Time to Buy Stock in These 2 Big Banks

Making their way onto the Zacks Rank #1 (Strong Buy) list now appears to be a good time to consider a pair of big bank stocks in Bank of America BAC and Wells Fargo WFC.

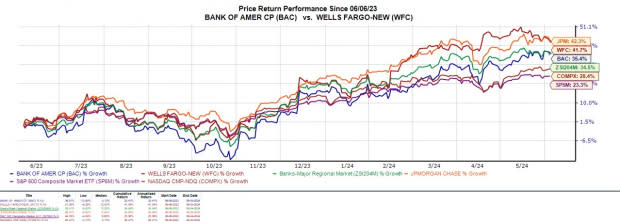

The strong performance of Bank of America and Wells Fargo’s stock looks likely to continue with both up over +35% in the last year to outpace the broader indexes while being on the heels of JPMorgan’s JPM +42%.

What may also attract investors is that BAC and WFC still trade at a fourth and a third of the price of JPM respectively and the Zacks Banks-Major Regional Industry is in the top 10% of over 250 Zack industries.

Image Source: Zacks Investment Research

Industry Leaders

Big banks have been able to post stronger earnings in recent years due to the reversal of loan loss reserves set aside in 2020 during the pandemic recession. With reserves being repaid, they were added back to balance sheets as earnings while fees from mergers and acquisitions amid heightened corporate deal-making have served as a further catalyst.

Of course, big banks such as Bank of America and Wells Fargo have been able to profit from higher interest rates as well. Propelling the economic stability is their large branch networks, with both banks having 4,000 or more branches. Specifically, Bank of America has excelled in savings accounts and investment options while Wells Fargo’s leadership is reflected among personal loans and lines of credit.

Rising EPS Estimates

Attributing to the strong buy ratings for BAC and WFC is that earnings estimate revisions have trended higher.

After a tougher to-compete-against year, Bank of America’s annual earnings are expected to dip -5% in fiscal 2024 but are forecasted to rebound and jump 9% in FY25 to $3.54 per share. Furthermore, over the last 60 days, FY24 and FY25 EPS estimates have now spiked 4% and 5% respectively.

Image Source: Zacks Investment Research

Similarly, Wells Fargo’s annual earnings are expected to drop -8% this year but are forecasted to rebound and rise 10% in FY25 to $5.50 per share. Plus, FY24 earnings estimates have remained 5% higher in the last two months while FY25 EPS estimates are up 3%.

Image Source: Zacks Investment Research

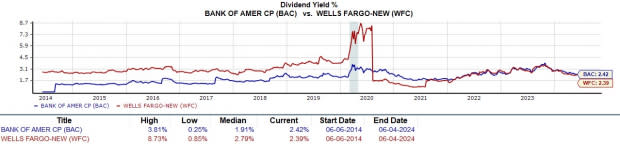

Solid Dividends

Investors love dividends and BAC and WFC are attractive in this regard with annual yields over 2%. Notably, their dividend yields are slightly below the industry average of 2.86% but are nicely above the S&P 500’s 1.28%.

Image Source: Zacks Investment Research

Bottom Line

Considering Bank of America and Wells Fargo both trade near the industry P/E average of 11X, the positive trend of earnings estimate revisions is compelling and suggestive of more upside in their stocks. More importantly, as banking leaders BAC and WFC should remain viable investments for 2024 and beyond.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance