TikTok and Disney+ Outshine Games in Record Year for Mobile Apps

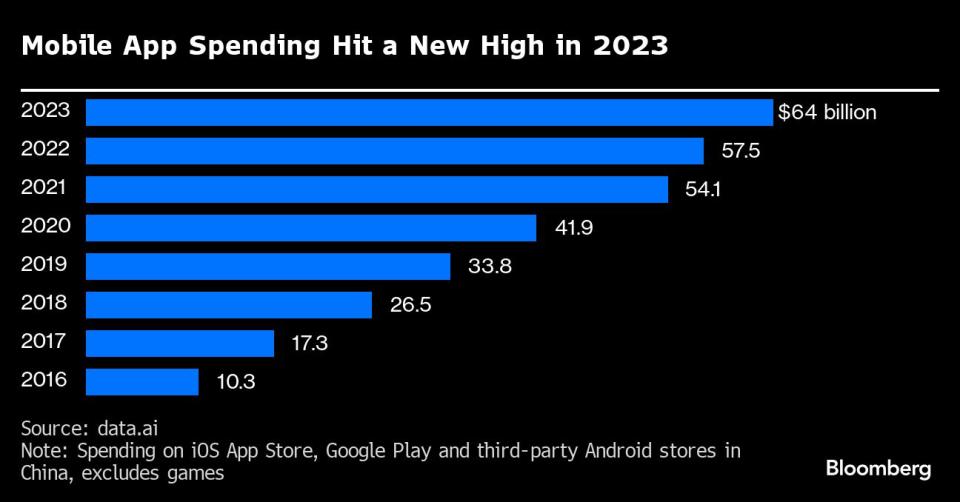

(Bloomberg) -- ByteDance Ltd.’s TikTok became the first app to surpass $10 billion in cumulative consumer spending, helping power mobile app sales to a new high in a year revenue from games was down, according to the latest annual report by data.ai.

Most Read from Bloomberg

Trump Scores Easy Win in Iowa With DeSantis a Distant Second

Iowa Latest: Biden Calls Trump ‘Clear Frontrunner’ After Win

Apple to Pull Blood-Oxygen Tool From Watches to Avoid US Ban If Appeal Fails

What Is Disease X? How Scientists Are Preparing for the Next Pandemic

Video-streaming platforms like TikTok and Disney+ drove an 11% rise in consumer app sales in 2023, showing resilient demand while the games industry dealt with a double-digit sales decline in China that dragged global sales down 2%.

TikTok’s in-app purchases of credit that can be used to tip favored creators and live streamers accounted for the bulk of its income, and “unlocked the secret to monetization on mobile,” according to the market researchers, whose services are used by many of the world’s biggest brands to track the performance of their mobile apps and ads.

“Social apps and the creator economy pioneered new pathways to monetization beyond advertising,” said Lexi Sydow, director of corporate marketing and insights at data.ai. “TikTok laid the groundwork through its content creator tipping mechanism. In 2024, direct consumer monetization in social apps through in-app purchases is set to grow 150% to $1.3 billion as competition ramps up.”

Spending in apps, rather than games, grew as consumers spent more on streaming, user-generated content and dating apps. Still, the bigger revenue driver remained advertising, which rose 8% in 2023 to $362 billion and accounted for two-thirds of mobile sales. That makes the battle to attract and retain user attention paramount, as data.ai estimates 2024 will bring in $402 billion in global mobile ad spending.

Consumers again increased their time spent on smartphones — Indonesia ranked highest with over 6 hours per person per day. The average among the top 10 markets hit 5 hours of daily app usage, and spending in apps increased by 3% in 2023. South Korea, Brazil, Mexico and Turkey all hit 25% growth or more in consumer app spending for the year, according to data.ai.

Chinese budget shopping sensations Shein and PDD Holdings Inc.’s Temu shot up the download rankings, growing by 140%, with Temu leading downloads across 125 markets. Elsewhere, the travel and ticketing sectors staged a rebound in popularity and spending as post-pandemic demand for in-person events and experiences boomed.

Artificial intelligence became a key path for attracting new users, with generative AI surging sevenfold and distinct sub-segments emerging around AI chatbots and art generators. Generative AI apps surpassed $10 million in monthly consumer spending by late 2023.

“This AI growth also fueled embedded features across virtually all mobile sectors, paving the way for a fresh wave of digital innovation,” the data.ai report said.

Most Read from Bloomberg Businessweek

Trumponomics 2.0: What to Expect If Trump Wins the 2024 Election

Kim Kardashian’s Skims Isn’t the Only Celebrity Brand to Watch

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance