Those Who Purchased Interpace Diagnostics Group (NASDAQ:IDXG) Shares Five Years Ago Have A 98% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Interpace Diagnostics Group, Inc. (NASDAQ:IDXG) for five whole years - as the share price tanked 98%. And some of the more recent buyers are probably worried, too, with the stock falling 26% in the last year.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Interpace Diagnostics Group

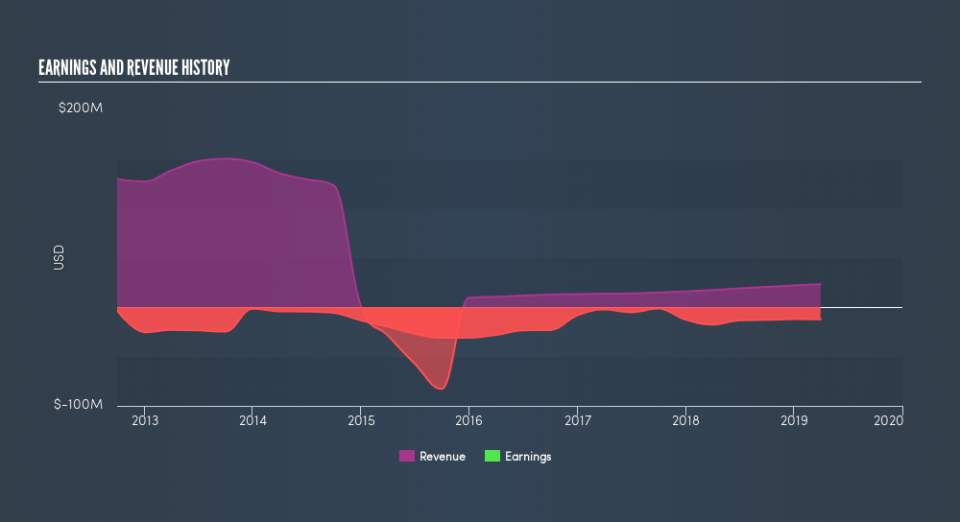

Interpace Diagnostics Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Interpace Diagnostics Group reduced its trailing twelve month revenue by 25% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 55% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Interpace Diagnostics Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Interpace Diagnostics Group had a tough year, with a total loss of 26%, against a market gain of about 7.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 55% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance