Thomas Cook seals emergency bailout from China's Fosun

Struggling travel business Thomas Cook (TCG.L) has agreed to an emergency takeover that will see debtors and its largest investor pump new cash into the firm to save it from collapse.

Thomas Cook said on Wednesday that it has agreed to sell the majority of its tour operator business and a stake in its airline business to Chinese conglomerate Fosun, its largest shareholder.

Fosun will pay £450m ($548m) of new money for 75% of the company’s tour operator business and 25% of its embattled airline business. Fosun, which also owns football club Wolverhampton Wonderers and France’s Club Med, already owns 15% of Thomas Cook.

The rescue deal will also see the group’s lenders and bondholders bring around £450m into the business, while converting existing debt into approximately 75% of the equity of the airline and up to 25% of new equity for the tour operator arm.

Thomas Cook said that despite efforts to come up with a plan that would allow existing shareholders to invest alongside Fosun, Wednesday’s rescue plan was likely to see existing investors “significantly diluted.” The company also warned that it may cancel its listing under the rescue plan.

“Shareholders in the troubled travel company may have to accept that their investment could be worthless,” Russ Mould, investment director at stockbroker AJ Bell, said.

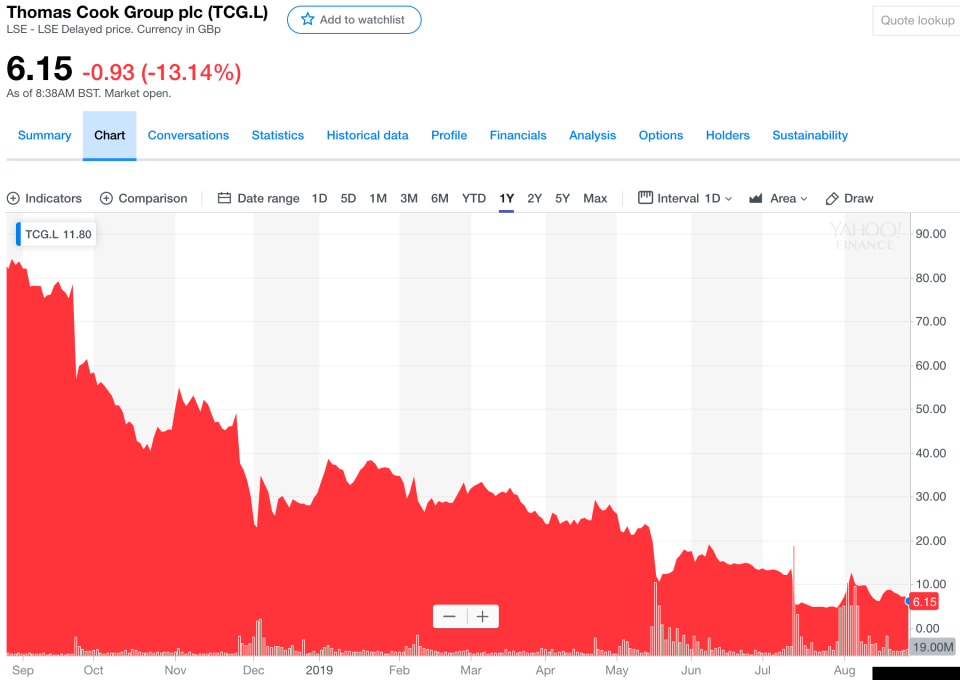

Shares in Thomas Cook crashed by 15% in London. The stock price has collapsed over 90% over the last 12 months.

The emergency rescue package comes as Thomas Cook has been struggling with mounting debts and a viciously competitive landscape for European travel companies.

Thomas Cook has run up debts of £1.2bn and made a first half loss of £1.5bn as it battled a weak bookings market and asset writedowns. The company faced a cash crunch ahead of the key winter booking season.

Fierce competition in the airline sector has also seen rivals such as WOW Airlines, FlyBMI, and Germania all collapse so far this year.

Last month, Thomas Cook said Fosun would provide a £750m cash injection in a bid to secure the future of the company. Fosun first invested in Thomas Cook in 2015 as part of broader investments into European and US travel and entertainment businesses.

Thomas Cook is one of the world’s biggest travel companies, with over 21,000 staff and 200 hotels globally.

Yahoo Finance

Yahoo Finance