Those who invested in PB Holding (AMS:PBH) five years ago are up 9.0%

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in PB Holding N.V. (AMS:PBH), since the last five years saw the share price fall 85%. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for PB Holding

PB Holding didn't have any revenue in the last year, so it's fair to say it doesn't yet have a proven product (or at least not one people are paying for). You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that PB Holding will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. PB Holding has already given some investors a taste of the bitter losses that high risk investing can cause.

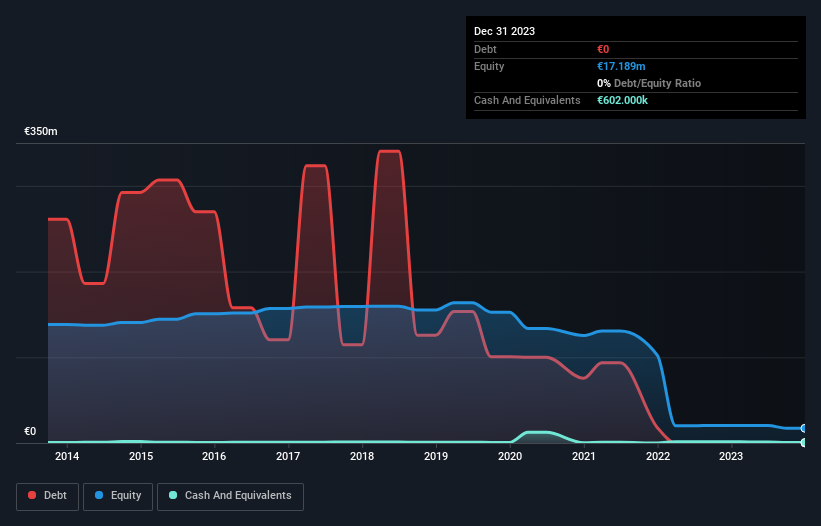

PB Holding has plenty of cash in the bank, with cash in excess of all liabilities sitting at €544k, when it last reported (December 2023). That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 13% per year, over 5 years , it seems like the market might have been over-excited previously. The image below shows how PB Holding's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between PB Holding's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that PB Holding's TSR of 9.0% over the last 5 years is better than the share price return.

A Different Perspective

While the broader market gained around 20% in the last year, PB Holding shareholders lost 7.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand PB Holding better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with PB Holding (including 1 which is concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance