Those who invested in Prospect Resources (ASX:PSC) a year ago are up 390%

This month, we saw the Prospect Resources Limited (ASX:PSC) up an impressive 86%.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Prospect Resources

Given that Prospect Resources didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Prospect Resources saw its revenue grow by 1,255%. That's a strong result which is better than most other loss making companies. So the hefty 76% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

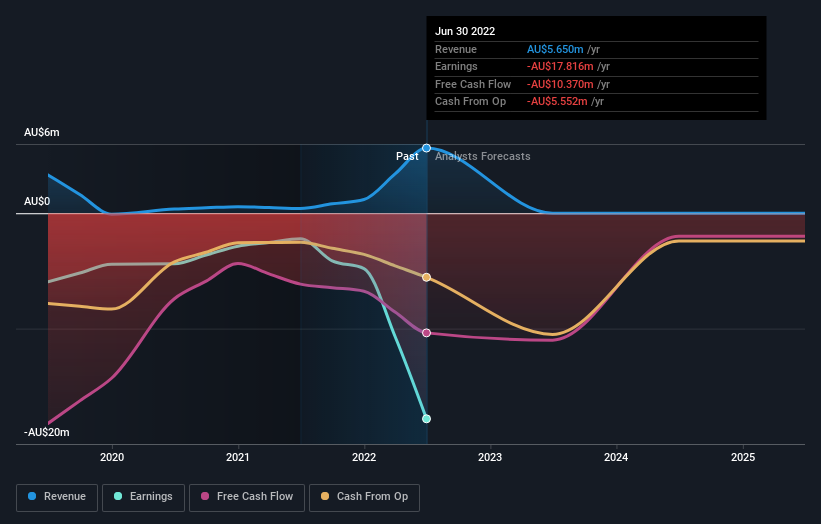

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Prospect Resources

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Prospect Resources' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Prospect Resources hasn't been paying dividends, but its TSR of 390% exceeds its share price return of -76%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Prospect Resources shareholders have received a total shareholder return of 390% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 59% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Prospect Resources (including 1 which is a bit concerning) .

Prospect Resources is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance