Those who invested in Brown-Forman (NYSE:BF.B) five years ago are up 38%

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. But Brown-Forman Corporation (NYSE:BF.B) has fallen short of that second goal, with a share price rise of 26% over five years, which is below the market return. Unfortunately the share price is down 0.5% in the last year.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Brown-Forman

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

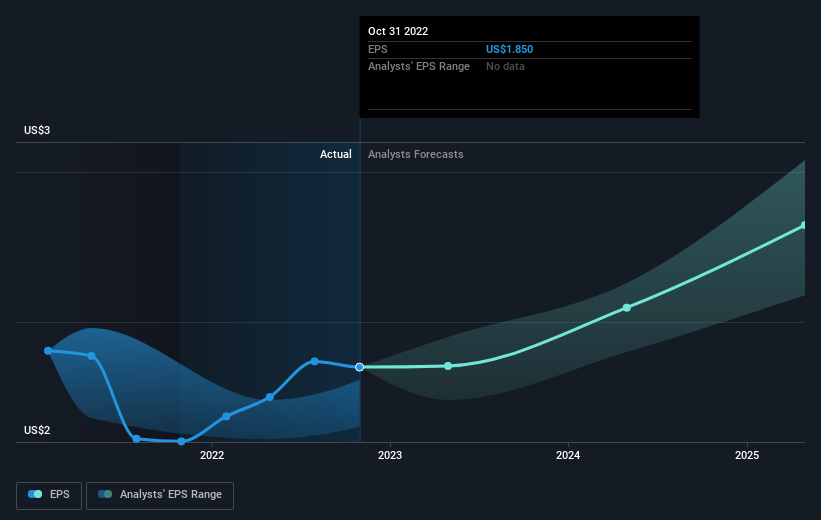

Over half a decade, Brown-Forman managed to grow its earnings per share at 3.6% a year. This EPS growth is lower than the 5% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Brown-Forman has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Brown-Forman, it has a TSR of 38% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Brown-Forman shareholders have received a total shareholder return of 0.6% over the last year. That's including the dividend. Having said that, the five-year TSR of 7% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Brown-Forman you should be aware of.

Of course Brown-Forman may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance