Three Growth Stocks On Chinese Exchanges With Insider Ownership As High As 18%

As global markets navigate through fluctuating economic signals, China's equity landscape has shown resilience amid challenging conditions, with certain sectors demonstrating robust insider confidence. High insider ownership can often signal strong belief in the company's future prospects, a particularly reassuring sign for investors in the current climate of uncertainty.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 26% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Let's explore several standout options from the results in the screener.

Jiangsu Cnano Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cnano Technology Co., Ltd. focuses on researching, developing, producing, and selling carbon nanotube materials and related products within China, with a market capitalization of approximately CN¥8.15 billion.

Operations: The company generates its revenue primarily from the sale of carbon nanotube materials and related products.

Insider Ownership: 18.4%

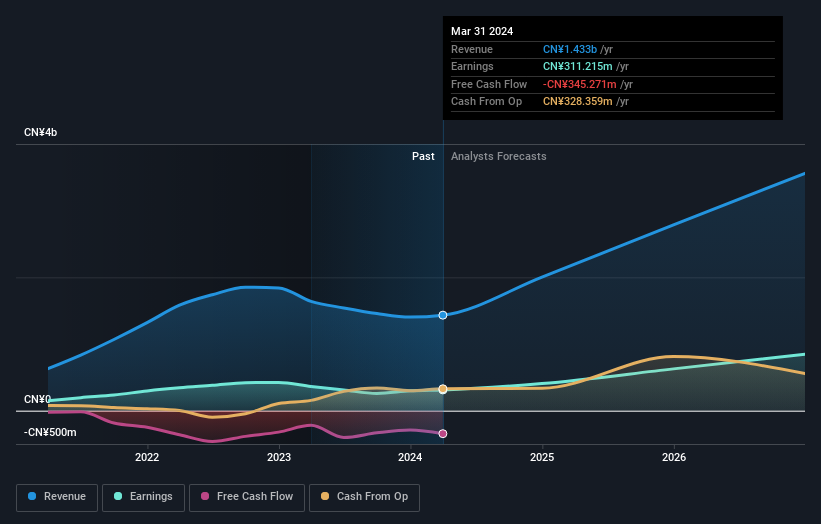

Jiangsu Cnano Technology, a growth company with high insider ownership in China, has shown robust financial performance with a recent first-quarter revenue increase to CNY 307.1 million and net income rising to CNY 53.79 million. Despite a dividend yield of 1.26%, concerns about its coverage by free cash flows persist. Analysts forecast significant earnings growth over the next three years, outpacing the Chinese market average, although the Return on Equity is expected to remain low at 18.5%. The company's stock is considered undervalued by analysts, predicting a potential price increase of 36.5%.

Jiangsu Leadmicro Nano-Equipment Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Leadmicro Nano-Equipment Technology Ltd specializes in designing, manufacturing, and servicing film deposition and etching equipment with a market capitalization of CN¥10.98 billion.

Operations: The company generates CN¥1.77 billion from its equipment manufacturing segment.

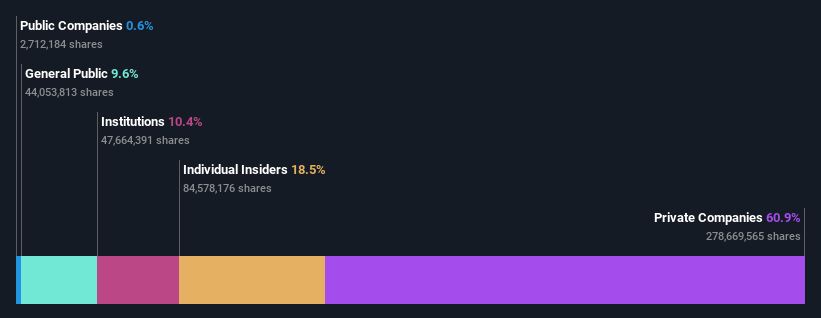

Insider Ownership: 18.5%

Jiangsu Leadmicro Nano-Equipment Technology, a growth-focused firm in China with high insider ownership, is experiencing rapid financial advancements. With earnings and revenue both forecasted to grow by approximately 39.6% annually, the company significantly outpaces average market growth rates. Despite a low Return on Equity projection of 20%, its Price-To-Earnings ratio stands favorably at 39.9x against the industry's 48.8x, indicating good relative value. Recent activities include shareholder meetings and modest share buybacks totaling CNY 30.01 million, underscoring active management engagement.

Baowu Magnesium Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. operates in the mining, smelting, and processing of non-ferrous metals both in China and internationally, with a market capitalization of CN¥11.26 billion.

Operations: The company generates CN¥7.54 billion from non-ferrous metal smelting and rolling activities.

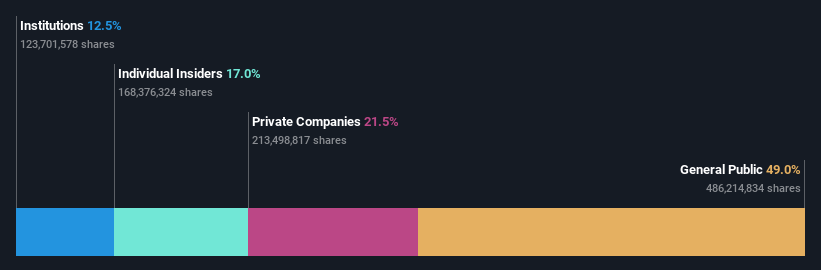

Insider Ownership: 17%

Baowu Magnesium Technology Co., Ltd. is positioned for robust growth with expected annual revenue and earnings increases of 24.8% and 47.44%, respectively, outperforming broader market expectations in China. However, challenges include poor coverage of debt by operating cash flow and a low forecasted Return on Equity at 15%. Recent corporate actions include multiple dividend announcements and a significant stock split, reflecting active management but also shareholder dilution over the past year.

Dive into the specifics of Baowu Magnesium Technology here with our thorough growth forecast report.

Make It Happen

Delve into our full catalog of 365 Fast Growing Chinese Companies With High Insider Ownership here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688116 SZSE:002182 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance