Those Who Purchased NatureBank Asset Management (CVE:COO) Shares Five Years Ago Have A 60% Loss To Show For It

NatureBank Asset Management Inc. (CVE:COO) shareholders are doubtless heartened to see the share price bounce 33% in just one week. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 60% in the period. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

View our latest analysis for NatureBank Asset Management

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, NatureBank Asset Management moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

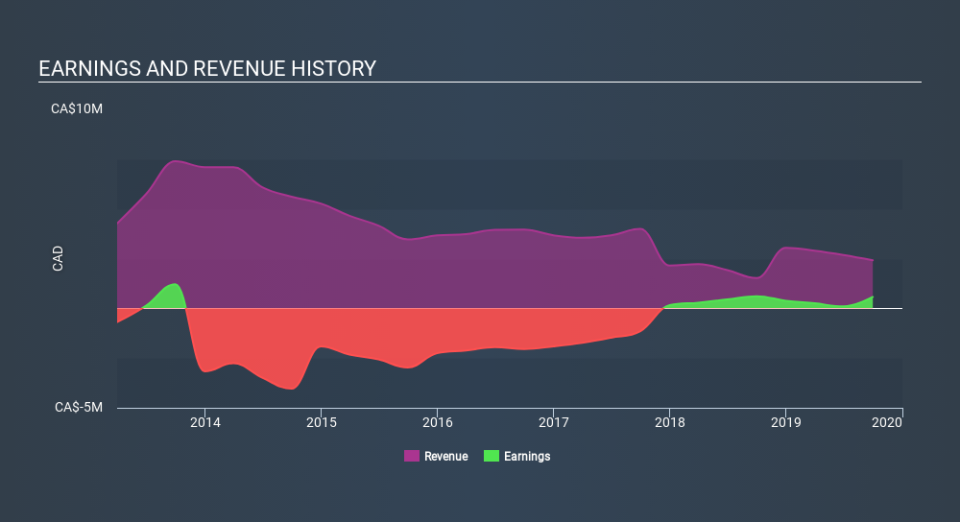

It could be that the revenue decline of 16% per year is viewed as evidence that NatureBank Asset Management is shrinking. That could explain the weak share price.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on NatureBank Asset Management's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that NatureBank Asset Management has rewarded shareholders with a total shareholder return of 33% in the last twelve months. Notably the five-year annualised TSR loss of 17% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand NatureBank Asset Management better, we need to consider many other factors. For instance, we've identified 6 warning signs for NatureBank Asset Management (2 are concerning) that you should be aware of.

But note: NatureBank Asset Management may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance