Three Growth Companies With High Insider Ownership And A Minimum 21% Earnings Growth

Amid recent turbulence in the U.S. stock market, characterized by sharp declines and heightened inflation concerns, investors are navigating a challenging economic landscape. In such times, growth companies with high insider ownership can be particularly appealing, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Growth Rating |

PDD Holdings (NasdaqGS:PDD) | 32.1% | ★★★★★★ |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 28.6% | ★★★★★★ |

Li Auto (NasdaqGS:LI) | 35.2% | ★★★★★★ |

FTC Solar (NasdaqGM:FTCI) | 32.6% | ★★★★★★ |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | ★★★★★★ |

Finance of America Companies (NYSE:FOA) | 17% | ★★★★★★ |

Cipher Mining (NasdaqGS:CIFR) | 19.6% | ★★★★★★ |

Alkami Technology (NasdaqGS:ALKT) | 14.4% | ★★★★★★ |

EHang Holdings (NasdaqGM:EH) | 33% | ★★★★★★ |

BBB Foods (NYSE:TBBB) | 23.8% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Bilibili

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. operates as an online entertainment platform primarily targeting the younger demographics in China, with a market capitalization of approximately $5.22 billion.

Operations: The company generates CN¥22.53 billion in revenue primarily through its internet information services.

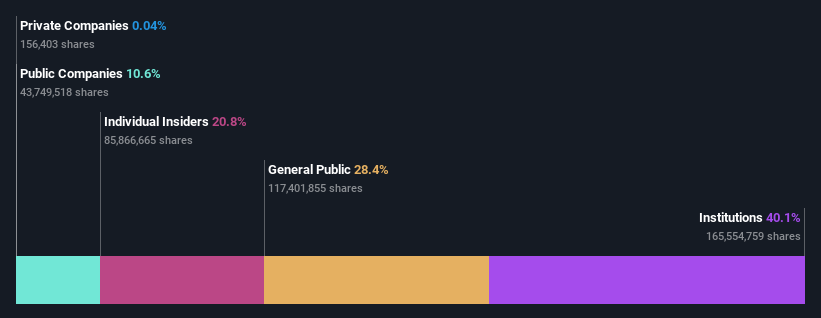

Insider Ownership: 20.8%

Earnings Growth Forecast: 75.2% p.a.

Bilibili, a growth-oriented company with significant insider ownership, has shown resilience despite recent financial challenges. For the fiscal year 2023, Bilibili reported a decrease in net loss to CNY 4.82 billion from CNY 7.50 billion the previous year and an increase in annual revenue to CNY 22.53 billion from CNY 21.90 billion. The company is trading at a substantial discount of 21.6% below its estimated fair value and is expected to become profitable within three years, with earnings forecasted to grow by approximately 75% annually. However, its return on equity is projected to remain low at around 7%.

Sea

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other regions, with a market capitalization of approximately $36.29 billion.

Operations: The company generates revenue through three primary segments: e-commerce at $9.00 billion, digital entertainment at $2.17 billion, and digital financial services at $1.76 billion.

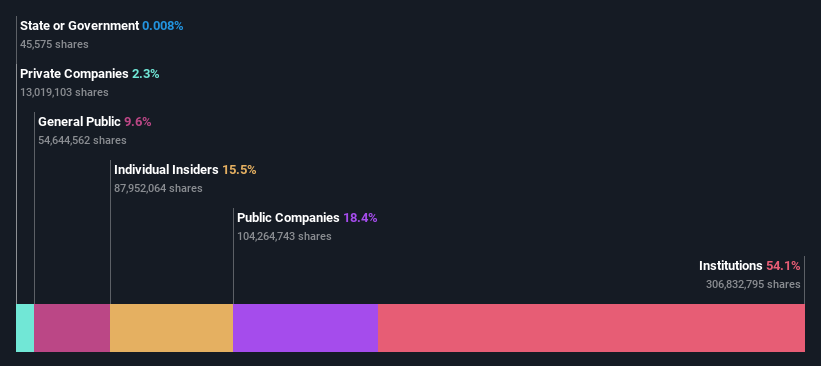

Insider Ownership: 15.3%

Earnings Growth Forecast: 38.9% p.a.

Sea Limited, a growth-focused firm with notable insider ownership, faces challenges and opportunities. In 2023, it transitioned to profitability with annual net income of US$150.73 million after a substantial loss the previous year. Quarterly revenues rose to US$3.62 billion but were paired with a net loss in Q4 2023. Analysts predict robust annual earnings growth of 38.92% over the next three years, outpacing the US market forecast of 14.1%. Despite recent setbacks, Sea trades at 35.9% below its estimated fair value, suggesting potential undervaluation amidst recovery signs and expected revenue growth exceeding market averages.

Click here and access our complete growth analysis report to understand the dynamics of Sea.

The valuation report we've compiled suggests that Sea's current price could be quite moderate.

Li Auto

Simply Wall St Growth Rating: ★★★★★★

Overview: Li Auto Inc. is a company based in the People’s Republic of China, specializing in the electric vehicle market, with a market capitalization of approximately $27.88 billion.

Operations: The company generates CN¥123.85 billion from its auto manufacturing segment.

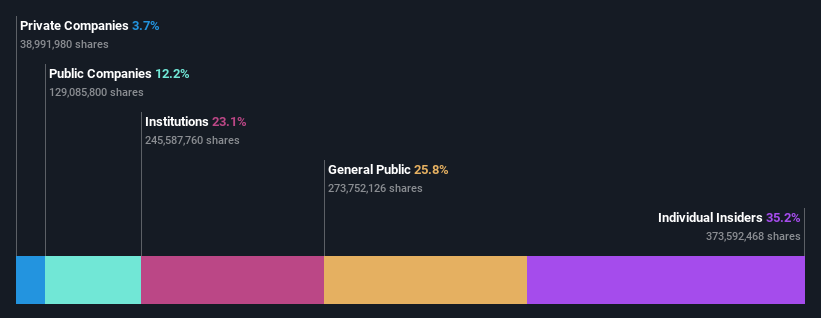

Insider Ownership: 35.2%

Earnings Growth Forecast: 21.9% p.a.

Li Auto, a player in the electric vehicle market, recently became profitable and is trading at 6.5% below its estimated fair value. The company's revenue and earnings are expected to grow by 21.9% annually, outpacing the US market forecasts of 8.2% for revenue and 14.1% for earnings growth respectively. Despite high volatility in share price and shareholder dilution over the past year, Li Auto's robust product launches like the Li L6 SUV indicate potential for sustained growth amidst aggressive market expansion strategies.

Delve into the full analysis future growth report here for a deeper understanding of Li Auto.

Upon reviewing our latest valuation report, Li Auto's share price might be too pessimistic.

Seize The Opportunity

Navigate through the entire inventory of 205 Fast Growing Companies With High Insider Ownership here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include NasdaqGS:BILI NYSE:SE and NasdaqGS:LI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance