Those Who Purchased American Superconductor (NASDAQ:AMSC) Shares A Year Ago Have A 30% Loss To Show For It

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by American Superconductor Corporation (NASDAQ:AMSC) shareholders over the last year, as the share price declined 30%. That's disappointing when you consider the market returned 30%. On the other hand, the stock is actually up 4.5% over three years. It's down 4.2% in the last seven days.

View our latest analysis for American Superconductor

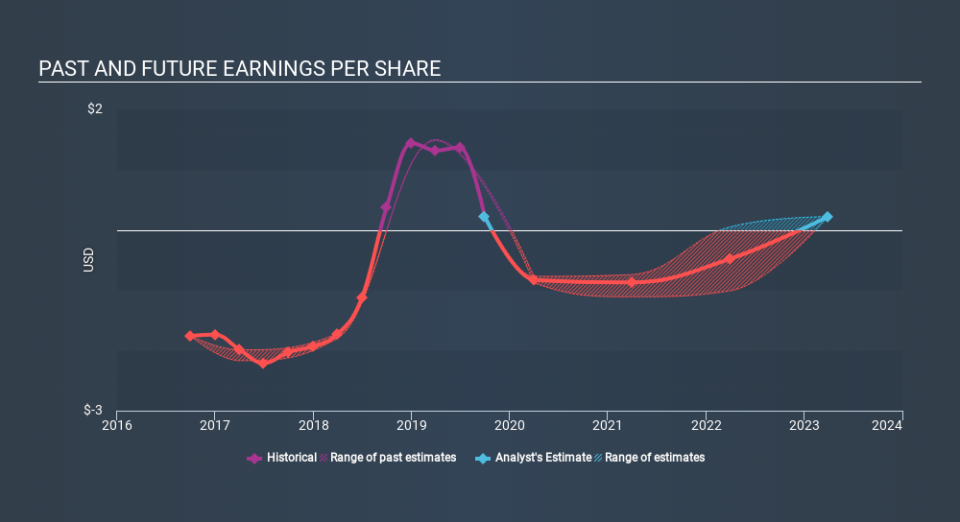

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately American Superconductor reported an EPS drop of 41% for the last year. This fall in the EPS is significantly worse than the 30% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that American Superconductor has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at American Superconductor's financial health with this free report on its balance sheet.

A Different Perspective

Investors in American Superconductor had a tough year, with a total loss of 30%, against a market gain of about 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.1% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on American Superconductor you might want to consider these 3 valuation metrics.

Of course American Superconductor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance