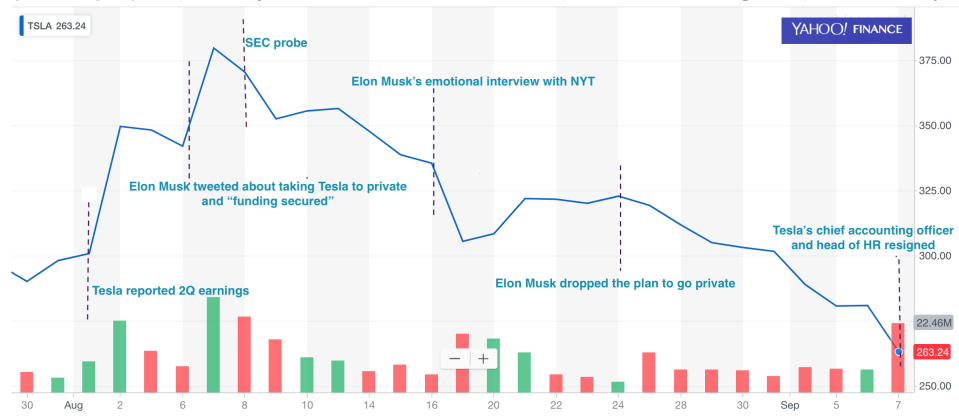

Timeline: Tesla, thanks to Elon Musk, had an insane month

Tesla, the pioneering electric car maker, got off to a good start this August.

During the second-quarter earnings call on Aug. 1, CEO Elon Musk doubled down on the promise to make Tesla (TSLA) profitable toward the end of this year. Restrained and subdued, he also personally apologized to two analysts he had lashed out at in May. All these factors sent Tesla stock soaring 16%, its largest one-day gain since March 2013.

Bullish sentiment continued as Saudi Arabia sovereign fund took a sizable stake in the cash-burning machine. Then Musk sent out a bombshell tweet of nine words that would change the company stock’s trajectory.

“Am considering taking Tesla private at $420. Funding secured.” (He later added: “Investor support is confirmed.”)

The stock initially shot up to over $375 per share. One month later, Tesla’s share closed at $263.2 on Sept. 7, down 30.6% from its peak following the tweet.

Here is how Tesla’s roller coaster ride played out from Aug. 7 to Sept. 7:

Tuesday, Aug. 7, 2018

Hours after Musk tweeted his plan and added shareholders could either to sell at $420 or hold shares to stay with Tesla as it goes private, the company put out a blog post to explain the plan.

“Being public means that there are large numbers of people who have the incentive to attack the company,” Musk wrote. The executive with a high ego has been struggling with short sellers, who bet the company would fall. He said the plan would “ultimately be finalized through a vote of our shareholders” and he believes two-thirds of current shareholders would stay with Tesla in the transition.

Following these statements, Tesla’s stock price surged, closing at $379.57 per share on Tuesday, a nearly 11% jump from the day before.

Wednesday, Aug. 8, 2018

While the tweet attracted thousands of “likes” on the social media platform, it also drew the attention of the U.S. Securities and Exchange Commission (SEC). Regulators soon followed up by inquiring whether Musk really had “funding secured,” the Wall Street Journal reported. Tesla stock fell 2.4% on the news and dropped by another 4.8% on Thursday.

Monday, Aug. 13, 2018

Things seemed more promising as Musk announced Tesla has hired Silver Lake and Goldman Sachs as financial advisers, and Wachtell, Lipton, Rosen & Katz and Munger, Tolles & Olson as legal advisers, to work on a plan to take Tesla private. The New York Times on the same day reported that some members of Tesla’s board were “totally blindsided by Mr. Musk’s decision to air his plan on Twitter.”

A subplot of the public company’s massive buyout plan was spotted from a rapper’s Instagram account. Singer Azealia Banks posted about her weekend at Musk’s house visiting musician Grimes, Musk’s girlfriend. She told Business Insider that she “saw him in the kitchen tucking his tail in-between his legs, scrounging for investors.”

Monday, Aug. 16, 2018

Musk revealed his struggles, including the use of Ambien to help him sleep and the use of recreational drugs, during an emotional interview with the New York Times, raising concerns about his mental health and well-being. The electric car maker’s stock closed 8.9% lower on the next day.

Thursday, Aug. 23, 2018

After Goldman Sachs and Morgan Stanley, the top two advisers on M&A deals dropped coverage on Tesla, Bloomberg confirmed that the banks had been hired to advise Musk in his potential bid to take Tesla private.

Friday, Aug. 24, 2018

Everything took a sharp turn on late Friday night. Tesla announced that Musk abandoned the plan to take his company private in a post on its corporate blog. He admitted the process “would be even more time-consuming and distracting than initially anticipated” and “the better path is for Tesla to remain public.”

Thursday, Sept. 6, 2018

Short seller Andrew Left of Citron Research said he is suing Tesla and Musk for violating federal securities laws. He claims Musk is “liable as a participant in a fraudulent scheme,” which inflated the stock price by spreading false information.

Friday, Sept. 7, 2018

Tesla’s Chief Accounting Officer Dave Morton, who joined right before Musk’s infamous “funding secured” tweet, resigned from the company.

“Since I joined Tesla on August 6th, the level of public attention placed on the company, as well as the pace within the company, have exceeded my expectations. As a result, this caused me to reconsider my future,” Morton was quoted as saying in a company filing.

On the same day, Tesla confirmed that its Chief People Officer Gaby Toledano was exiting the company, the latest to the long list of high-level executives who have left the company in the past two years.

The night before the executives’ exodus, Musk appeared to be smoking marijuana during an interview with comedian Joe Rogan. While legal in California, the decision for the CEO of three companies — including one that puts rockets in space — to smoke weed publicly during such a turbulent time raised eyebrows.

After the markets closed Friday, Tesla announced the promotions of seven Tesla employees. Musk also tried to assure employees and investors that they would have a strong quarter despite this dramatic run.

“We are about to have the most amazing quarter in our history, building and delivering more than twice as many cars as we did last quarter,” Musk wrote. “For a while, there will be a lot of fuss and noise in the media. Just ignore them. Results are what matter and we are creating the most mind-blowing growth in the history of the automotive industry.”

Krystal Hu covers technology and economy for Yahoo Finance. Follow her on Twitter.

Read more:

The real reason why traders are shorting Alibaba

Not happy with Amazon, Whole Foods workers push to unionize

Walmart buys from US suppliers, but that doesn’t protect it from tariffs

Yahoo Finance

Yahoo Finance