TimkenSteel (TMST) Shares Rise 11% Since Earnings Beat in Q3

TimkenSteel Corporation TMST stock is up around 11% since the company came up with its third-quarter 2021 results, wherein earnings topped the Zacks Consensus Estimate.

The company benefited from higher industrial and energy demand and a strong pricing environment in the reported quarter notwithstanding the semiconductor supply-chain disruptions that affected shipments to mobile customers.

Earnings and Revenues Discussion

TimkenSteel logged profits of $50.1 million or 94 cents per share in third-quarter 2021 against a loss of $13.9 million or 31 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share were $1.04, which topped the Zacks Consensus Estimate of 66 cents.

Sales climbed around 67% year over year to $343.7 million in the quarter, aided by improved industrial and energy demand as well as higher average raw material surcharge per ton. The figure surpassed the Zacks Consensus Estimate of $330 million.

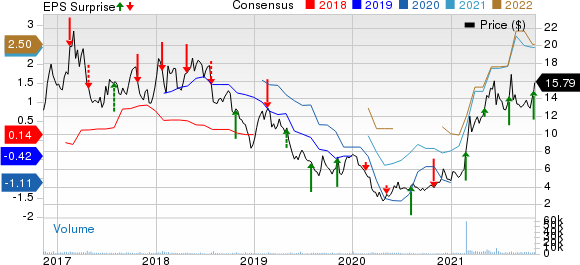

Timken Steel Corporation Price, Consensus and EPS Surprise

Timken Steel Corporation price-consensus-eps-surprise-chart | Timken Steel Corporation Quote

Operating Figures

Ship tons rose 38% year over year to 212,700 in the quarter. The upside was driven by higher energy and industrial shipments.

Manufacturing costs improved year over year mainly driven by increased melt utilization and the impact of systemic cost-reduction actions.

Financials

At the end of the reported quarter, the company had cash and cash equivalents of $172 million, up around 130% year over year.

The company generated $53.8 million in operating cash flow in the quarter.

Outlook

Moving ahead, TimkenSteel sees fourth-quarter ship tons to be lower than third-quarter levels. Although its order book is full for the balance of 2021, fourth-quarter shipments are forecast to be hurt by reduced melt utilization as a result of the recently completed annual Faircrest melt shop maintenance shutdown. The company also noted that periodic automotive customer manufacturing outages due to the chip shortage may impact mobile shipments in the fourth quarter.

The company also expects capital expenditures to be in the band of $15-$20 million in 2021.

Price Performance

Shares of TimkenSteel have shot up 267.2% in the past year compared with 68.7% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

TimkenSteel currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth considering in the basic materials space include Nutrien Ltd. NTR, Methanex Corporation MEOH and Steel Dynamics, Inc. STLD, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has an expected earnings growth rate of 206.11% for the current year. The stock has also rallied around 63% over a year.

Methanex has a projected earnings growth rate of 453.7% for the current year. The company’s shares have gained around 29% in a year.

Steel Dynamics has a projected earnings growth rate of 477.5% for the current year. The company’s shares have surged around 97% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Timken Steel Corporation (TMST) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance