Three Growth Companies On Chinese Exchange With Insider Ownership And Earnings Growth Of At Least 22%

Amid a backdrop of economic slowdown and increased foreign selling, Chinese markets have shown resilience with slight declines in major indices like the Shanghai Composite and CSI 300. In such an environment, growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Baolong Automotive

Simply Wall St Growth Rating: ★★★★★☆

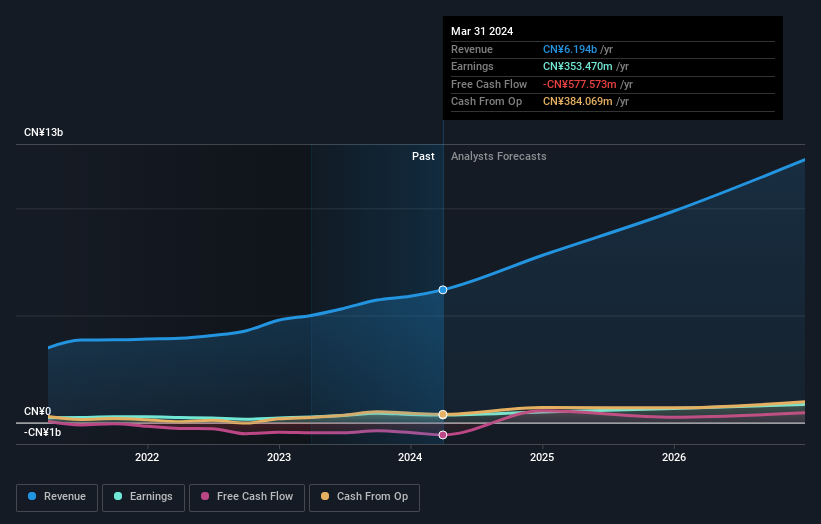

Overview: Shanghai Baolong Automotive Corporation specializes in manufacturing and selling automotive parts and components, with a market capitalization of approximately CN¥6.83 billion.

Operations: The company specializes in the production and sale of automotive parts and components.

Insider Ownership: 32.5%

Earnings Growth Forecast: 30.1% p.a.

Shanghai Baolong Automotive, a notable entity in China's automotive sector, has shown significant growth with its first-quarter sales rising to CNY 1.48 billion. Despite a decrease in net income to CNY 68.01 million, the company is trading below estimated fair value and is positioned well compared to industry peers. However, its dividends are not adequately covered by cash flows, and debt concerns persist as it is not well covered by operating cash flow. Yet, revenue and earnings growth projections remain robust, outpacing market averages significantly.

BrightGene Bio-Medical Technology

Simply Wall St Growth Rating: ★★★★☆☆

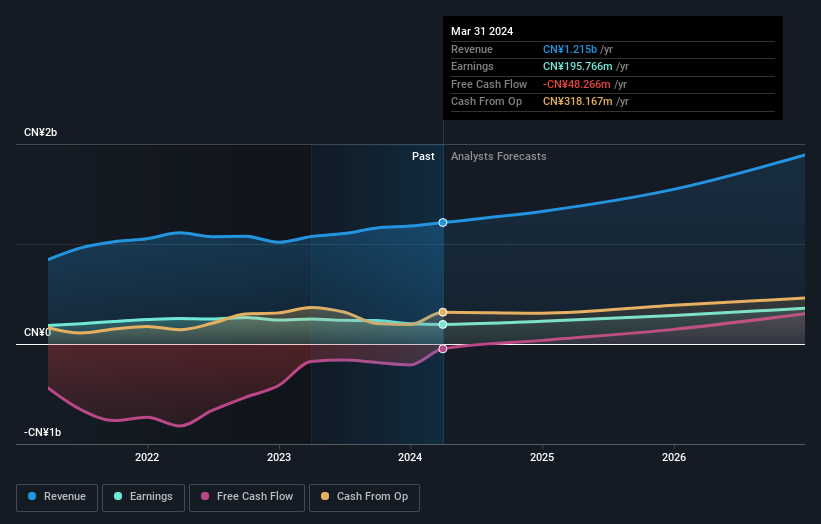

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company based in China that focuses on the research, development, manufacturing, and commercialization of pharmaceutical products, with a market capitalization of CN¥15.06 billion.

Operations: The company generates its revenue primarily through the research, development, manufacturing, and sale of pharmaceutical products in China.

Insider Ownership: 32.2%

Earnings Growth Forecast: 22.1% p.a.

BrightGene Bio-Medical Technology, despite recent insider participation in a substantial private placement, shows mixed financial signals. The company's first-quarter sales increased to CNY 340.13 million from CNY 304.94 million year-over-year, yet net income slightly declined. While trading below fair value and expecting revenue to grow faster than the market average, concerns about its profit margins and debt coverage persist. Moreover, its earnings growth is projected to align with the market rate over the next three years.

Sichuan Shudao Equipment & TechnologyLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Shudao Equipment & Technology Ltd, operating under the ticker SZSE:300540, is a company focused on manufacturing and distributing various industrial equipment, with a market capitalization of approximately CN¥3.39 billion.

Operations: The company generates its revenue primarily from general equipment manufacturing, amounting to CN¥691.37 million.

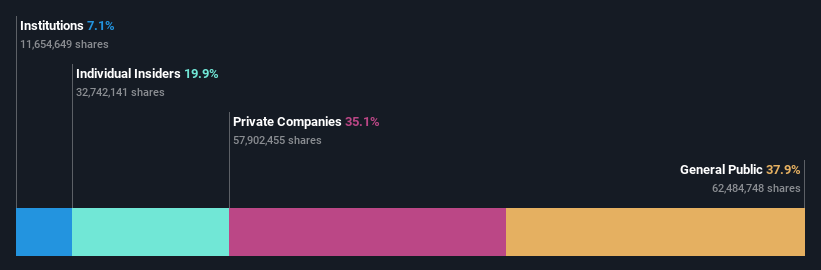

Insider Ownership: 19.9%

Earnings Growth Forecast: 46.3% p.a.

Sichuan Shudao Equipment & Technology Ltd. recently reported a significant increase in quarterly sales, rising from CNY 17.16 million to CNY 40.17 million year-over-year, although net income decreased from CNY 16.2 million to CNY 3.96 million in the same period. Despite this, the company's earnings are expected to grow by a very large margin annually over the next three years, outpacing the Chinese market average. However, shareholder dilution occurred last year and return on equity is forecasted to be low at 8.3% in three years' time, reflecting some financial vulnerabilities amidst its rapid growth trajectory.

Taking Advantage

Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 371 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603197SHSE:688166 and SZSE:300540.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance