Things to Note Ahead of Oasis Petroleum's (OAS) Q1 Earnings

Oasis Petroleum Inc. OAS is set to release first-quarter 2020 results before the opening bell on Monday, May 11. The current Zacks Consensus Estimate for the to-be-reported quarter is a loss of 17 cents per share on revenues of $324 million.

Let’s delve into the factors that might have influenced the oil and natural gas explorer’s performance in the March quarter. But it’s worth taking a look at Oasis Petroleum’s previous quarter performance first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, the Houston, TX-based upstream player beat the consensus mark on higher realized oil prices and reduced year-over-year operating expenses. Oasis Petroleum reported adjusted loss per share of 2 cents, 4 cents narrower than the Zacks Consensus Estimate. Meanwhile, the company’s quarterly revenues of $483.9 million came ahead of the Zacks Consensus Estimate of $421 million.

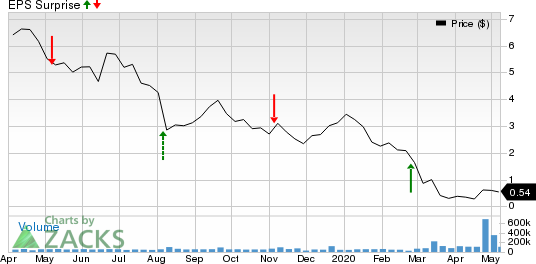

As far as earnings surprises are concerned, Oasis Petroleum beat estimates on two occasions and missed twice, delivering an average negative surprise of 108.33%. This is depicted in the graph below:

Oasis Petroleum Inc Price and EPS Surprise

Oasis Petroleum Inc price-eps-surprise | Oasis Petroleum Inc Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for first quarter earnings per share has been revised 6.25% downward in the last 7 days. Moreover, the estimated figure indicates a massive 750% drop from the year-ago reported earnings. The Zacks Consensus Estimate for revenues also suggests a 43.7% decrease from the prior-year reported figure of $575.7 million.

Factors to Consider This Quarter

Oasis Petroleum’s asset base is primarily focused on the Bakken shale oil play of the Williston Basin, where it competes with the likes of Whiting Petroleum WLL.

Lower activity and downtime associated with cold weather is likely to have negatively impacted Oasis Petroleum’s output in the to-be-reported quarter. The Zacks Consensus Estimate for first-quarter average daily production is pegged at 78,677 oil-equivalent barrels BOE, indicating a 14.2% decrease from 91,714 BOE a year ago.

However, on a somewhat positive note, Oasis Petroleum’s bottom line is expected to have reflected the impact of improving operating cost in the to-be-reported results. Sophisticated well design, higher productivity, service cost control and overall efficiency led to a 43% reduction in the company’s E&P operating cost structure since 2014, a trend that most likely continued in the first quarter.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Oasis Petroleum is likely to beat estimates in the March quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company stands at -3.70%.

Zacks Rank: Oasis Petroleum has a Zacks Rank of 3.

Stocks to Consider

While earnings beat looks uncertain for Oasis Petroleum, here are some firms from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this season:

Sunoco LP SUN has an Earnings ESP of +14.75% and a Zacks Rank #3. The firm is scheduled to release earnings on May 1.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Noble Midstream Partners LP NBLX has an Earnings ESP of +14.04% and is Zacks #3 Ranked. The partnership is scheduled to release earnings on May 8.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN) : Free Stock Analysis Report

Oasis Petroleum Inc (OAS) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

Noble Midstream Partners LP (NBLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance