We Think Elmos Semiconductor (ETR:ELG) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Elmos Semiconductor AG (ETR:ELG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Elmos Semiconductor

How Much Debt Does Elmos Semiconductor Carry?

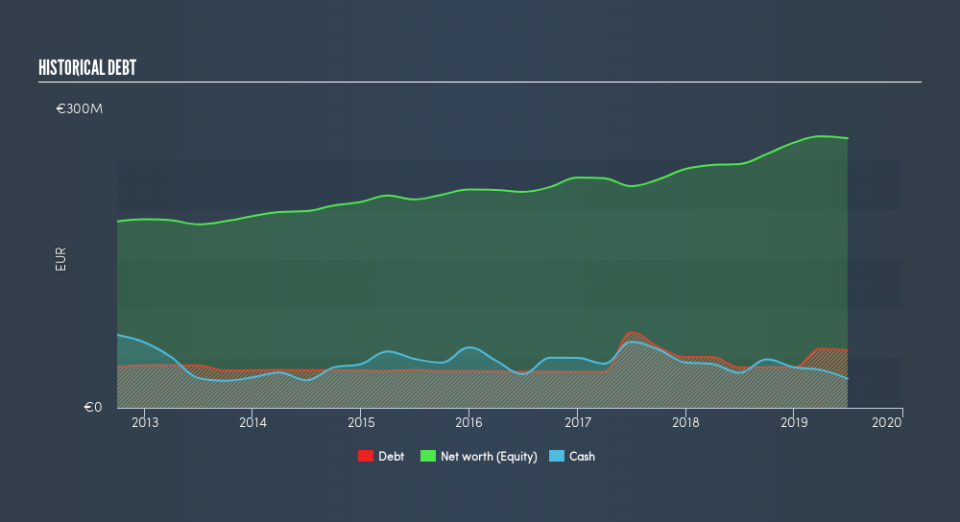

As you can see below, at the end of June 2019, Elmos Semiconductor had €54.8m of debt, up from €40.6m a year ago. Click the image for more detail. However, it does have €29.3m in cash offsetting this, leading to net debt of about €25.6m.

A Look At Elmos Semiconductor's Liabilities

Zooming in on the latest balance sheet data, we can see that Elmos Semiconductor had liabilities of €48.3m due within 12 months and liabilities of €60.8m due beyond that. Offsetting these obligations, it had cash of €29.3m as well as receivables valued at €61.0m due within 12 months. So it has liabilities totalling €18.9m more than its cash and near-term receivables, combined.

Since publicly traded Elmos Semiconductor shares are worth a total of €478.7m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Elmos Semiconductor has a low net debt to EBITDA ratio of only 0.33. And its EBIT covers its interest expense a whopping 46.8 times over. So we're pretty relaxed about its super-conservative use of debt. And we also note warmly that Elmos Semiconductor grew its EBIT by 17% last year, making its debt load easier to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Elmos Semiconductor's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Elmos Semiconductor recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for and improvement.

Our View

The good news is that Elmos Semiconductor's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that Elmos Semiconductor can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Elmos Semiconductor's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance