Three Things You Should Check Before Buying Neways Electronics International N.V. (AMS:NEWAY) For Its Dividend

Is Neways Electronics International N.V. (AMS:NEWAY) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

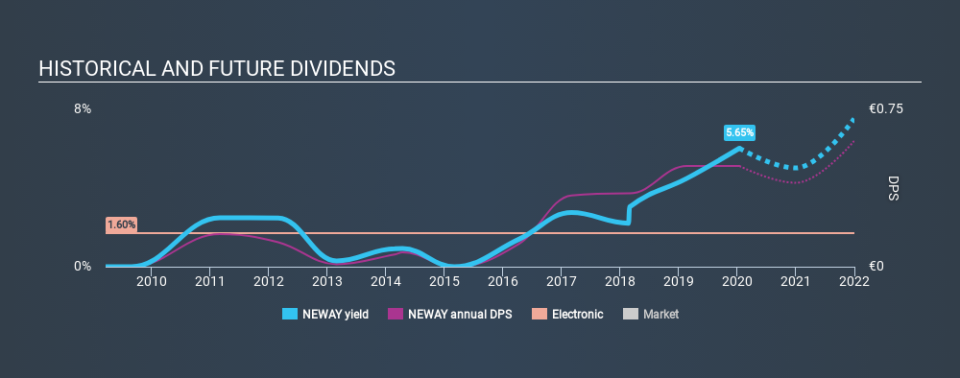

In this case, Neways Electronics International likely looks attractive to dividend investors, given its 5.6% dividend yield and nine-year payment history. It sure looks interesting on these metrics - but there's always more to the story . There are a few simple ways to reduce the risks of buying Neways Electronics International for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Neways Electronics International paid out 45% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while Neways Electronics International pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Is Neways Electronics International's Balance Sheet Risky?

As Neways Electronics International has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Neways Electronics International has net debt of 2.06 times its EBITDA. Using debt can accelerate business growth, but also increases the risks.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Net interest cover of 9.15 times its interest expense appears reasonable for Neways Electronics International, although we're conscious that even high interest cover doesn't make a company bulletproof.

We update our data on Neways Electronics International every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the last decade of data, we can see that Neways Electronics International paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was €0.16 in 2011, compared to €0.48 last year. Dividends per share have grown at approximately 13% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Neways Electronics International has grown its earnings per share at 41% per annum over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we like Neways Electronics International's low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. In sum, we find it hard to get excited about Neways Electronics International from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Now, if you want to look closer, it would be worth checking out our free research on Neways Electronics International management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance