK. MoneySuperMarket’s calculations show that you’d be able to save a deposit on a one-bedroom home in London, if you lived at home for just over six years. This is a long time compared with somewhere like Glasgow, Scotland.

Yahoo Finance

Yahoo Finance