Three Growth Companies With High Insider Ownership Anticipating Up To 13% Revenue Growth

In recent sessions, U.S. stock markets have experienced mixed reactions as the Federal Reserve maintained interest rates, aligning with expectations but leaving future economic policies somewhat uncertain due to persistent inflation concerns. Amid these conditions, investors may find particular interest in growth companies with high insider ownership, which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Growth Rating |

PDD Holdings (NasdaqGS:PDD) | 32.1% | ★★★★★★ |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 28.6% | ★★★★★★ |

Li Auto (NasdaqGS:LI) | 35.2% | ★★★★★★ |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | ★★★★★★ |

FTC Solar (NasdaqGM:FTCI) | 32.6% | ★★★★★★ |

Finance of America Companies (NYSE:FOA) | 17% | ★★★★★★ |

Cipher Mining (NasdaqGS:CIFR) | 19.6% | ★★★★★★ |

Carlyle Group (NasdaqGS:CG) | 27.3% | ★★★★★★ |

EHang Holdings (NasdaqGM:EH) | 33% | ★★★★★★ |

BBB Foods (NYSE:TBBB) | 23.8% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

AppLovin

Simply Wall St Growth Rating: ★★★★★☆

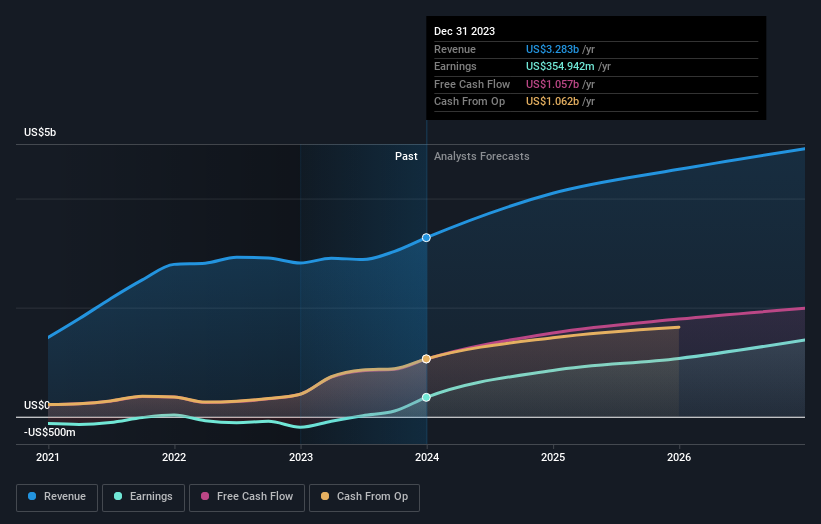

Overview: AppLovin Corporation operates a software-based platform designed to improve advertising, marketing, and monetization of content globally, with a market capitalization of approximately $22.97 billion.

Operations: The company generates revenue through two primary segments: Apps, which brought in $1.44 billion, and Software Platform, contributing $1.84 billion.

Insider Ownership: 37%

Revenue Growth Forecast: 12.4% p.a.

AppLovin, a growth-focused company with high insider ownership, has shown promising financial dynamics despite recent concerns about debt management. The firm recently amended its credit agreements to refinance existing debts, signaling proactive financial stewardship. Insiders haven't made substantial stock purchases recently, reflecting a cautious stance amidst ongoing strategic maneuvers including share repurchases and lock-up periods affecting stock liquidity. Nevertheless, AppLovin's revenue and earnings are forecasted to outpace the market significantly with expected annual growth rates of 12.4% and 31.7% respectively, supported by a robust return on equity projection of 34.3%. These factors position AppLovin as an intriguing entity in the tech sector with solid growth prospects tempered by prudent insider trading activities and financial adjustments.

Unlock comprehensive insights into our analysis of AppLovin stock in this growth report.

Upon reviewing our latest valuation report, AppLovin's share price might be too pessimistic.

Coinbase Global

Simply Wall St Growth Rating: ★★★★☆☆

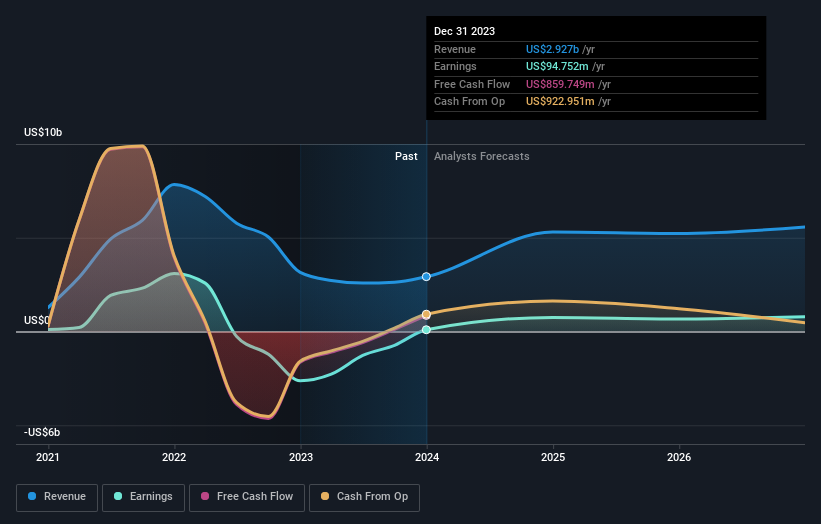

Overview: Coinbase Global, Inc. operates as a provider of financial infrastructure and technology for the crypto economy in both the United States and internationally, with a market capitalization of approximately $51.57 billion.

Operations: The company generates its revenue primarily from Internet Software & Services, totaling approximately $2.93 billion.

Insider Ownership: 18.1%

Revenue Growth Forecast: 11.7% p.a.

Coinbase Global, Inc. recently reported a significant turnaround with Q1 2024 earnings showing a net income of US$1.18 billion, compared to a net loss the previous year, alongside doubled revenue figures. Despite this growth, insider transactions have not been substantial in recent months. The company is also adjusting its board size following a director's decision not to seek re-election. While Coinbase's earnings are expected to grow faster than the market average at 27.4% annually, its revenue growth forecast at 11.7% lags behind more aggressive market benchmarks. This mixed financial and operational outlook highlights both strengths in profitability and challenges in achieving higher revenue growth rates.

Simply Wall St Growth Rating: ★★★★★☆

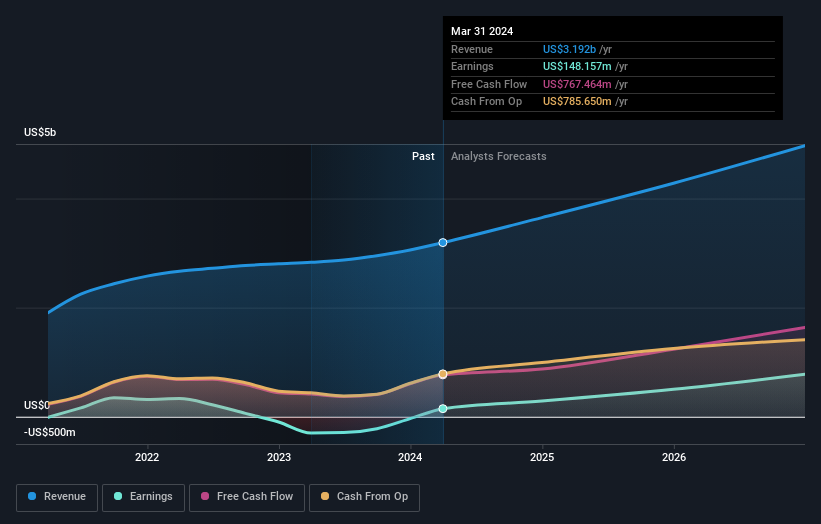

Overview: Pinterest, Inc. operates as a visual discovery and search platform both in the United States and internationally, with a market capitalization of approximately $27.63 billion.

Operations: The company generates revenue primarily from its role as an internet information provider, totaling approximately $3.19 billion.

Insider Ownership: 11.2%

Revenue Growth Forecast: 13.9% p.a.

Pinterest, Inc. has shown promising financial improvements, transitioning to profitability this year with a significant reduction in net losses from US$208.58 million to US$24.81 million in the latest quarter. The company's revenue and earnings are expected to grow robustly at 13.9% and 34.61% per year respectively, outpacing the broader US market forecasts of 8.2% for revenue and 14% for earnings growth annually. Despite trading below its estimated fair value by 26.5%, there is no recent insider buying or selling activity reported, which could suggest a stable insider confidence level moving forward.

Get an in-depth perspective on Pinterest's performance by reading our analyst estimates report here.

Where To Now?

Click here to access our complete index of 201 Fast Growing Companies With High Insider Ownership.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include NasdaqGS:APP NasdaqGS:COIN and NYSE:PINS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance