Those Who Purchased Collagen Solutions (LON:COS) Shares Five Years Ago Have A 71% Loss To Show For It

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Collagen Solutions plc (LON:COS) for five whole years - as the share price tanked 71%.

See our latest analysis for Collagen Solutions

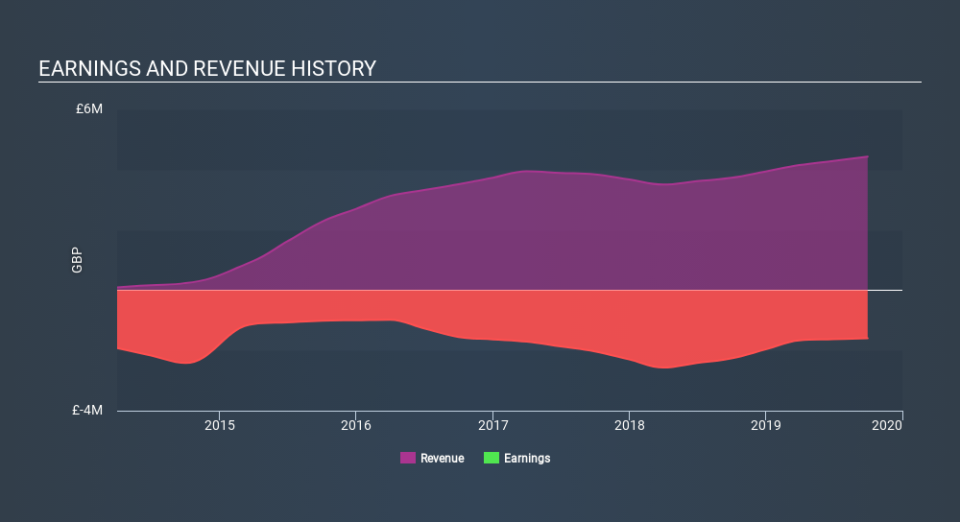

Given that Collagen Solutions didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Collagen Solutions saw its revenue increase by 20% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 22% each year, in the same time period. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Collagen Solutions's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Collagen Solutions provided a TSR of 17% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 22% per year, over five years. It could well be that the business is stabilizing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Collagen Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance