Time For an A/C Tune-Up? HVAC Provider Soars to New Heights

The spring season is in full bloom.

It’s a good time for a tune-up to the old A/C unit, as the last thing we want before the summer heat hits is to find out we have a freon leak or some other issue. I’ve been there before and trust me, you never know how much you miss cool air in ninety-degree heat until something goes wrong with your condenser.

It’s also a good time to evaluate our portfolios. Just as our outer world experiences the ebbs and flows of nature, stocks move in and out of favor as earnings cycles rotate over time. As temperatures change, we adjust our living conditions to meet our needs. And as earnings estimates shift, we must adjust our exposure to take advantage of the new trends.

It just so happens that as we head into the final month of spring, one related pocket of the market is beginning to outperform and show relative strength. Stocks in this area are also witnessing positive earnings estimate revisions, which our research has shown to be the most powerful force impacting stock prices.

Top-Ranked Industry Heats Up as Summer Looms

We can tilt the odds in our favor by focusing on stocks that are within top industry groups and displaying relatively little volatility compared to the general market.

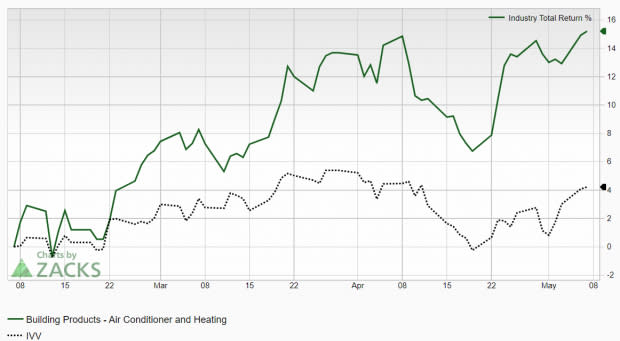

The Zacks Building Products – Air Conditioner & Heating industry group currently ranks in the top 11% out of approximately 250 industries. Targeting individual stocks contained within the leading industry groups provides a constant tailwind to our investing success. We can see the steady outperformance over the past few months:

Image Source: Zacks Investment Research

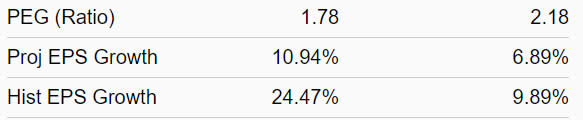

Also note the favorable characteristics for this industry below:

Image Source: Zacks Investment Research

Because it is ranked in the top half of all industry groups, we expect this group to outperform the market over the next 3 to 6 months. Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping.

In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

HVAC Provider Surges to All-Time High

Comfort Systems USA FIX, a provider of heating, ventilation, and air conditioning systems, has quietly soared to new heights this year. A Zacks Rank #1 (Strong Buy) stock, the company also provides plumbing, mechanical and electrical installation, fire protection, and maintenance services. Comfort Systems serves building owners and developers, general contractors, engineers, and property managers.

The industrial giant has surpassed earnings estimates in each of the past four quarters. Just two weeks ago, Comfort Systems delivered first-quarter earnings of $2.69/share, a 19% surprise over the $2.26/share consensus estimate. FIX has posted a trailing four-quarter average earnings surprise of 20%.

The company reported a significant increase in revenue to $1.54 billion during Q1, a 30.8% improvement relative to the year-ago period. A robust backlog of $5.91 billion (as of the end of the first quarter) illustrates its dynamic future revenue potential.

Recent acquisitions including companies such as Summit Industrial Construction as well as J&S Mechanical Contractors have not only helped FIX’s growth outlook, but have also improved its capabilities. These transactions have enabled Comfort Systems to enter new markets and strengthen its competitive offering.

And the stock has responded in kind. Shares of FIX have surged nearly 70% in 2024:

Image Source: StockCharts

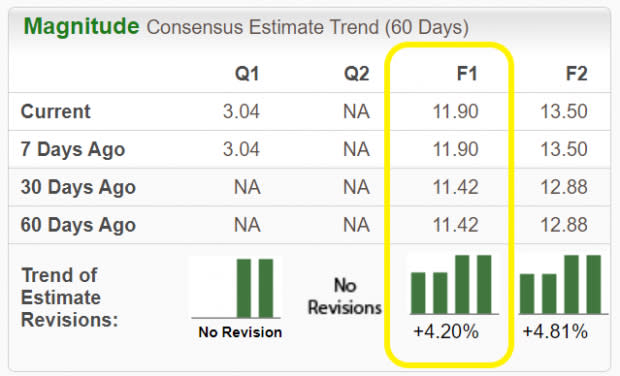

Earnings estimates are on the rise as of late. For the full year, analysts have raised estimates by 4.2% in the past 60 days. The 2024 Zacks Consensus Estimate now stands at $11.9/share, reflecting staggering growth of 36.2% relative to last year.

Image Source: Zacks Investment Research

As the summer heat emerges, make sure to keep an eye on this leading group that contains stocks like FIX.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance