We Think Pearson (LON:PSON) Can Stay On Top Of Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Pearson plc (LON:PSON) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Pearson

What Is Pearson's Debt?

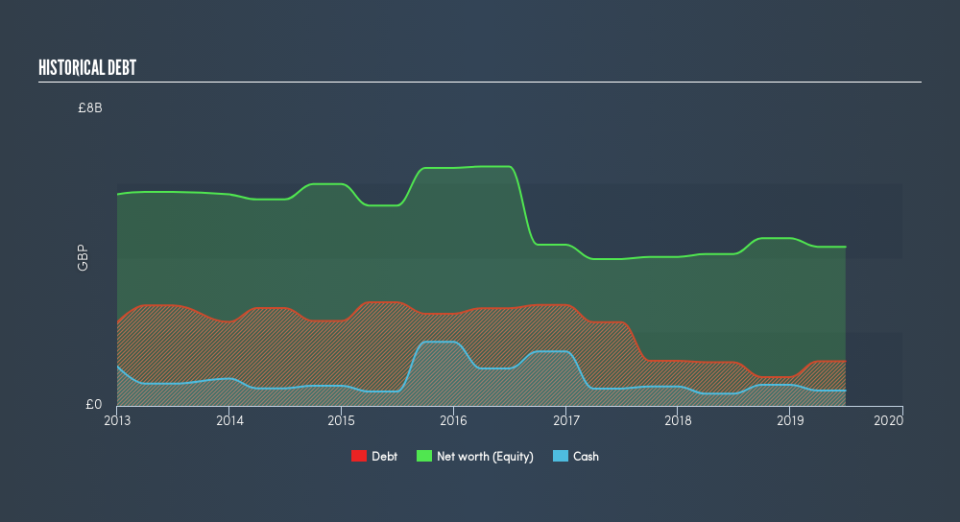

The chart below, which you can click on for greater detail, shows that Pearson had UK£1.21b in debt in June 2019; about the same as the year before. However, it does have UK£417.0m in cash offsetting this, leading to net debt of about UK£789.0m.

A Look At Pearson's Liabilities

The latest balance sheet data shows that Pearson had liabilities of UK£1.40b due within a year, and liabilities of UK£2.27b falling due after that. Offsetting these obligations, it had cash of UK£417.0m as well as receivables valued at UK£1.27b due within 12 months. So its liabilities total UK£1.98b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Pearson is worth UK£6.33b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Pearson has a low net debt to EBITDA ratio of only 1.4. And its EBIT covers its interest expense a whopping 23.8 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Pearson has increased its EBIT by 2.2% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Pearson can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Pearson's free cash flow amounted to 49% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

When it comes to the balance sheet, the standout positive for Pearson was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to handle its total liabilities. When we consider all the elements mentioned above, it seems to us that Pearson is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Pearson insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance