Top 3 German Dividend Stocks To Consider

As global markets react to the recent U.S. Federal Reserve rate cut, European indices have shown mixed performance, with Germany's DAX index posting modest gains. Amidst this backdrop of cautious optimism and monetary policy adjustments, dividend stocks in Germany present a compelling opportunity for investors seeking steady income. In evaluating good dividend stocks, it's essential to consider companies with a history of stable earnings and robust cash flows—factors that are particularly reassuring in today's fluctuating market environment.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.79% | ★★★★★★ |

All for One Group (XTRA:A1OS) | 3.10% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 5.08% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.69% | ★★★★★☆ |

Allianz (XTRA:ALV) | 4.67% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.18% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.35% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.33% | ★★★★★☆ |

MVV Energie (XTRA:MVV1) | 3.64% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

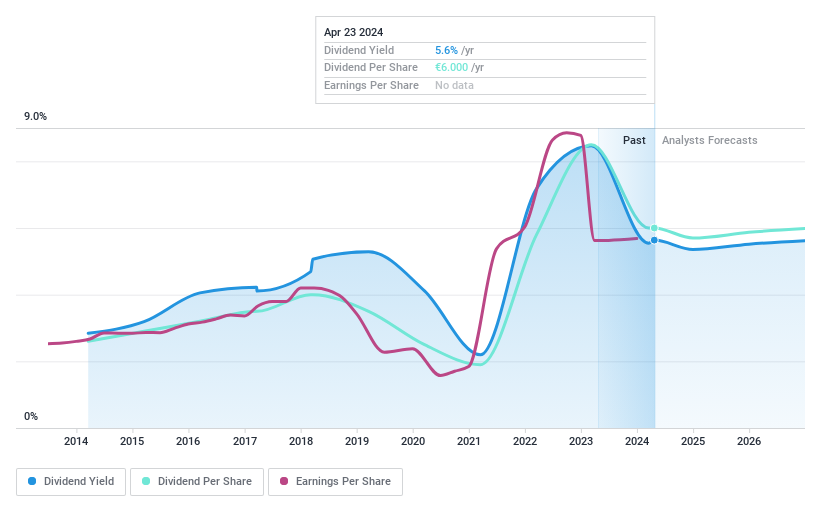

Bayerische Motoren Werke

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally with a market cap of €49.05 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft generates revenue from its Automotive segment (€132.39 billion), Motorcycles segment (€3.15 billion), and Financial Services segment (€37.87 billion).

Dividend Yield: 7.6%

Bayerische Motoren Werke's dividend yield of 7.64% places it in the top 25% of German dividend payers, though its high cash payout ratio indicates dividends are not well covered by cash flows. Recent earnings show a decline, with H1 2024 net income at €5.40 billion compared to €6.23 billion a year ago. The company has also completed significant share buybacks worth €3.35 billion, reflecting strong capital return initiatives despite volatile dividend history.

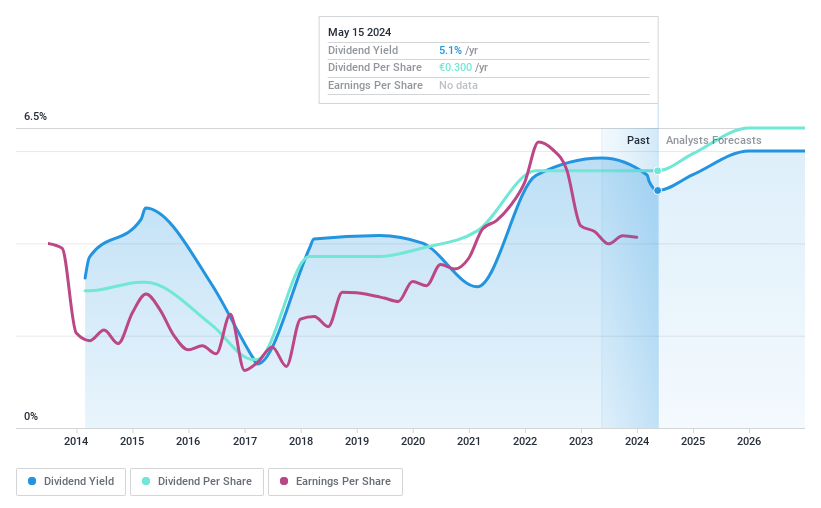

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €610.97 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue from various segments including Financial Consulting (€429.61 million), FERI (€231.23 million), Banking (€206.97 million), DOMCURA (€129.26 million), Deutschland.Immobilien (€51.61 million), and Industrial Broker (€36.51 million).

Dividend Yield: 5.4%

MLP's dividend yield of 5.37% ranks in the top 25% of German dividend payers, supported by a low cash payout ratio of 11.1%, indicating strong coverage by free cash flow. Despite a volatile dividend history, recent earnings show improvement with Q2 net income rising to €10.31 million from €2.39 million last year, and H1 revenue increasing to €514.28 million from €474.97 million a year ago, suggesting robust financial health for sustainable dividends.

Click to explore a detailed breakdown of our findings in MLP's dividend report.

Our valuation report unveils the possibility MLP's shares may be trading at a discount.

PharmaSGP Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany, with a market cap of €256.59 million.

Operations: PharmaSGP Holding SE generates its revenue primarily from the sale of over-the-counter drugs and healthcare products in Germany.

Dividend Yield: 6.4%

PharmaSGP Holding's dividend yield of 6.36% places it among the top 25% of German dividend payers, with a cash payout ratio of 77.8%, indicating dividends are well-covered by free cash flow. Recent earnings for H1 2024 show sales increased to €58.37 million from €49.71 million, and net income rose to €8.68 million from €6.86 million, reflecting solid financial performance despite a short dividend history and high debt levels.

Next Steps

Investigate our full lineup of 33 Top German Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BMW XTRA:MLP and XTRA:PSG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com