Those Who Purchased DO & CO (VIE:DOC) Shares A Year Ago Have A 35% Loss To Show For It

Over the last month the DO & CO Aktiengesellschaft (VIE:DOC) has been much stronger than before, rebounding by 40%. But that wasn't enough to see the company deliver market-beating returns over the year. Specifically, the stock returned 35% whereas the market is down , having returned (-35%) over the last year.

View our latest analysis for DO & CO

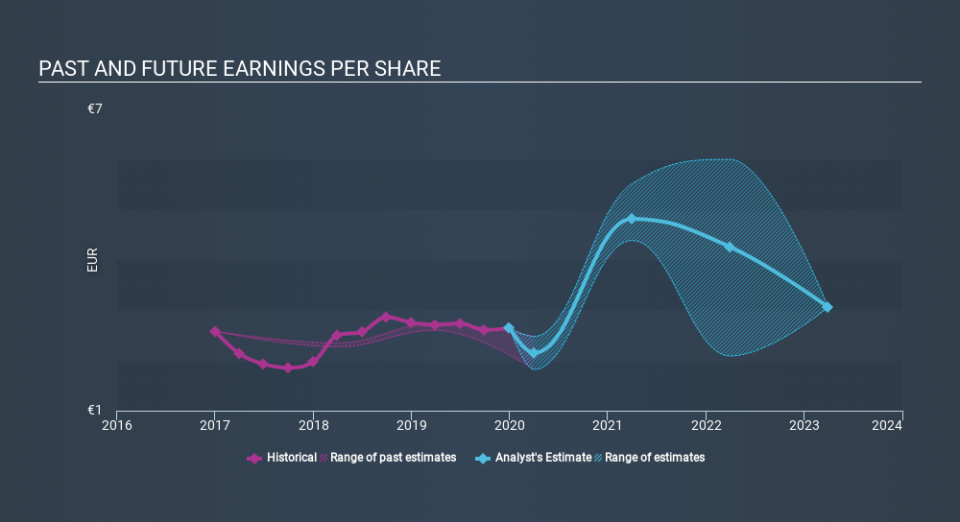

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately DO & CO reported an EPS drop of 3.8% for the last year. This reduction in EPS is not as bad as the 35% share price fall. This suggests the EPS fall has made some shareholders are more nervous about the business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on DO & CO's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered DO & CO's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. DO & CO's TSR of was a loss of 35% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that DO & CO shareholders are down 35% for the year. Unfortunately, that's worse than the broader market decline of 30%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with DO & CO .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance