Three Undervalued Stocks Estimated To Be Discounted Between 18.5% And 36.1%

As global markets exhibit a mix of trends with notable gains across major indices and a surprising dip in U.S. consumer prices, investors are navigating through an evolving economic landscape. In such a market environment, identifying stocks that appear undervalued could present opportunities for those looking to potentially enhance their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Truecaller (OM:TRUE B) | SEK35.50 | SEK70.71 | 49.8% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥11.56 | CN¥23.07 | 49.9% |

Daqo New Energy (NYSE:DQ) | US$16.45 | US$32.83 | 49.9% |

DO & CO (WBAG:DOC) | €165.80 | €330.45 | 49.8% |

Vista Energy. de (BMV:VISTA A) | MX$829.99 | MX$1656.29 | 49.9% |

Adventure (TSE:6030) | ¥5070.00 | ¥10108.25 | 49.8% |

Mobile Telecommunications Company Saudi Arabia (SASE:7030) | SAR11.16 | SAR22.12 | 49.6% |

Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.70 | CN¥17.27 | 49.6% |

Lumi Gruppen (OB:LUMI) | NOK12.90 | NOK25.77 | 49.9% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$240.02 | US$479.55 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

Credit Acceptance

Overview: Credit Acceptance Corporation, operating in the United States, offers financing programs along with related products and services, with a market capitalization of approximately $7.40 billion.

Operations: The company generates its revenue primarily through offering dealers financing programs and related products and services, totaling approximately $866.70 million.

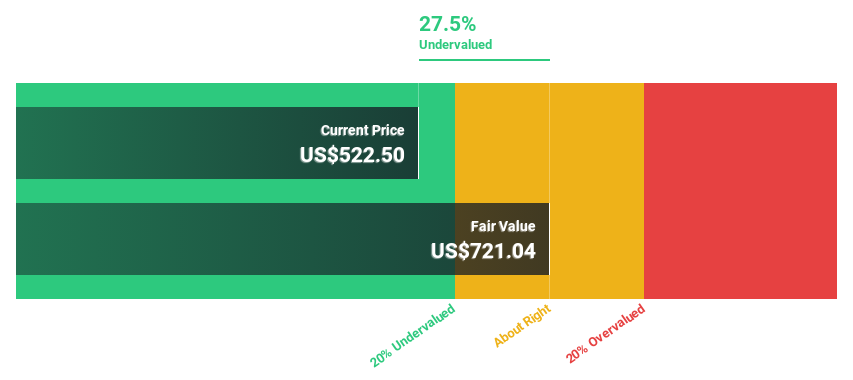

Estimated Discount To Fair Value: 18.5%

Credit Acceptance, with a current price of US$606.95, trades below the estimated fair value of US$744.58, reflecting an undervaluation based on discounted cash flows. Despite this potential upside, the company carries a high level of debt which might concern cautious investors. Recently added to several Russell indexes, Credit Acceptance has shown robust revenue and earnings growth forecasts at 45.5% and 35.9% per year respectively, outpacing broader market expectations significantly.

BILL Holdings

Overview: BILL Holdings, Inc. offers financial automation software to small and midsize businesses globally, with a market capitalization of approximately $5.86 billion.

Operations: The company generates its revenue primarily through its software and programming segment, which brought in $1.24 billion.

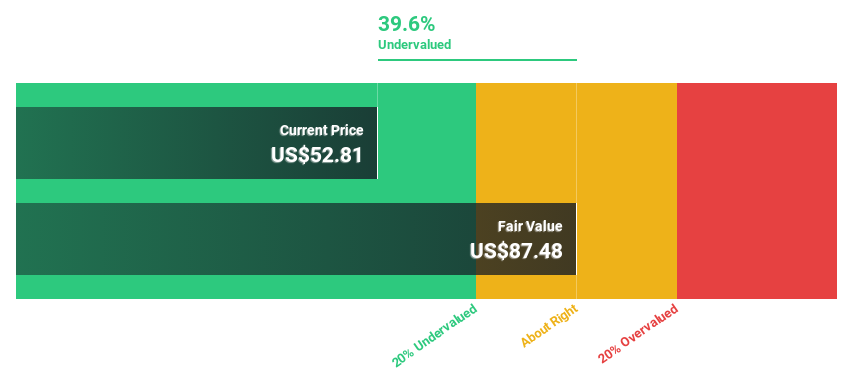

Estimated Discount To Fair Value: 36.1%

BILL Holdings, priced at US$55.73, is deemed undervalued with a fair value estimate of US$87.19, trading 36.1% below this mark due to strong cash flows. Despite a low forecasted Return on Equity of 7.2% in three years, it is set to become profitable and exceed market growth expectations within the same period. Recent additions to multiple Russell indexes underscore its growing market recognition while strategic executive appointments aim to enhance customer engagement and operational efficiency.

Our growth report here indicates BILL Holdings may be poised for an improving outlook.

Click to explore a detailed breakdown of our findings in BILL Holdings' balance sheet health report.

PharmaEssentia

Overview: PharmaEssentia Corporation is a biopharmaceutical company based in Taiwan, focusing on treatments for human diseases with operations both domestically and internationally, and has a market capitalization of approximately NT$214.14 billion.

Operations: The company generates revenue primarily through its Research and Development of New Drugs segment, totaling approximately NT$5.87 billion.

Estimated Discount To Fair Value: 24.2%

PharmaEssentia is trading at NT$647, 24.2% below its estimated fair value of NT$854.02, highlighted by robust non-cash earnings and a discount based on discounted cash flow analysis. Despite a highly volatile share price recently, it offers strong growth prospects with earnings expected to increase significantly, forecasted at 66.1% annually over the next three years—outpacing the TW market's 18.7%. Recent approval in China for Ropeginterferon alfa-2b underlines potential revenue expansion in major markets despite low forecasted Return on Equity of 13.8% in three years.

Taking Advantage

Click this link to deep-dive into the 972 companies within our Undervalued Stocks Based On Cash Flows screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CACC NYSE:BILL and TWSE:6446.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com