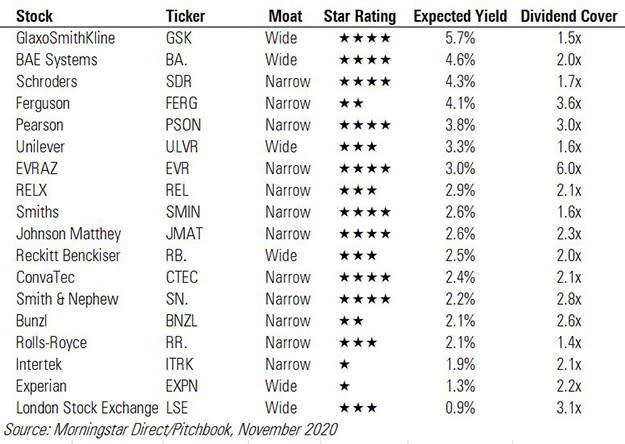

Top FTSE Dividend Paying Stocks

The return of lockdown in the UK will give income investors some anxiety, not least because in the first shutdown companies cut and deferred billions of pounds of payouts. The latest Link Dividend Monitor predicts the damage for this year to be £40 billion of lost income. But many companies are in a better position than they were in March to pay dividends, and some have already started to resume or increase income payments, among them Tesco (TSCO) and J Sainsbury (SBRY). Caution remains key though as the outlook for 2021 remains hazy for the economy, consumers and companies. Stock market volatility has returned in recent weeks, fuelled by the US Presidential election and the second wave of coronavirus cases in Europe.

The latest Link Dividend Monitor forecasts a £70 billion payout for income investors in 2021 under a best-case scenario – the 2019 level was above £100 billion – but under a worst-case scenario, dividend income could drop back to the £60 billion level last seen in 2012 and 2013.

Latest third-quarter earnings reports from the big dividend payers of the FTSE 100 provide show the uncertain path of the income recovery: Shell (RDSB), which stunned investors in March with the first dividend cut since WW2, has just announced plans to increase its payout again. While the third-quarter payout was $0.1665, barely up from $0.16 in Q2, investors took the move as a statement of intent, and shares rallied from multi-decade lows of 866p to 970p. Still it’s not all progress in the right direction for oil majors: BP (BP.), which also cut its payout earlier this year, has just declared a dividend of 5.25 US cents per share, nearly half that of Q3 2020, when it was 10.25 cents.

Yields for BP and Shell are nearly 14% and 10% respectively – this year’s share price falls mean that the dividend yield is pushed higher even after cuts to payouts – which is way above the yields on our monthly list of top-yielding FTSE stocks. As seen earlier this year, a 10% yield is often a reliable warning sign of trouble ahead for investors; all the big names yielding 10% going into the crisis in March then cut or axed their dividends. (It’s worth pointing out that the forward yield for BP and Shell is much lower as the impact of dividend cuts starts to filter through).

To make it on to our monthly list, the company must have a wide or narrow economic moat, pay a dividend and have a dividend cover of more than 1.25x times earnings. Some 10 out of the 18 stocks on this month’s list yield between 1.9% and 3%. Bigger yields are available, with the FTSE 100’s average yield at 4.7%, but this year has shown the perils of yield chasing. GlaxoSmithKline (GSK), which hasn’t changed cut dividend this year, remains top of the table again this month with a trailing yield of 6% and expected yield of 5.7%. It also has the advantage of having a wide economic moat, according to Morningstar analysts, and is currently undervalued as rival AstraZeneca (AZN) sets the pace in the pursuit of a coronavirus vaccine. It’s just declared a 19p dividend for Q3, the same as the previous quarter and the same period of 2019.

“We continue to view the stock as undervalued with the market not likely fully appreciating the firm’s marketed portfolio, especially in vaccines, an area that provides extra support to the firm’s wide moat,” says Morningstar pharma analyst Damien Conover.

Why is Glaxo yielding more than others on this list? In simple terms, it held its quarterly dividend steady at 19p, as it has done for many previous quarters. But its shares have fallen this 20% year, so when the price goes down and the payout stays the same, the yield inevitably goes up.

Among shares also yielding over 4% are wide-moat defence manufacturer BAE Systems (BA.) – which restarted dividends this year – wealth manager Schroders (SDR) and construction products group Ferguson (FERG). Morningstar analyst Joachim Kotze says: “The company pays a stable and secure dividend … [and] we are positive on the fundamental outlook for BAE Systems driven by a portfolio that is well aligned to growth in global defense spending.”

Narrow-moat Pearson (PSON), makes it into the top five with a yield of 3.8%, and is the most undervalued stock in this list after a 20% share price slide this year. According to Morningstar analysts, the company’s shares, at around 522p, are trading around 34% below their fair value of 780p. In contrast, product safety specialist Intertek (ITRK) is the most overvalued on our list. Rated as a one-star stock by Morningstar analysts, its current share price around 5,700p is around 40% above its fair value of 4,100p.

Just as yields at the top of the table have pushed higher this month, so it is with the bottom yielders on our list. The forward yield on wide-moat London Stock Exchange (LSE), whose shares have been in demand in 2020 amid heightened stock market volatility, has nudged towards 1%, having been 0.5% in October.

Yahoo Finance

Yahoo Finance