Is Tissue Regenix Group (LON:TRX) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Tissue Regenix Group plc (LON:TRX) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tissue Regenix Group

What Is Tissue Regenix Group's Debt?

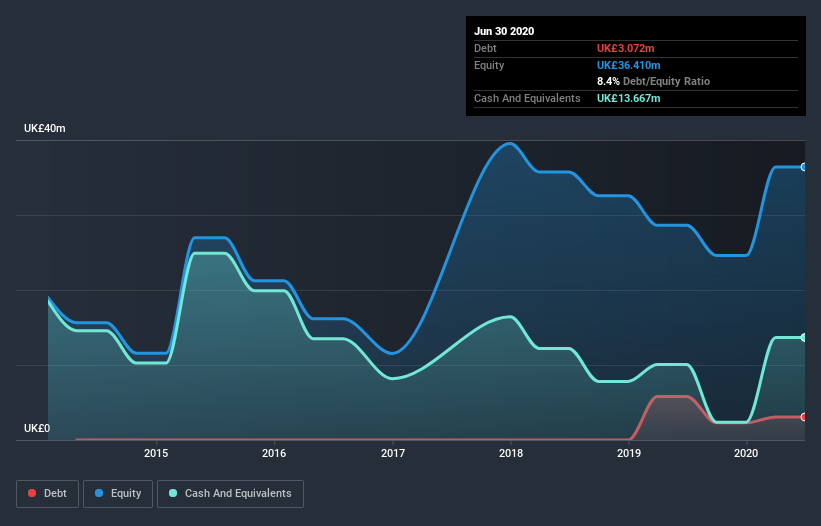

As you can see below, Tissue Regenix Group had UK£3.07m of debt at June 2020, down from UK£5.79m a year prior. But on the other hand it also has UK£13.7m in cash, leading to a UK£10.6m net cash position.

How Strong Is Tissue Regenix Group's Balance Sheet?

We can see from the most recent balance sheet that Tissue Regenix Group had liabilities of UK£4.24m falling due within a year, and liabilities of UK£2.94m due beyond that. Offsetting this, it had UK£13.7m in cash and UK£3.31m in receivables that were due within 12 months. So it can boast UK£9.80m more liquid assets than total liabilities.

This luscious liquidity implies that Tissue Regenix Group's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Tissue Regenix Group has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Tissue Regenix Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Tissue Regenix Group reported revenue of UK£13m, which is a gain of 7.7%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Tissue Regenix Group?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Tissue Regenix Group had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through UK£6.4m of cash and made a loss of UK£5.3m. With only UK£10.6m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Tissue Regenix Group you should be aware of, and 1 of them makes us a bit uncomfortable.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance