Here’s What We Think About Industria de Diseño Textil SA’s (BME:ITX) CEO Pay

In 2005 Pablo Isla de Tejera was appointed CEO of Industria de Diseño Textil SA (BME:ITX). This analysis aims first to contrast CEO compensation with other large companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Industria de Diseño Textil

How Does Pablo Isla de Tejera’s Compensation Compare With Similar Sized Companies?

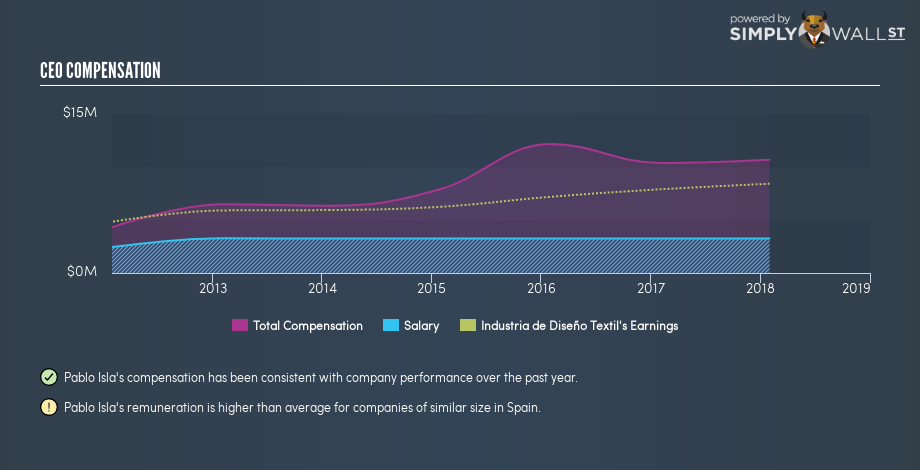

Our data indicates that Industria de Diseño Textil SA is worth €84b, and total annual CEO compensation is €11m. (This figure is for the year to 2018). While this analysis focuses on total compensation, it’s worth noting the salary is lower, valued at €3.3m. We took a group of companies with market capitalizations over €7.1b, and calculated the median CEO compensation to be €4.3m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts – even though some are quite a bit bigger than others).

It would therefore appear that Industria de Diseño Textil SA pays Pablo Isla de Tejera more than the median CEO remuneration at large companies, in the same market. However, this fact alone doesn’t mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see a visual representation of the CEO compensation at Industria de Diseño Textil, below.

Is Industria de Diseño Textil SA Growing?

Industria de Diseño Textil SA has increased its earnings per share (EPS) by an average of 7.5% a year, over the last three years In the last year, its revenue is up 4.8%.

I would argue that the improvement in revenue isn’t particularly impressive, but I’m happy with the modest EPS growth. It’s clear the performance has been quite decent, but it it falls short of outstanding,based on this information.

It could be important to check this free visual depiction of what analysts expect for the future.

Has Industria de Diseño Textil SA Been A Good Investment?

Since shareholders would have lost about 13% over three years, some Industria de Diseño Textil SA shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary…

We compared total CEO remuneration at Industria de Diseño Textil SA with the amount paid at other large companies. We found that it pays well over the median amount paid in the benchmark group.

Over the last three years, shareholder returns have been downright disappointing, and the underlying business has failed to impress us. Although we’d stop short of calling it inappropriate, we think the CEO compensation is probably more on the generous side of things. So you may want to check if insiders are buying Industria de Diseño Textil shares with their own money (free access).

Or you might prefer this data-rich interactive visualization of historic revenue and earnings.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance