Three Swedish Dividend Stocks Offering Up To 5.7% Yield

As global markets show signs of resilience, with indices like the S&P 500 approaching record highs, Sweden's recent economic adjustments, including a key interest rate cut by the Riksbank, paint a promising backdrop for investors looking at dividend stocks. In such an environment, understanding what constitutes a robust dividend stock is crucial; factors like stable earnings, consistent payout histories, and strong market positions become particularly valuable.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 5.97% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.59% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.55% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.09% | ★★★★★☆ |

Duni (OM:DUNI) | 4.55% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.54% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.54% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.04% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.55% | ★★★★☆☆ |

Husqvarna (OM:HUSQ B) | 3.44% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

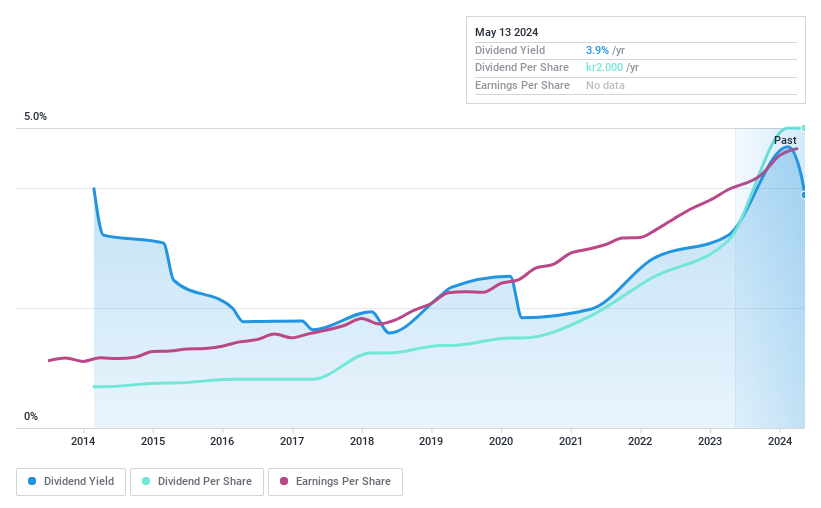

Bahnhof

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector primarily in Sweden and across Europe, with a market capitalization of approximately SEK 5.54 billion.

Operations: Bahnhof AB generates its revenue primarily from the internet and telecommunications services within Sweden and other parts of Europe.

Dividend Yield: 3.9%

Bahnhof AB's recent earnings report showed a revenue increase to SEK 491.38 million and net income growth to SEK 56.17 million, indicating financial health. However, its dividend sustainability is questionable with a high payout ratio of 97.7%, implying dividends are not well-covered by earnings despite a stable dividend history over the past decade. The stock trades below estimated fair value by 24.3%, offering potential undervaluation but its low yield of 3.88% trails behind top Swedish dividend payers.

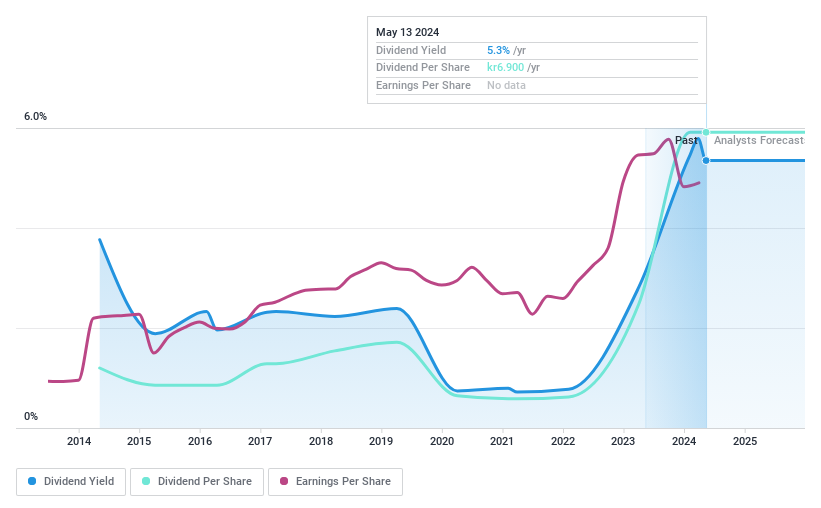

BioGaia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that specializes in probiotic products with a global reach, boasting a market capitalization of approximately SEK 13.03 billion.

Operations: BioGaia AB generates its revenue primarily from the sale of probiotic products across various global markets.

Dividend Yield: 5.3%

BioGaia's dividend yield of 5.35% ranks well in Sweden, but its sustainability is questionable with a high cash payout ratio of 215.5%, indicating dividends are not adequately covered by free cash flow. Although the company's P/E ratio at 35.1x is favorable compared to the industry, inconsistent dividend payments over the past decade and coverage issues raise concerns about reliability and growth prospects, despite a recent earnings uptick to SEK 121.85 million in Q1 2024 from SEK 115.95 million last year.

Click here to discover the nuances of BioGaia with our detailed analytical dividend report.

The valuation report we've compiled suggests that BioGaia's current price could be inflated.

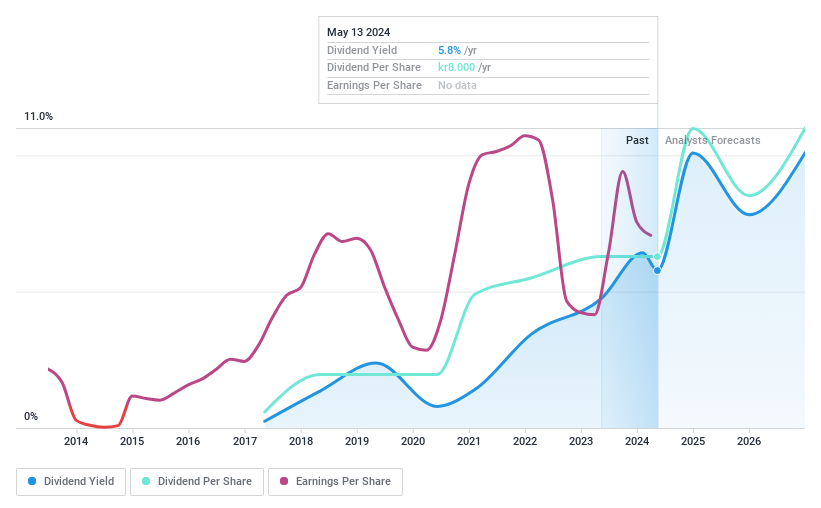

G5 Entertainment

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB (publ), based in Sweden, specializes in developing and publishing free-to-play games for smartphones, tablets, and personal computers, with a market capitalization of SEK 1.12 billion.

Operations: G5 Entertainment AB generates its revenue primarily from the development and publication of free-to-play games for various digital platforms.

Dividend Yield: 5.8%

G5 Entertainment offers a dividend yield of 5.77%, ranking in the top quartile within the Swedish market, supported by a stable yet short history of dividend payments over seven years. Despite recent earnings declines to SEK 37.48 million from SEK 47.76 million, dividends remain well-covered with an earnings payout ratio of 54.4% and cash payout ratio of 36.8%. The company's upcoming board reshuffle could influence future financial strategies, maintaining investor interest in its governance dynamics.

Get an in-depth perspective on G5 Entertainment's performance by reading our dividend report here.

Our valuation report unveils the possibility G5 Entertainment's shares may be trading at a discount.

Seize The Opportunity

Discover the full array of 24 Top Dividend Stocks right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BAHN B OM:BIOG B and OM:G5EN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance