Is It Too Late To Consider Buying Warner Bros. Discovery, Inc. (NASDAQ:WBD)?

Warner Bros. Discovery, Inc. (NASDAQ:WBD) saw significant share price movement during recent months on the NASDAQGS, rising to highs of US$30.51 and falling to the lows of US$16.62. Some share price movements can give investors a better opportunity to enter into the stock, and potentially buy at a lower price. A question to answer is whether Warner Bros. Discovery's current trading price of US$17.74 reflective of the actual value of the large-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Warner Bros. Discovery’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Check out our latest analysis for Warner Bros. Discovery

Is Warner Bros. Discovery still cheap?

Warner Bros. Discovery appears to be expensive according to my price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 36.06x is currently well-above the industry average of 28.64x, meaning that it is trading at a more expensive price relative to its peers. If you like the stock, you may want to keep an eye out for a potential price decline in the future. Since Warner Bros. Discovery’s share price is quite volatile, this could mean it can sink lower (or rise even further) in the future, giving us another chance to invest. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of Warner Bros. Discovery look like?

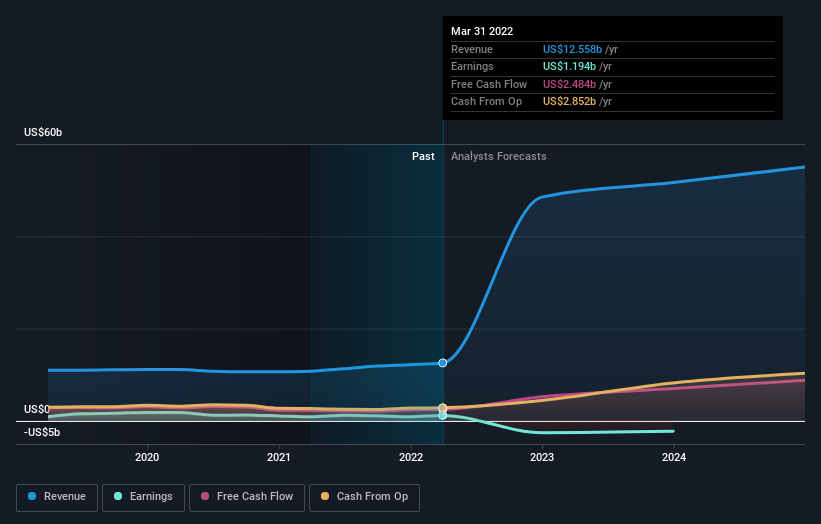

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of Warner Bros. Discovery, it is expected to deliver a highly negative earnings growth in the upcoming, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What this means for you:

Are you a shareholder? If you believe WBD is currently trading above its peers, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Given the uncertainty from negative growth in the future, this could be the right time to reduce your total portfolio risk. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on WBD for a while, now may not be the best time to enter into the stock. Its price has risen beyond its industry peers, on top of a negative future outlook. However, there are also other important factors which we haven’t considered today, such as the track record of its management. Should the price fall in the future, will you be well-informed enough to buy?

If you want to dive deeper into Warner Bros. Discovery, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 4 warning signs for Warner Bros. Discovery (of which 3 make us uncomfortable!) you should know about.

If you are no longer interested in Warner Bros. Discovery, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance