We Think Entasis Therapeutics Holdings (NASDAQ:ETTX) Needs To Drive Business Growth Carefully

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Entasis Therapeutics Holdings (NASDAQ:ETTX) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Entasis Therapeutics Holdings

How Long Is Entasis Therapeutics Holdings' Cash Runway?

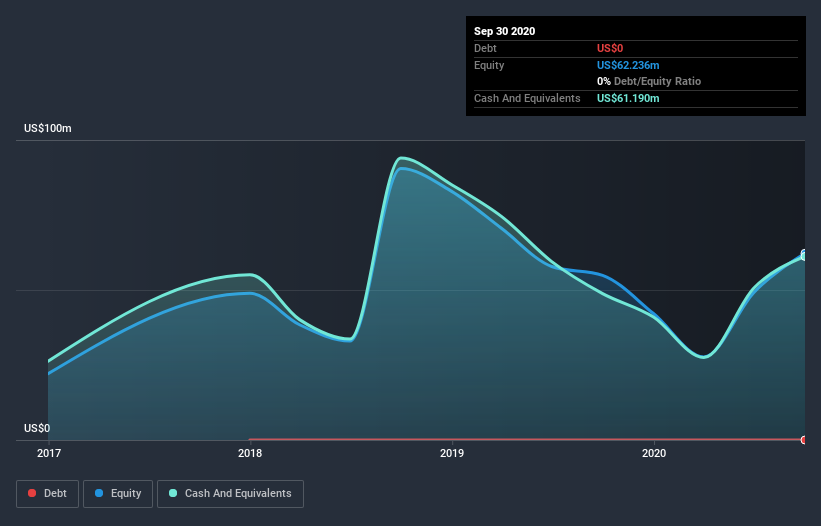

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2020, Entasis Therapeutics Holdings had US$61m in cash, and was debt-free. In the last year, its cash burn was US$46m. Therefore, from September 2020 it had roughly 16 months of cash runway. Importantly, analysts think that Entasis Therapeutics Holdings will reach cashflow breakeven in 4 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. You can see how its cash balance has changed over time in the image below.

How Is Entasis Therapeutics Holdings' Cash Burn Changing Over Time?

Because Entasis Therapeutics Holdings isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. It seems likely that the business is content with its current spending, as the cash burn rate stayed steady over the last twelve months. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Entasis Therapeutics Holdings Raise Cash?

Since its cash burn is increasing (albeit only slightly), Entasis Therapeutics Holdings shareholders should still be mindful of the possibility it will require more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Entasis Therapeutics Holdings' cash burn of US$46m is about 70% of its US$65m market capitalisation. That's very high expenditure relative to the company's size, suggesting it is an extremely high risk stock.

So, Should We Worry About Entasis Therapeutics Holdings' Cash Burn?

On this analysis of Entasis Therapeutics Holdings' cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. Summing up, we think the Entasis Therapeutics Holdings' cash burn is a risk, based on the factors we mentioned in this article. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Entasis Therapeutics Holdings (2 make us uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance