Three High-Yielding Dividend Stocks With Returns Up To 6.1%

Following a week of significant losses, the U.S. stock market has shown signs of resilience, with stocks rebounding as investors focus on upcoming mega-cap earnings reports. This shifting landscape underscores the importance of stable investments like high-yielding dividend stocks, which can offer consistent returns in fluctuating markets.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Premier Financial (NasdaqGS:PFC) | 6.02% | ★★★★★★ |

Columbia Banking System (NasdaqGS:COLB) | 7.55% | ★★★★★★ |

First Interstate BancSystem (NasdaqGS:FIBK) | 7.09% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.78% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.16% | ★★★★★★ |

Evans Bancorp (NYSEAM:EVBN) | 5.05% | ★★★★★★ |

Bank of Marin Bancorp (NasdaqCM:BMRC) | 6.35% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.94% | ★★★★★★ |

LCNB (NasdaqCM:LCNB) | 5.78% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.26% | ★★★★★★ |

Click here to see the full list of 207 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

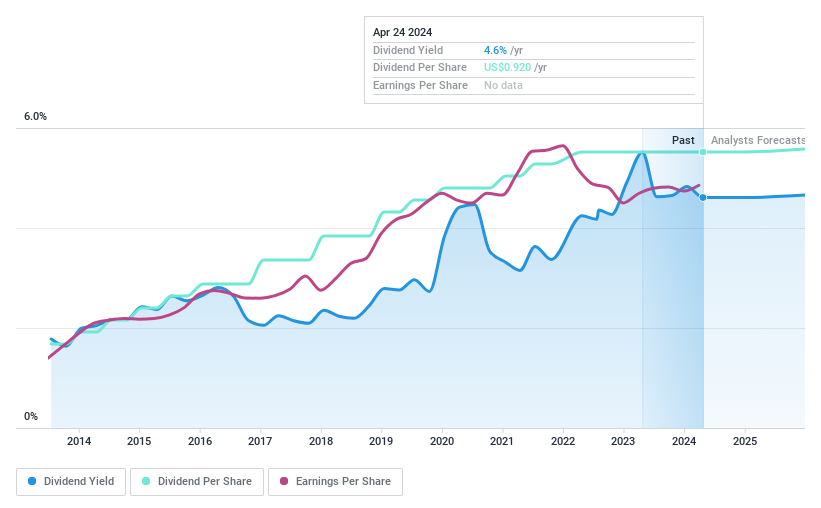

Sierra Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sierra Bancorp, operating as the bank holding company for Bank of the Sierra, offers retail and commercial banking services in California, with a market capitalization of approximately $287.57 million.

Operations: Sierra Bancorp generates its revenue primarily from banking services, totaling $141.85 million.

Dividend Yield: 4.6%

Sierra Bancorp's recent financial performance shows a steady increase in net interest income and net income, with the first quarter of 2024 reporting US$28.72 million and US$9.33 million respectively. The company maintains a stable dividend, declaring a quarterly cash dividend of US$0.23 per share payable on May 13, 2024. Despite challenges like increased charge-offs and delayed SEC filings, Sierra Bancorp continues its shareholder return strategy through consistent dividends and share repurchases, completing a buyback tranche worth US$3.53 million recently.

Dive into the specifics of Sierra Bancorp here with our thorough dividend report.

Upon reviewing our latest valuation report, Sierra Bancorp's share price might be too pessimistic.

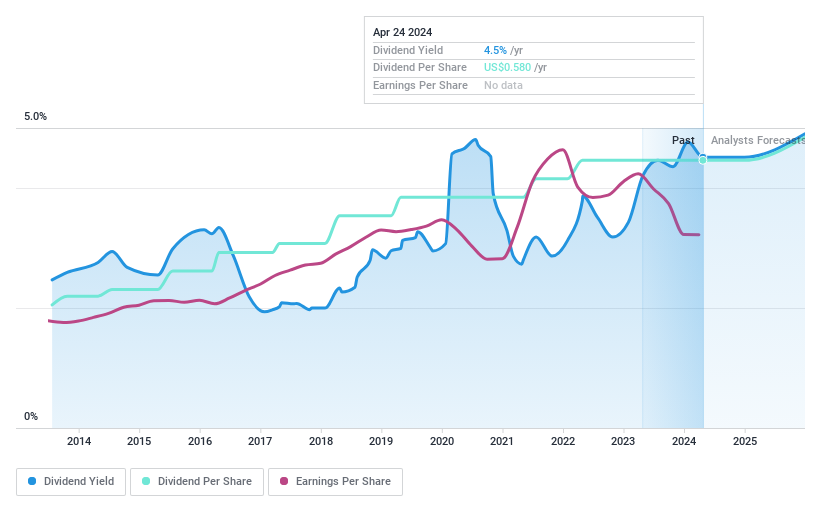

Lakeland Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lakeland Bancorp, Inc., serving as the bank holding company for Lakeland Bank, offers a range of financial products and services to businesses and consumers with a market capitalization of approximately $837.23 million.

Operations: Lakeland Bancorp, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $289.81 million.

Dividend Yield: 4.5%

Lakeland Bancorp has maintained a stable dividend over the past decade, recently declaring a quarterly cash dividend of US$0.145 per share, payable on May 8, 2024. Despite trading 47.4% below estimated fair value and enduring a slight decline in net interest income from US$75.93 million to US$62.56 million in Q1 2024, the company's dividends are well-covered with a payout ratio of 45%. However, its dividend yield of 4.51% lags behind the top quartile of U.S. dividend payers at 4.8%.

Click here to discover the nuances of Lakeland Bancorp with our detailed analytical dividend report.

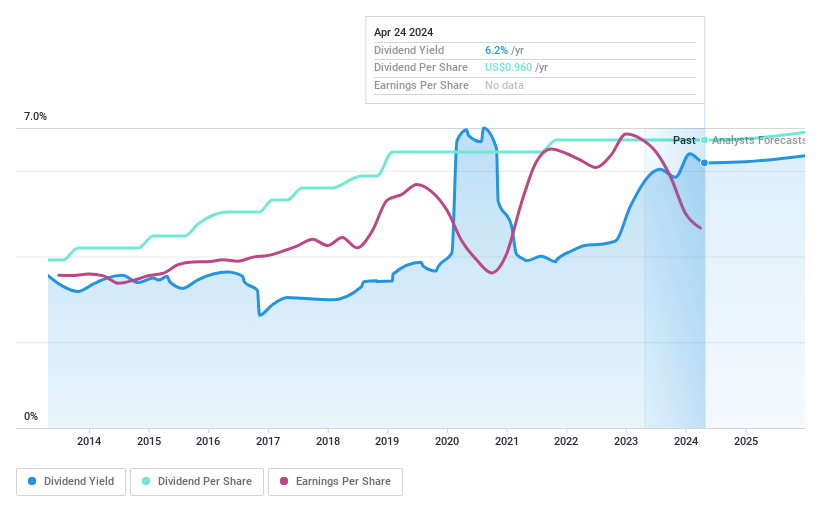

Provident Financial Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc., serving as the bank holding company for Provident Bank, offers a range of banking products and services to individuals, families, and businesses in the United States, with a market capitalization of approximately $1.17 billion.

Operations: Provident Financial Services, Inc. generates its revenue primarily from traditional banking and other financial services, totaling approximately $441.20 million.

Dividend Yield: 6.2%

Provident Financial Services reported a decrease in net interest income from US$108.32 million to US$93.67 million and a drop in net income from US$40.54 million to US$32.08 million for Q1 2024, reflecting potential challenges in maintaining profitability. Despite these figures, the company has consistently paid dividends, declaring a quarterly dividend of US$0.24 per share for May 31, 2024. The dividend yield stands at an attractive 6.19%, higher than many U.S peers, supported by a stable payout ratio of 60%. However, the recent earnings dip could pressure future payouts unless offset by operational improvements or cost efficiencies.

Turning Ideas Into Actions

Delve into our full catalog of 207 Top Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:BSRR NasdaqGS:LBAI and NYSE:PFS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance