Time to Buy CVS Stock Before Crucial Q4 Earnings?

Trading near its 52-week lows and 23% from its highs, investors will be paying close attention to CVS Health’s CVS fourth-quarter earnings on February 8.

Let’s take a look at what’s in store for the Retail-Pharmacies and Drug Stores giant going into the quarterly report.

Brief Overview

CVS stock continued to drift lower over the last quarter which intensified following news that the company may potentially acquire Oak Street Health OSH for $10 billion. Evolving into a pharmacy innovation company with integrated offerings across the entire spectrum of pharmacy care, acquiring Oak Street Health would continue CVS Health’s push into primary care, specifically within Medicare.

Image Source: Zacks Investment Research

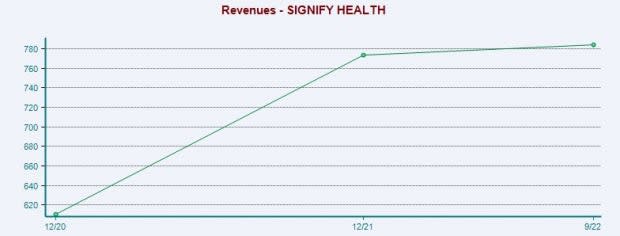

After acquiring health insurance giant Aetna in 2018, CVS is strategically increasing its footprint in primary healthcare. More recently, CVS announced the $8 billion acquisition of Signify Health (SGFY) which is expected to be completed in the first half of 2023.

Image Source: Zacks Investment Research

These acquisitions could have lucrative long-term advantages in regard to revenue.Yet Wall Street noted CVS possibly acquiring Oak Street health does make strategic sense, but could dilute CVS’s bottom line, especially with the already planned acquisition of Signify Health which further sparked the recent decline in CVS stock.

Image Source: Zacks Investment Research

Quarterly Estimates

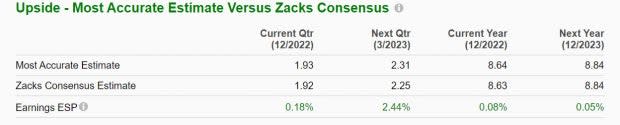

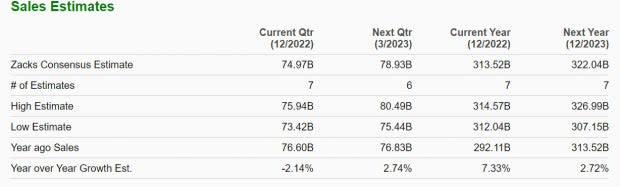

The Zacks Consensus for CVS’s Q4 earnings is $1.92, which would be a -3% drop from Q4 2021 EPS of $1.98. However, with the Most Accurate Consensus at $1.93 per share, this indicates that CVS could slightly beat its bottom-line expectations by 0.18%. On the top line, Q4 sales are forecasted to be $74.97 billion, down -2% from the prior year quarter.

Image Source: Zacks Investment Research

Overall, CVS earnings are now expected to be up 3% for FY22 and rise another 3% in FY23 at $8.84 per share. Earnings estimate revisions have slightly gone up for FY22 but have declined for FY23 over the last quarter. Sales are forecasted to be up 7% to round out FY22 and rise another 3% in FY23 to $322.04 billion. More impressively, FY23 sales would represent 65% growth over the last five years following CVS’s acquisition of Aetna during this period.

Image Source: Zacks Investment Research

Performance & Valuation

Over the last year, CVS stock is down -22% to underperform the S&P 500’s -9% but slightly edge its primary competitor Walgreens Boots Alliance’s WBA -25%. In the last decade when including dividends, CVS’s total return is +110% which has topped WBA’s +17% but still trailed the benchmark.

Image Source: Zacks Investment Research

Trading around $85 per share and 9.7X forward earnings CVS stock does trade attractively relative to its past. CVS trades 55% below its decade-long high of 21.8X and at a 22% discount to the median of 12.5X. Furthermore, as a leader in its space CVS stock still trades near the industry average and Walgreens 8.2X respectively, and nicely beneath the S&P 500’s 18.9X.

Image Source: Zacks Investment Research

Dividends

While waiting for a turnaround in CVS stock, investors are rewarded with a 2.82% annual dividend yield. This is above the S&P 500’s average dividend yield of 1.51% but below Walgreens’ 5.18% with the other companies in the Retail-Pharmacies and Drug Store Industry not offering a dividend.

Image Source: Zacks Investment Research

Bottom Line

CVS stock currently lands a Zacks Rank #3 (Hold) going into its Q4 earnings report. While earnings estimates have trended higher to round out CVS’s fiscal 2022 they have declined for FY23 and the company’s guidance and outlook will be important in providing a catalyst for the stock.

Insight on completing the acquisition of Signify Health and clarification on the speculation that the company could also acquire Oak Street Health will also be important as it could affect CVS's bottom line going forward. However, at its current level holding on to CVS stock could be rewarding as its top line should continue to grow with the company expanding into primary healthcare, and stronger bottom line growth should be reflected down the line as the company adjusts to operating costs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Oak Street Health, Inc. (OSH) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

Signify Health, Inc. (SGFY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance