Those Who Purchased Farfetch (NYSE:FTCH) Shares A Year Ago Have A 58% Loss To Show For It

Even the best stock pickers will make plenty of bad investments. Unfortunately, shareholders of Farfetch Limited (NYSE:FTCH) have suffered share price declines over the last year. The share price is down a hefty 58% in that time. Because Farfetch hasn't been listed for many years, the market is still learning about how the business performs. Unhappily, the share price slid 2.8% in the last week.

Check out our latest analysis for Farfetch

Because Farfetch is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Farfetch increased its revenue by 56%. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 58%. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

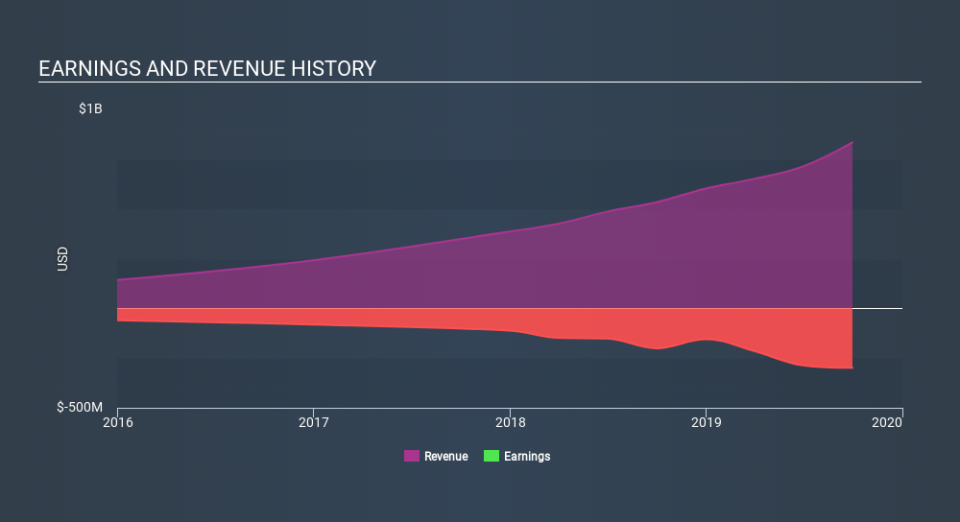

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Farfetch is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Farfetch in this interactive graph of future profit estimates.

A Different Perspective

While Farfetch shareholders are down 58% for the year, the market itself is up 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 4.3%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance