Three High-Growth Stocks With Insider Ownership Reaching 38%

As global markets navigate through a period of relative calm with an eye on upcoming earnings reports and key economic indicators, investors continue to seek opportunities that align with both growth potential and stability. High insider ownership in growth companies can signal strong confidence from those who know the business best, making such stocks particularly intriguing in the current investment landscape.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

Let's review some notable picks from our screened stocks.

Sichuan Development LomonLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Development Lomon Co., Ltd. is a company based in China that specializes in the research, development, production, and sale of phosphorus chemical products, with a market capitalization of approximately CN¥12.86 billion.

Operations: The company generates its revenue from the research, development, production, and sale of phosphorus chemical products.

Insider Ownership: 18.2%

Sichuan Development Lomon Ltd. is navigating a mixed financial landscape with a decreased profit margin from 9.6% to 5% over the past year, yet it shows promise with earnings expected to grow by 29.39% annually and revenue forecasted to increase by 18.4% per year, outpacing the Chinese market's growth rates. Recent corporate governance changes include the election of new directors and amendments to company bylaws, signaling potential shifts in strategic direction amidst unstable dividend records and trading at significant undervaluation compared to estimated fair value.

Nanjing Hanrui CobaltLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Hanrui Cobalt Co., Ltd. focuses on the extraction of cobalt and copper ores, with a market capitalization of approximately CN¥8.40 billion.

Operations: The company generates revenue primarily from the extraction of cobalt and copper ores.

Insider Ownership: 29.3%

Nanjing Hanrui Cobalt Co.,Ltd. has demonstrated robust financial performance with first-quarter sales rising to CNY 1.31 billion from CNY 1.13 billion year-over-year, and net income increasing to CNY 30.66 million from CNY 17.74 million. The company's earnings are expected to grow by a significant 31.5% annually over the next three years, outpacing the Chinese market prediction of 22.3%. Despite this growth, its Return on Equity is anticipated to remain low at 8.9%. Recent corporate actions include dividend adjustments and changes in company bylaws, reflecting an evolving operational scope.

Ginlong Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ginlong Technologies Co., Ltd. is a global company specializing in the research, development, production, and sale of string inverters, with a market capitalization of approximately CN¥19.99 billion.

Operations: The company primarily generates revenue through the sale of string inverters across various global markets.

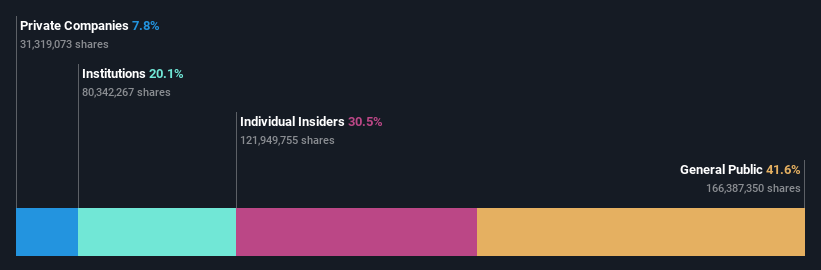

Insider Ownership: 38.1%

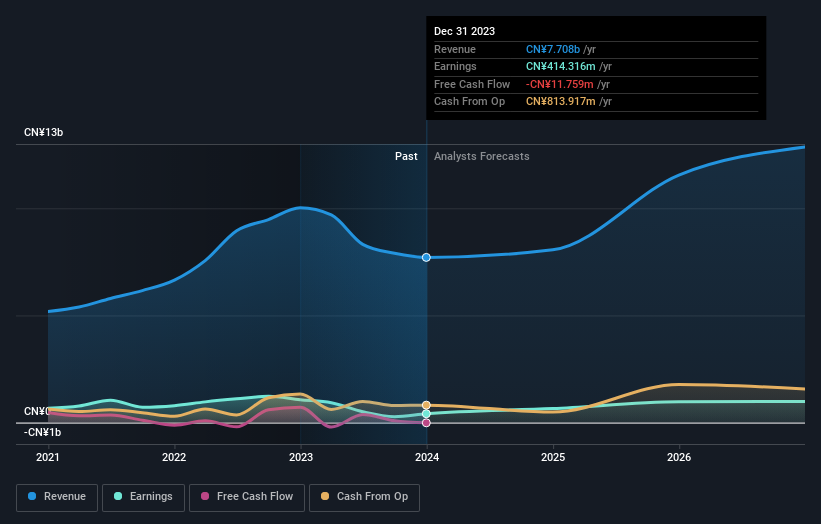

Ginlong Technologies has seen a decline in net income from CNY 1.06 billion to CNY 779.36 million year-over-year, with recent quarterly figures also showing significant drops in sales and earnings. Despite these challenges, the company's revenue and earnings are expected to grow at 18.1% and 25.72% per year respectively, outperforming the broader Chinese market projections of 13.7% and 22.3%. However, its profit margins have decreased sharply from last year's levels, and it faces issues like high share price volatility and shareholder dilution over the past year.

Turning Ideas Into Actions

Unlock our comprehensive list of 1453 Fast Growing Companies With High Insider Ownership by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SZSE:002312SZSE:300618 SZSE:300763 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance