Things to Know Before Marathon Petroleum's (MPC) Q4 Earnings

Marathon Petroleum Corporation MPC is set to release fourth-quarter 2019 results on Wednesday Jan 29, before the opening bell. The current Zacks Consensus Estimate for the to-be-reported quarter is pegged at earnings of 85 cents per share on revenues of $29.7 billion.

The Zacks Consensus Estimate for fourth-quarter earnings has been steady over the past seven days.

Highlights of Q3 Earnings & Surprise History

In the last reported quarter, this Findlay, OH-based company’s earnings beat the consensus mark on the back of strong throughput, which soared 55% from the third quarter of 2018. Marathon Petroleum reported adjusted earnings per share of $1.63, surpassing the Zacks Consensus Estimate of $1.30. However, the downstream operator’s revenues of $31.2 billion missed the Zacks Consensus Estimate of $31.5 billion.

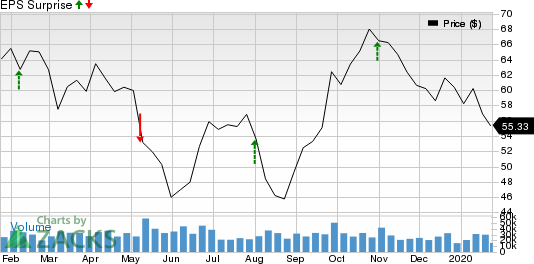

As far as earnings surprises are concerned, Marathon Petroleum is on a solid footing, having exceeded the Zacks Consensus Estimate thrice in the last four reports. This is depicted in the graph below:

Marathon Petroleum Corporation Price and EPS Surprise

Marathon Petroleum Corporation price-eps-surprise | Marathon Petroleum Corporation Quote

Given this upbeat scenario, let’s delve into the factors that might have impacted the company’s performance in the December quarter.

Factors to Consider for Q4 Results

Marathon Petroleum’s fourth-quarter revenue results are likely to reflect synergies from 2018's Andeavor acquisition.

Its retail division is expected to have benefited from higher year-over-year margins and sales owing to Speedway and the acquired retail assets of Andeavor. The Zacks Consensus Estimate for convenience stores as of Dec 31, 2019 stands at 3,931, indicating an increase from 3,923 reported at the end of fourth-quarter 2018. Moreover, the Zacks Consensus Estimate for merchandise sale and margins is pegged at a respective $1.54 billion and $439 million. The year-ago merchandise sale and margins figures were $1.48 billion and $417 million each.

The Zacks Consensus Estimate for the Midstream segment profitability is pegged at $943 million for fourth-quarter 2019, indicating a rise from $889 million reported in the year-ago period, attributable to stronger contributions from MPLX and Andeavor Logistics.

However, the Zacks Consensus Estimate for refined products sales volume and refinery throughput stands at 3,619 thousand barrels per day (mbpd) and 3,052 mbpd each, suggesting a drop from the year-ago reported figures of 3,764 mbpd and 3,111 mbpd, respectively. Consequently, the Zacks Consensus Estimate for the company’s largest segment’s profitability is pinned at $218 million, implying a 76.38% fall from the year-ago reported figure.

What Does Our Model Say?

The proven Zacks model does not conclusively predict an earnings beat for Marathon Petroleum this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Marathon Petroleum has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 85 cents each.

Zacks Rank: Marathon Petroleum carries a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult for the stock this earnings season.

Stocks to Consider

Here are some companies from the energy space that you may want to consider on the basis of our model, which shows that these have the right combination of elements to beat on earnings this reporting cycle:

NuStar Energy L.P. NS has an Earnings ESP of +1.32% and a Zacks Rank of 1. The company is slated to report fourth-quarter earnings on Feb 5.

ConocoPhillips COP has an Earnings ESP of +2.45% and a Zacks Rank #2. The company is slated to announce fourth-quarter 2019 earnings on Feb 4.

Magellan Midstream Partners MMP has an Earnings ESP of +3.81% and is Zacks #3 Ranked. The partnership is slated to release fourth-quarter earnings on Jan 30. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance