Three Leading Dividend Stocks In Sweden With Yields Up To 8.2%

Amidst a backdrop of fluctuating global markets and economic uncertainties, Sweden's stock market presents opportunities for investors seeking steady income through dividends. In the current environment, where careful selection becomes paramount, dividend stocks stand out as a potentially prudent choice for those looking to generate regular returns.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.48% | ★★★★★★ |

Betsson (OM:BETS B) | 5.91% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.53% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.39% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.05% | ★★★★★☆ |

Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.28% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.43% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.47% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.66% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

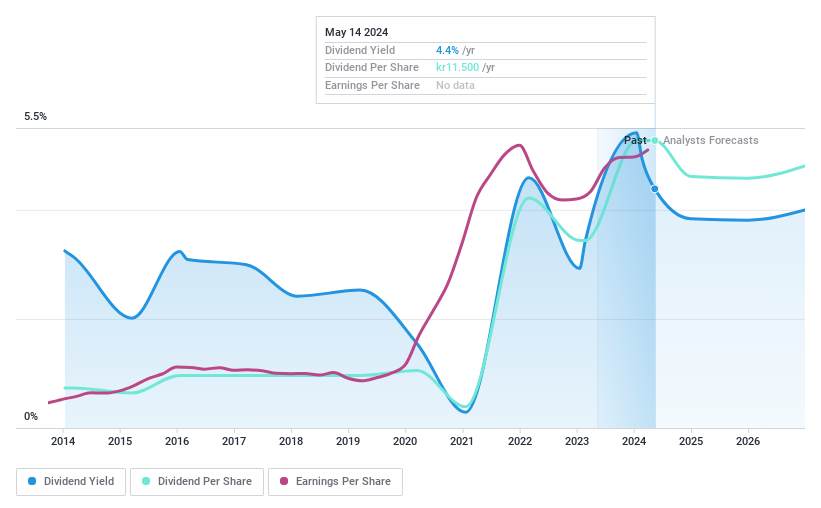

Avanza Bank Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB operates primarily in Sweden, providing a comprehensive suite of financial products including savings accounts, pension solutions, and mortgages, with a market capitalization of approximately SEK 40.49 billion.

Operations: Avanza Bank Holding AB generates its revenue primarily through commercial operations, which amounted to SEK 3.84 billion.

Dividend Yield: 4.5%

Avanza Bank Holding has shown a robust financial performance with a notable increase in customer base and net inflows, reporting SEK 34.90 billion in 2024. Its dividend payout ratio stands at 88.6%, supported by earnings and a low cash payout ratio of 18.5%, suggesting sustainability from both profit and cash flow perspectives. However, its dividend track record over the past decade has been volatile, despite recent growth. The firm's P/E ratio at 19.9x remains attractive compared to the broader Swedish market average of 22.6x, indicating potential value for investors seeking dividends with relative market affordability.

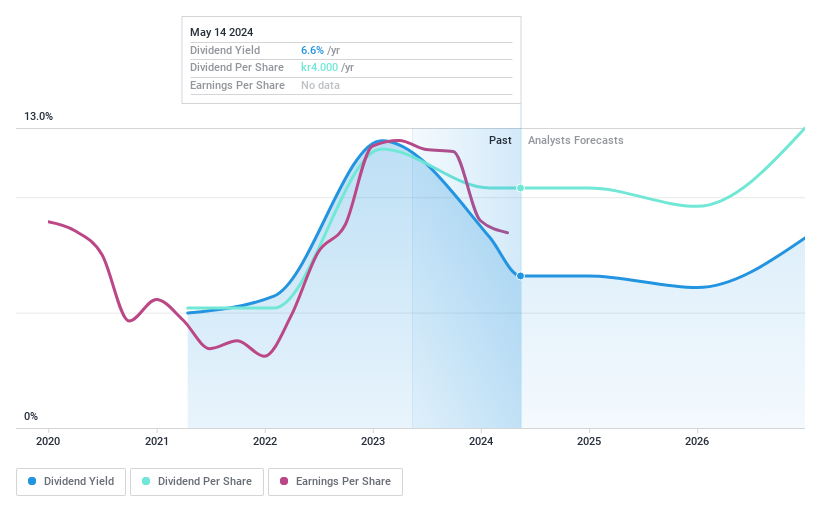

Nordic Paper Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates globally, specializing in the production and sale of natural greaseproof and kraft paper, with a market capitalization of SEK 3.26 billion.

Operations: Nordic Paper Holding AB generates revenue primarily through two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper contributing SEK 2.19 billion.

Dividend Yield: 8.2%

Nordic Paper Holding recently cut its dividend to SEK 4.00 per share, reflecting a cautious approach amidst a slight decline in quarterly sales and net income. Although the company has increased dividends over three years, it has been paying dividends for less than a decade, suggesting an unstable dividend track record. Despite this, with an earnings coverage of 68.3% and cash flow coverage at 78%, its current payouts are well-supported financially. However, high debt levels could pose challenges to future sustainability and growth prospects.

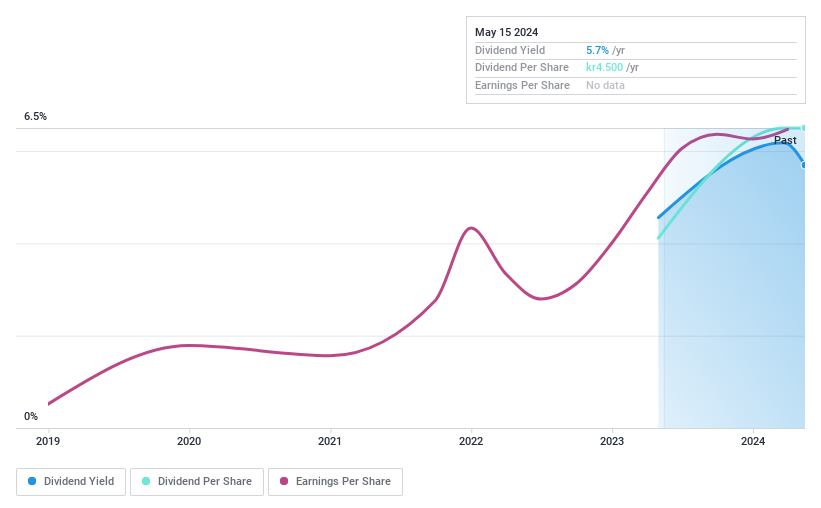

Solid Försäkringsaktiebolag

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates as a provider of non-life insurance products for private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.60 billion.

Operations: Solid Försäkringsaktiebolag generates revenue through three primary segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag recently approved a dividend of SEK 82.84 million, equating to SEK 4.50 per share, reflecting its commitment to shareholder returns amidst a positive earnings report with net income rising to SEK 45.04 million from SEK 41.51 million year-over-year. The company's payout ratio stands at 50.2%, indicating that dividends are well-covered by earnings, though its dividend history is too short to assess long-term sustainability or growth reliably.

Taking Advantage

Delve into our full catalog of 24 Top Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AZA OM:NPAPER and OM:SFAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance