Those Who Purchased Groupe Partouche (EPA:PARP) Shares Three Years Ago Have A 36% Loss To Show For It

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Groupe Partouche SA (EPA:PARP) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 39%. And more recent buyers are having a tough time too, with a drop of 27% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Groupe Partouche

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Groupe Partouche actually managed to grow EPS by 47% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

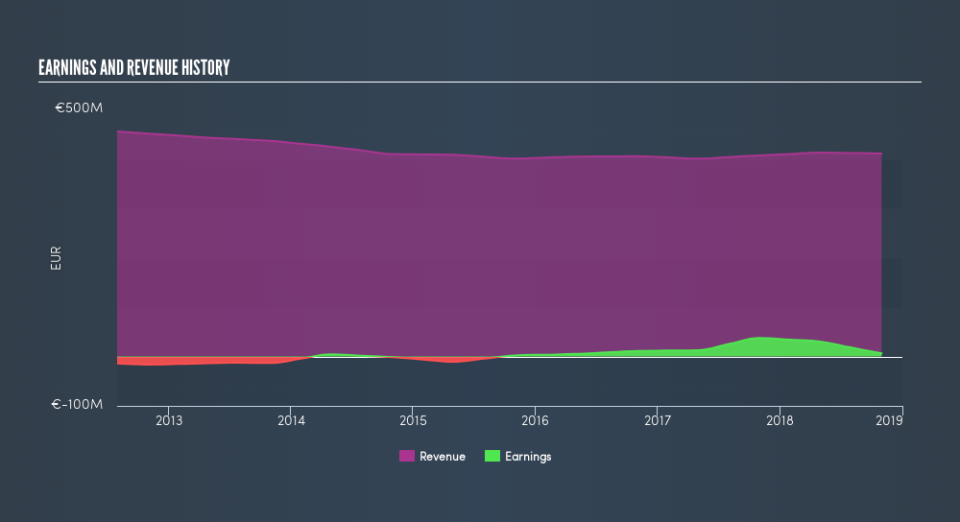

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

If you are thinking of buying or selling Groupe Partouche stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

The last twelve months weren't great for Groupe Partouche shares, which performed worse than the market, costing holders 27%. The market shed around 0.09%, no doubt weighing on the stock price. Shareholders have lost 13% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before deciding if you like the current share price, check how Groupe Partouche scores on these 3 valuation metrics.

We will like Groupe Partouche better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance