Three High-Growth Chinese Stocks On The Shenzhen Exchange With Insider Ownership Of At Least 14%

Amid a backdrop of global economic shifts and a slowing Chinese economy, the Shenzhen Exchange presents unique opportunities, particularly in high-growth companies with significant insider ownership. Such characteristics often signal strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 28.5% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Let's dive into some prime choices out of from the screener.

Leyard Optoelectronic

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company based in China, operating both domestically and internationally, with a market capitalization of approximately CN¥11.22 billion.

Operations: The company's revenue is derived from its operations in the audio-visual technology sector across both domestic and international markets.

Insider Ownership: 28.6%

Leyard Optoelectronic, a growth company with high insider ownership in China, is poised for significant earnings growth, projected at 47.4% annually, outpacing the broader Chinese market's 22.2%. However, its revenue growth forecast of 15.7% per year slightly trails the desired 20% benchmark for high-growth entities but still exceeds the market average of 13.7%. Challenges include a low forecasted return on equity of 10.4% in three years and an unstable dividend track record despite recent increases approved at their AGM in May 2024.

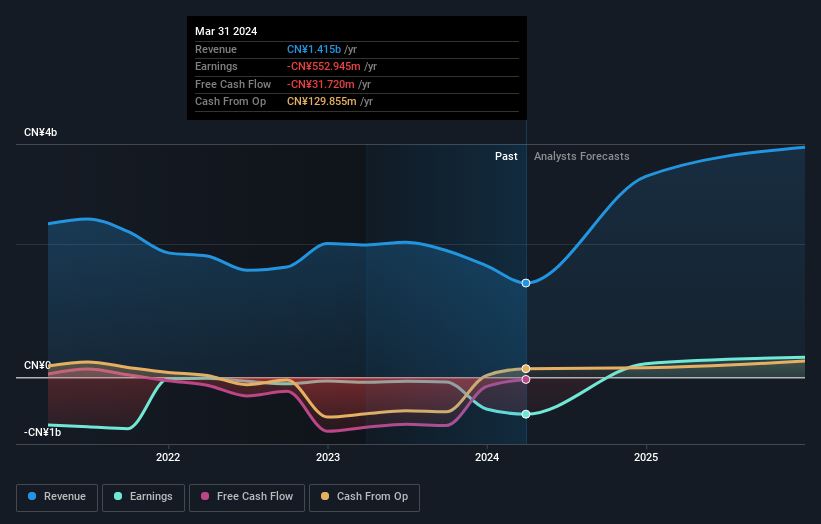

Troy Information Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Troy Information Technology Co., Ltd. is a digital transformation service provider in China, with a market capitalization of approximately CN¥4.46 billion.

Operations: The company generates revenue through its digital transformation services in China.

Insider Ownership: 25%

Troy Information Technology, a Chinese growth company with high insider ownership, is navigating challenges but shows potential for significant expansion. Despite recent financial struggles, including a substantial net loss in 2023 and reduced sales in early 2024, the company is forecasted to grow revenue by 42.8% annually and become profitable within three years. This expected growth surpasses the average market projections and indicates a recovery trajectory that could appeal to investors looking for long-term value creation opportunities.

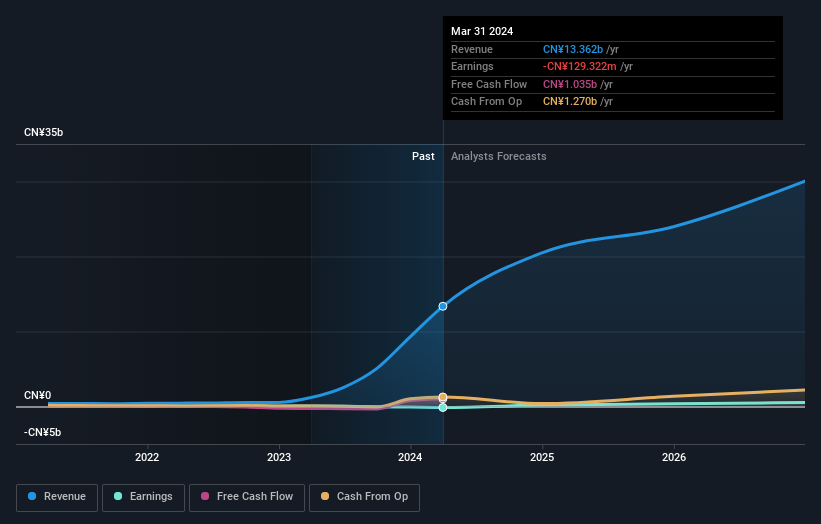

Fujian Wanchen Biotechnology Group

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Group (SZSE: 300972) specializes in the R&D, cultivation, production, and sale of edible fungi in China, with a market capitalization of approximately CN¥3.96 billion.

Operations: The company primarily generates revenue from the research, development, cultivation, production, and sales of edible fungi.

Insider Ownership: 14.9%

Fujian Wanchen Biotechnology Group, despite a challenging financial year with significant revenue growth to CNY 9.29 billion but a net loss of CNY 82.93 million, is poised for recovery. The company's revenue is expected to grow at 26.1% annually, outpacing the Chinese market forecast of 13.7%. With anticipated profitability in three years and strong insider ownership suggesting confidence in long-term strategies, it remains an attractive prospect for growth-focused investors despite recent setbacks and shareholder dilution.

Seize The Opportunity

Click this link to deep-dive into the 368 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:300296 SZSE:300366 and SZSE:300972.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance