Time to Buy the Dip? These Top Ranked Stocks are on Sale Now

Broad market indexes are down about -5% over the last couple of weeks, and some market participants are already anticipating the worst outcomes. But is there really something terrible on the horizon, or is this just a garden variety pullback?

Although we have seen a hot inflation print, rising geopolitical tensions and doubts about interest rate cuts, I lean towards the current scenario being pause in the bull run and thus likely a buying opportunity.

The US economy is growing above trend, the AI revolution is improving worker productivity, stocks are fairly priced and though there might be a delay in interest rate cuts, they are very likely starting by the end of the year. All of this to me are signs of a continuing bull market, which will regularly have 5-10% corrections to shake the weak participants.

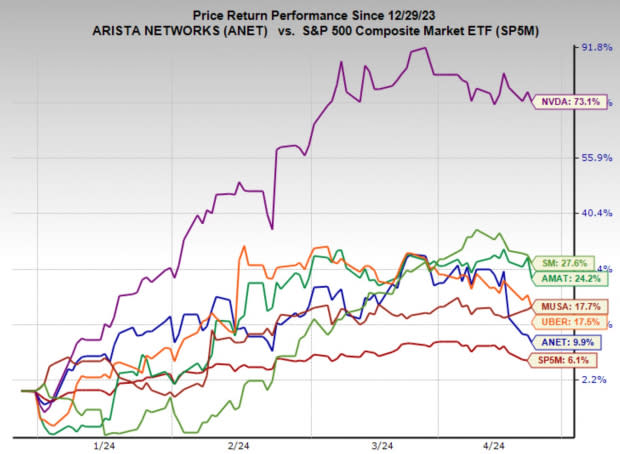

When looking for stocks to buy the dip on, I am seeking those that are showing relative strength against the market index and have top Zacks Ranks. Even better when I can identify stocks from a range of industries to increase diversification.

Image Source: Zacks Investment Research

Technology Stocks

As I mentioned, the Artificial Intelligence boom is driving major changes in the markets and economy. AI-adjacent stocks have been strong outperformers since the start of the year, and many are pulling back to appealing levels.

The market’s leading AI stock, Nvidia NVDA continues to boast a Zacks Rank #1 (Strong Buy) rating reflecting its continuously rising earnings revisions trend. Additionally, the price action has been forming a compelling technical trading setup.

We can see that since early March, Nvidia stock has been trading sideways and building out a bull flag. This setup echoes the consolidation that launched NVDA stock higher at the start of the year.

If the stock can trade above the $900 level, it would signal a technical breakout and likely send the stock to further highs.

Image Source: TradingView

Two other stocks that are a little further out on the supply chain regarding AI are Arista Networks ANET and Applied Materials AMAT. Both Arista Networks and Applied Materials are poised to play significant roles in the AI revolution by providing critical technology and infrastructure solutions.

Applied Materials, as a leading supplier of semiconductor manufacturing equipment, enables the production of advanced AI chips and processors. These chips are crucial for AI applications as they power machine learning algorithms and deep learning networks. Additionally, Arista Networks specializes in providing high-performance networking solutions, including switches and routers, which are essential for the efficient and reliable functioning of data centers, and which are critical for the technology.

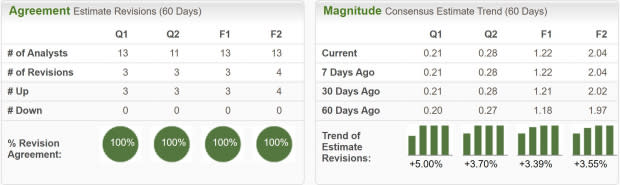

Furthermore, they both enjoy top Zacks Ranks. Arista Networks has a Zacks Rank #1 (Strong Buy) rating and Applied Materials has a Zacks Rank #2 (Buy) rating.

An additional technology stock that isn’t really within the AI ecosystem but is still one of the top performing stocks over the last year is Uber Technologies UBER.

With analysts unanimously upgrading earnings estimates across timeframes, Uber enjoys a Zacks Rank #1 (Strong Buy) rating, which it has held on and off during the last year.

Image Source: Zacks Investment Research

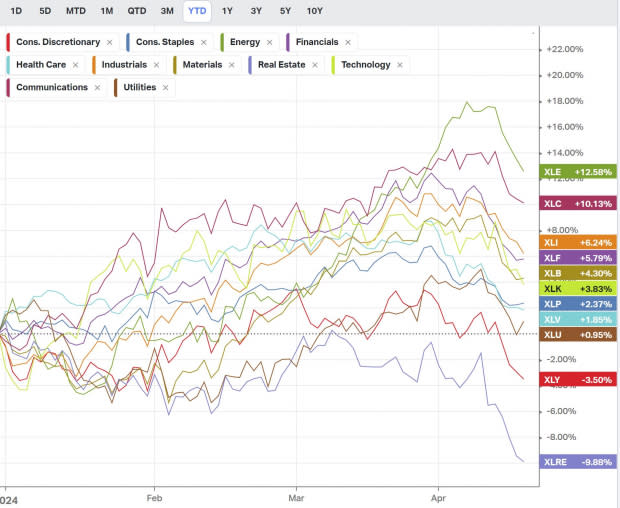

Oil Stocks

Another sector that has quietly seen big inflows and strong performance is oil. The price of crude oil has rallied nearly 18% YTD, and the oil sector ETF XLE is actually the best performing this year.

Image Source: Koyfin

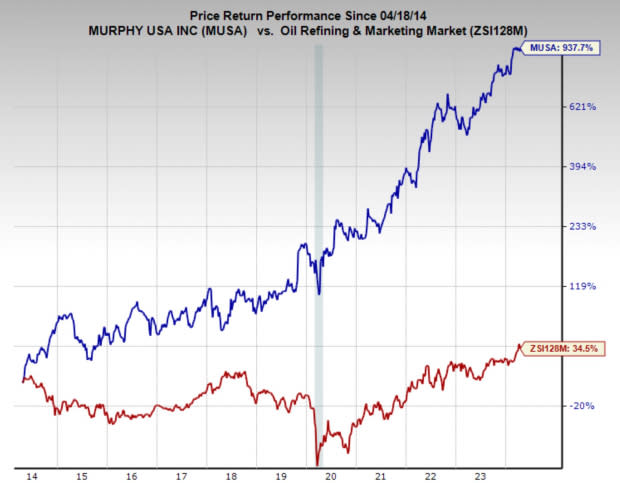

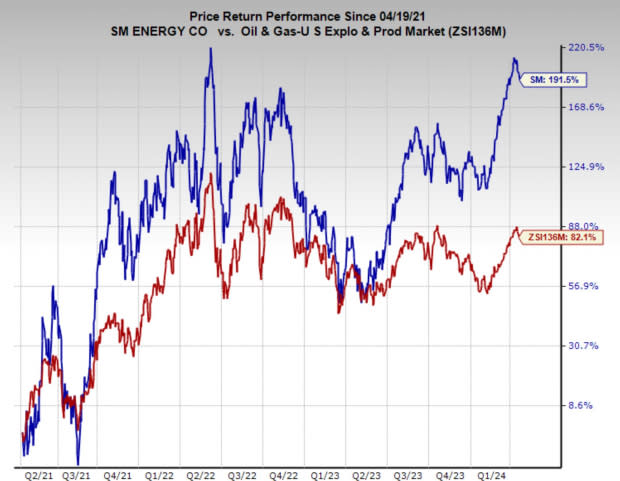

Two energy stocks that caught my eye are SM Energy SM and Murphy USA MUSA. Both have been market outperformers and have Zacks Rank #1 (Strong Buy) ratings.

Muphy USA is one of my favorite oil stocks as its long-term performance is exceptional. Thanks to its strategic partnership with Walmart WMT, Murphy USA retail and gas shops are always growing sales.

With its proven business model MUSA stock has compounded at an incredible 26.3% annually over the last decade, trouncing the industry and broad market returns.

Additionally, at 15.8x forward earnings it is below its 10-year median of 16.3x

Image Source: Zacks Investment Research

SM Energy is an oil exploration company, that has experienced some hefty revisions higher to its earnings estimates and has massively outperformed its respective industry. After recovering from the energy crash during Covid, the stock has grown at 43% annually over the last three years.

It is also trading at a historical discount. Today, SM Energy trades at a one year forward earnings multiple of 8.1x, below its 10-year median of 11.6x and below the industry average of 12x. It also pays a nice dividend of 1.4%.

Image Source: Zacks Investment Research

Bottom Line

Don’t let the hysteria of a small market pullback shake you out of this market. Instead make a shortlist of your favorite stocks and focus on which ones are showing relative strength and are showing up on the Zacks Rank.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Energy Select Sector SPDR ETF (XLE): ETF Research Reports

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance