Those Who Purchased GSTechnologies (LON:GST) Shares A Year Ago Have A 78% Loss To Show For It

It is a pleasure to report that the GSTechnologies Ltd. (LON:GST) is up 41% in the last quarter. But that is meagre solace when you consider how the price has plummeted over the last year. During that time the share price has plummeted like a stone, down 78%. So the rise may not be much consolation. The bigger issue is whether the company can sustain the momentum in the long term.

View our latest analysis for GSTechnologies

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

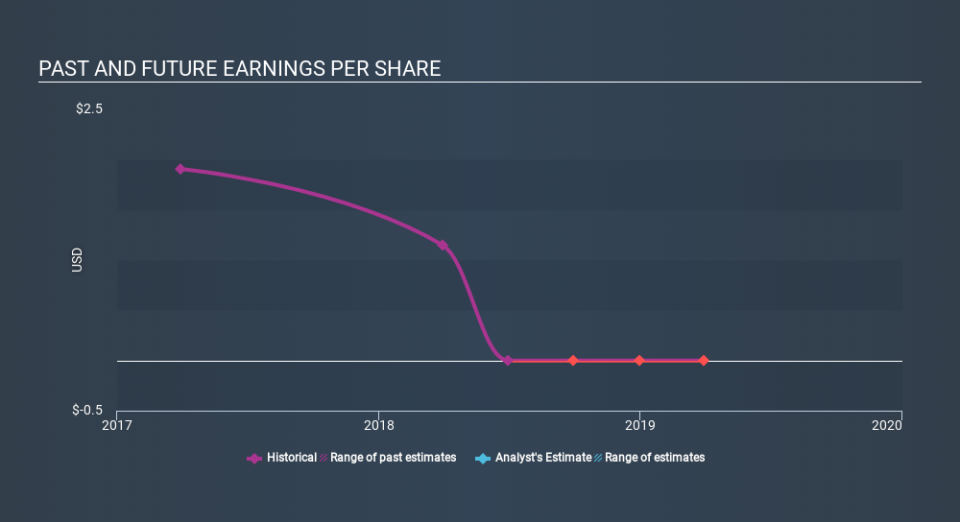

GSTechnologies fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on GSTechnologies's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 16% in the last year, GSTechnologies shareholders might be miffed that they lost 78%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 41%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance