Tiffany (TIF) Q1 Loss Wider Than Expected, Sales Plunge Y/Y

The coronavirus-induced stay-at-home orders, social distancing and store closures adversely impacted Tiffany & Co. TIF first-quarter fiscal 2020 results. This luxury jewelry retailer posted wider-than-expected loss for the quarter under review. Also, the company’s top line missed the Zacks Consensus Estimate and fell sharply from the year-ago period. In spite of the soft performance, the company remains optimistic going ahead owing to investments made in Mainland China domestic business, focus on global e-commerce, and new product innovation.

Management stated that while sales were down significantly in key markets such as the United States and Japan during the quarter, recovery was seen in Mainland China. Retail sales in Mainland China did decline roughly 85% and 15% year over year during the first and second months of the quarter but surged approximately 30% during the month of April. Notably, the momentum gained continued in the month of May with retail sales up approximately 90% in Mainland China. However, global net sales decreased approximately 40% in the May month.

Undoubtedly, store closures dented the company’s performance but its e-commerce business displayed strength. E-commerce sales surged 23% worldwide during the quarter under review. We note that important markets such as the United States and the United Kingdom registered growth of approximately 14% and 15%, respectively. Management pointed that sales via Mainland China e-commerce portal have improved sequentially each quarter since its launch in July 2019. Notably, the robust online sales trend worldwide continued through May, with sales more than doubled year over year.

With respect to product, the company remains enthusiastic about its Tiffany T1 collection that is off to a strong start. The company remains hopeful that Tiffany T1 will outperform Tiffany HardWear and Paper Flowers as well as Tiffany T-Color in terms of sales.

Also, management highlighted that the company had received antitrust clearances from Russian and Mexican authorities to proceed with its transaction with LVMH Moet Hennessy - Louis Vuitton SE (or LVMH). We noted that shares of this Zacks Rank #4 (Sell) company have lost 7.3% in the past three months compared with the industry’s decline of 2.8%.

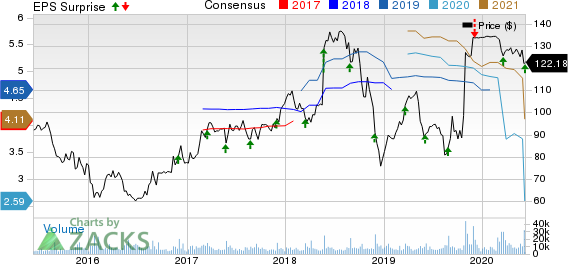

Tiffany Co. Price, Consensus and EPS Surprise

Tiffany Co. price-consensus-eps-surprise-chart | Tiffany Co. Quote

Q1 Highlights

Tiffany posted adjusted loss of 53 cents a share, wider than the Zacks Consensus Estimate of loss of 35 cents. The reported figure also compared unfavorably with earnings of $1.03 reported in the year-ago period. Lower net sales hurt the company’s bottom line.

Worldwide net sales plunged 45% to $555.5 million, and came below the Zacks Consensus Estimate of $646.4 million. Also, the company’s comparable sales (comps) plummeted 44% year over year. At constant currency, net sales and comps declined 44% and 43%, respectively. Sales declined owing to the closure of retail stores globally at various times during the quarter, thanks to the COVID-19 outbreak.

Sales declined 44% and 49% for Jewelry Collections and Engagement Jewelry, respectively, while Designer Jewelry sales fell 39% year over year.

Let’s Delve Deeper

Geography-wise, net sales in the Americas plunged 45% to $225 million and comps declined at the same rate. This can be attributed to closure of stores that began in mid-March and continued through the end of the quarter owing to the coronavirus outbreak.

In the Asia-Pacific region, net sales tumbled 46% to $174 million, while comps decreased 45%. We note that store closures in Mainland China and the rest of the Asia-Pacific markets hurt sales. However, stores in Mainland China began to re-open at the end of February, and as of Apr 30 roughly 85% of the retail stores in this region were fully or partly open.

In Japan, net sales decreased 40% to $86 million, while comps slid 41% owing to store closures that began in early April 2020 and the fall in tourist traffic. However, as of Apr 30 about 5% of the retail stores in this region were fully or partially open.

In Europe, net sales declined 40% to $61 million, while comps decreased 42%. This can be attributed to store closures that began in mid-March and continued through the second half of April. As of Apr 30 approximately 15% of the retail stores in this region were fully or partially open.

Gross margin decreased 610 basis points to 55.6% in the quarter under review. Management pointed that the contraction in margin was due to sales deleverage on fixed costs resulting from the effects of coronavirus on net sales as well as some overhead expenses resulting from certain manufacturing locations being closed or operating at lower capacity due to the pandemic. Higher inventory reserves also impacted the margin.

Store Update

During the quarter, Tiffany shuttered two company-operated outlets and relocated two stores. As of Apr 30, the company operated 324 stores (123 in the Americas, 90 in Asia-Pacific, 58 in Japan, 48 in Europe, and five in the UAE).

Other Financial Details

Tiffany, which shares space with Signet SIG, ended the quarter with cash and cash equivalents and short-term investments of $1,058.5 million and total debt (short-term borrowings and long-term debt) of $1,538 million, reflecting 48% of stockholders’ equity compared with 32% in the year-ago period. This increase was due to $500 million drawdown on the revolving credit facility during the quarter.

The company did not make any buybacks in the quarter owing to restrictions described in the merger agreement with LVMH.

2 Picks You Can’t Miss Out On

Big Lots BIG, a Zacks Rank #1 (Strong Buy) stock, has a trailing four-quarter positive earnings surprise of 62.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General DG has a long-term earnings growth rate of 12.4%. Currently, it sports a Zacks Rank #1.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Tiffany Co. (TIF) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance