Three Stocks Trading At A Massive Discount

Stocks recently deemed undervalued include Oakley Capital Investments and Rank Group, as they trade at a market price below their true valuations. There’s a few ways you can measure the value of a company – you can forecast how much money it will make in the future and base your valuation off of this, or you can look around at its peers of similar size and industry to roughly estimate what it should be worth. Below, I’ve created a list of companies that compare favourably in all criteria based on their most recent financial data, making them potentially good investments.

Oakley Capital Investments Limited (AIM:OCI)

Oakley Capital Investments Limited is private equity and venture capital firm specializing in investments in any stage of businesses development including start-up, early, growth, established businesses, late stage, mid markets, restructuring, management buy-outs, management buy-ins, public to privates, re-financings, secondary purchases, growth capital, turnarounds, and buy-and-build investments as well as investments in other funds. Oakley Capital Investments was founded in 2007 and with the company’s market cap sitting at GBP £376.84M, it falls under the small-cap stocks category.

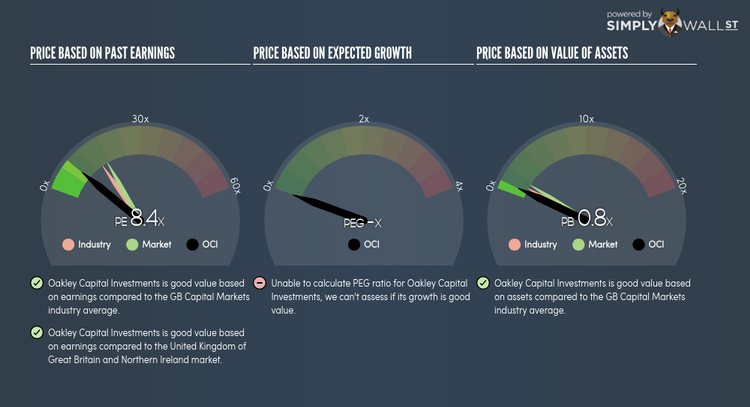

OCI’s stock is currently hovering at around -29% beneath its real value of £2.62, at a price tag of UK£1.86, based on my discounted cash flow model. This discrepancy signals a potential opportunity to buy OCI shares at a low price. Moreover, OCI’s PE ratio is trading at 8.42x while its Capital Markets peer level trades at, 15.2x meaning that relative to other stocks in the industry, we can purchase OCI’s shares for cheaper. OCI is also strong financially, with near-term assets able to cover upcoming and long-term liabilities. OCI has zero debt on its books as well, meaning it has no long term debt obligations to worry about. More on Oakley Capital Investments here.

The Rank Group Plc (LSE:RNK)

The Rank Group Plc, together with its subsidiaries, provides gaming services in Great Britain, Spain, and Belgium. Started in 1937, and now led by CEO John O’Reilly, the company currently employs 10,039 people and with the stock’s market cap sitting at GBP £731.36M, it comes under the small-cap category.

RNK’s stock is now hovering at around -21% below its true value of £2.35, at the market price of UK£1.85, based on its expected future cash flows. The difference between value and price signals a potential opportunity to buy RNK shares at a discount. What’s even more appeal is that RNK’s PE ratio stands at around 12.07x while its Hospitality peer level trades at, 19.36x suggesting that relative to other stocks in the industry, RNK can be bought at a cheaper price right now. RNK is also a financially healthy company, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

More on Rank Group here.

Barratt Developments plc (LSE:BDEV)

Barratt Developments PLC engages in the housebuilding and commercial development businesses in Great Britain. Started in 1958, and currently run by David Thomas, the company provides employment to 6,193 people and has a market cap of GBP £5.58B, putting it in the mid-cap group.

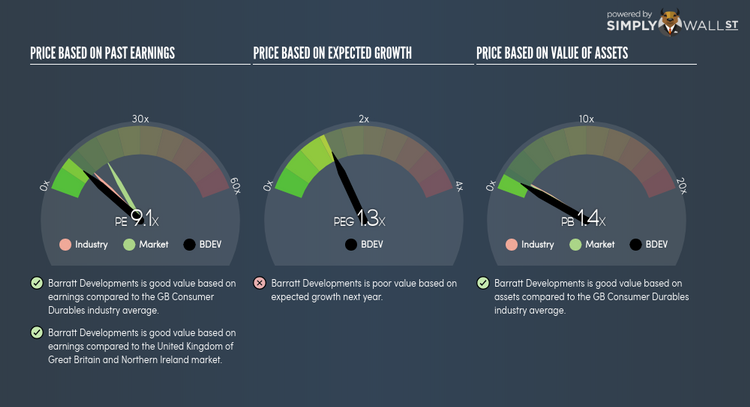

BDEV’s shares are now floating at around -39% lower than its actual worth of £9.35, at the market price of UK£5.69, based on its expected future cash flows. This mismatch signals an opportunity to buy BDEV shares at a discount. Furthermore, BDEV’s PE ratio is currently around 9.09x relative to its Consumer Durables peer level of, 11.15x implying that relative to its peers, we can purchase BDEV’s shares for cheaper. BDEV is also in good financial health, with current assets covering liabilities in the near term and over the long run. The stock’s debt-to-equity ratio of 4.97% has been diminishing over the past couple of years signifying its capability to pay down its debt. More detail on Barratt Developments here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance